I am happy to offer some insights on SAP drawn from our latest Value Index research, which provides an analytic representation of our assessment of how well vendors’ offerings meet buyers’ requirements. The Ventana Research Value Index: Analytics and Business Intelligence 2019 is the distillation of a year of market and product research efforts by Ventana Research. We utilized a structured research methodology that includes evaluation categories designed to reflect the breadth of the real-world...

Read More

Topics:

Data Science,

SAP,

Mobile Technology,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Digital Technology

I recently attended SAP TechEd in Las Vegas to hear the latest from the company regarding its analytics and business intelligence offerings as well as its data management platform. The company used the event to launch SAP Data Hub and made several other data and analytics announcements that I’ll cover below.

Read More

Topics:

Big Data,

SAP,

Machine Learning,

Analytics,

Data Preparation,

SAP TechEd

There were two noteworthy themes in SAP CEO Bill McDermott’s keynote at this year’s Sapphire conference. One was customer assurance; that is, placing greater emphasis on making the implementation of even complex business software more predictable and less of an effort. This theme reflects the maturing of the enterprise applications business as it transitions from producing highly customized software to providing configurable, off-the-rack purchases. Implementing ERP will never be simple, as I...

Read More

Topics:

Predictive Analytics,

Sales Performance,

SAP,

Supply Chain Performance,

Customer Performance,

Business Performance,

Financial Performance,

Uncategorized

Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

Human Capital,

NetSuite,

Office of Finance,

Reporting,

close,

Controller,

dashboard,

Tax,

Operational Performance,

Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

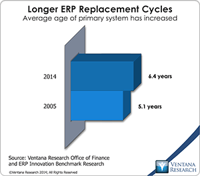

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

Supply Chain Performance,

ERP,

FP&A,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Reconciliation,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

finance,

Financial Performance Management,

FPM,

Intacct

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

Sales Performance,

SAP,

Supply Chain Performance,

ERP,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Customer Performance,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

Maximizing the performance and value of people in the workforce should be a primary focus for any business these days. It is a complex task, especially for larger organizations, and chances for success can be increased by investment in human capital management (HCM) applications. In this competitive software market SAP is making a strong push, aided by acquisitions in the last three years of SuccessFactors for talent management and more recently Fieldglass for contingent labor management....

Read More

Topics:

SAP,

HCM,

Human Capital Management,

Learning,

Performance,

Recruiting,

SuccessFactors,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Cloud Computing,

Financial Performance,

Compensation,

HRMS,

Vendor Management Systems,

Workforce Analytics,

Workforce Management,

Workforce Planning

Big data has become a big deal as the technology industry has invested tens of billions of dollars to create the next generation of databases and data processing. After the accompanying flood of new categories and marketing terminology from vendors, most in the IT community are now beginning to understand the potential of big data. Ventana Research thoroughly covered the evolving state of the big data and information optimization sector in 2014 and will continue this research in 2015 and...

Read More

Topics:

Big Data,

MapR,

Predictive Analytics,

Sales Performance,

SAP,

Supply Chain Performance,

Human Capital,

Marketing,

Mulesoft,

Paxata,

SnapLogic,

Splunk,

Customer Performance,

Operational Performance,

Business Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Cloudera,

Financial Performance,

Hortonworks,

IBM,

Informatica,

Information Management,

Operational Intelligence,

Oracle,

Datawatch,

Dell Boomi,

Information Optimization,

Savi,

Sumo Logic,

Tamr,

Trifacta,

Strata+Hadoop

Now available from Ventana Research is our Value Index on Total Compensation Management for 2014. Total compensation management directly addresses one of an organization’s largest investments – employee pay. As such it is a critical activity for supporting other human capital management and talent management processes.

Read More

Topics:

SAP,

Human Capital Management,

Kenexa,

Peoplefluent,

SuccessFactors,

Decusoft,

Towers Watson,

Analytics,

Business Analytics,

Business Collaboration,

Cloud Computing,

Financial Performance,

IBM,

Mobility,

Oracle,

Workforce Performance,

Compensation,

SumTotal Systems,

TCM,

Value Index,

beqom,

Pay for Performance