Last week, Scout RFP held their 2nd annual user conference, Spark 2019. Scout’s software is designed to manage sourcing and procurement processes in companies. Even with a very targeted focus, there was one key aspect that stood out compared to all the other conferences I usually attend; Spark 2019 mainly focused on customer success with little time devoted to promoting the software itself. Strategically, this fits in with Scout RFP's customers and target audiences. Scout’s users represent a...

Read More

Topics:

ERP,

Office of Finance,

FPM,

Price and Revenue Management,

procurement,

Predictive Planning,

sourcing,

Scout RFP

IBM’s THINK conference, just held this February in San Francisco, is IBM's annual user conference. THINK is designed to showcase upcoming product updates and releases from IBM, along with provide best practices on a wide range of topics. While many technologies were on display, there is one topic in particular I wanted to cover this year: Blockchain.

Read More

Topics:

Office of Finance,

IBM,

Financial Performance Management,

FPM,

Digital Technology,

blockchain

I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

process management,

report

In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

BEPS,

tax department,

tax planning

In 2016 Unit4 acquired Prevero, a financial performance management software company. The acquisition reflects a trend toward the convergence of transactional and analytical business applications. ERP and financial management software vendors increasingly are adding analytic capabilities – especially in financial performance management (FPM) – to the core functions of transaction processing and accounting in order to broaden the scope of their offerings. The integration of transaction processing...

Read More

Topics:

Marketing,

Office of Finance,

Continuous Planning,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Workforce Management,

Financial Performance Management,

FPM,

Work and Resource Management,

Operations & Supply Chain,

Sales Planning and Analytics

Ventana Research defines financial performance management (FPM) as the process of addressing often overlapping issues involving people, process, information and technology that affect how well finance organizations operate and support the activities of the rest of their organization. FPM software supports and automates the full cycle of finance department activities, which include planning and budgeting, analysis, assessment and review, closing and consolidation, internal financial reporting...

Read More

Topics:

Performance Management,

ERP,

FP&A,

Human Capital Management,

Office of Finance,

Consolidation,

Financial Performance Management,

FPM

Ventana Research recently awarded Workday a 2016 Technology Innovation Award for its newly released application, Workday Planning, because it simplifies and streamlines the budgeting and planning processes while facilitating collaboration, deepening visibility into spending and enabling tight fiscal control. These capabilities can help a variety of user organizations in several ways.

Read More

Topics:

Big Data,

Marketing,

Office of Finance,

Budgeting,

Controller,

In-memory,

CFO,

Workday,

demand management,

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

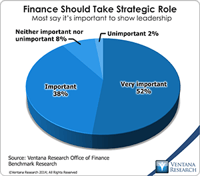

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

Governance,

GRC,

Human Capital,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

The ERP market is set to undergo a significant transformation over the next five years. At the heart of this transformation is the decade-long evolution of a set of technologies that are enabling a major shift in the design of ERP systems – the most significant change since the introduction of client/server systems in the 1990s. Some ERP software vendors increasingly are utilizing in-memory computing, mobility, in-context collaboration and user interface design to differentiate their...

Read More

Topics:

Performance Management,

ERP,

FP&A,

Human Capital,

Office of Finance,

Reporting,

Consolidation,

Reconciliation,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Uncategorized,

Financial Performance Management,

FPM