Digitally transforming core business processes became essential as organizations locked down in early 2020 because of the pandemic and the need to operate remotely presented a set of new challenges that were best addressed by software. Especially in the areas of sourcing, purchasing and payments, software has the ability to streamline processes, shorten process cycles, reduce unnecessary costs, provide greater visibility into cash flows, increase control and improve results. Digitizing...

Read More

Topics:

ERP,

Office of Finance,

continuous supply chain,

digital finance,

Purchasing/Sourcing/Payments

The term "corporate spend" usually refers to the incidental but still significant outlays organizations make to support operations. Especially in nonmanufacturing industries, purchases of indirect goods and business services – such as computers, office supplies, furniture and services – as well as travel and entertainment can represent a significant percentage of total costs. Technology has evolved to the point where executives – especially the chief financial officer – need to take an...

Read More

Topics:

ERP,

Financial Performance Management (FPM),

digital finance

Sometimes it takes a while for technology to fundamentally change how work is done. That’s because several innovations usually have to come together before a transformation can occur. For instance, Karl Benz created the first practical motorcar in 1885, but consumers would have to wait until the 1920s for the modern automobile. Computerized accounting systems originated in the 1950s but it’s only now that technologies have evolved and come together to fundamentally change how work is done.

Read More

Topics:

ERP,

Office of Finance,

close,

closing,

CFO,

controller,

Financial Performance Management,

ERP and Continuous Accounting

Infor recently held their Innovation Summit at Infor corporate headquarters in New York. At this annual event, they spend a good deal of time talking about progress on current initiatives and the exciting parts of the development roadmap. A key focus this year was AI and machine learning with Infor Coleman.

Read More

Topics:

ERP,

Office of Finance,

Enterprise Resource Planning

Last week, Scout RFP held their 2nd annual user conference, Spark 2019. Scout’s software is designed to manage sourcing and procurement processes in companies. Even with a very targeted focus, there was one key aspect that stood out compared to all the other conferences I usually attend; Spark 2019 mainly focused on customer success with little time devoted to promoting the software itself. Strategically, this fits in with Scout RFP's customers and target audiences. Scout’s users represent a...

Read More

Topics:

ERP,

Office of Finance,

FPM,

Price and Revenue Management,

procurement,

Predictive Planning,

sourcing,

Scout RFP

After more than a decade of steady development, ERP systems today are changing fundamentally, facilitated by the availability of advances such as cloud computing, advanced database architecture, collaboration, improved user-interface design, mobility, analytics and planning. This was evident when Oracle recently held its third analysts-only ERP Cloud Summit in New York to coincide with its Modern Finance Experience event. Oracle now has an increasingly robust set of business applications that...

Read More

Topics:

ERP,

Machine Learning,

Cloud Computing,

Robotic Process Automation,

Artificial intelligence,

blockchain,

AI

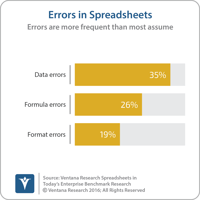

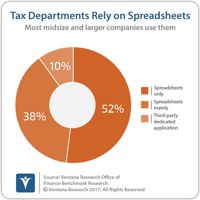

Accountants love electronic spreadsheets – and for good reason. They’re a powerful and versatile personal productivity tool and just about everyone knows how to use them. Spreadsheets are the default software tool for accountants because they enable autonomy (you don’t need to ask IT for anything) and they’re free (so you don’t have to make a business case to authorize buying something). Some accountants humorously (but earnestly) invoke the line “you’ll have to pry this spreadsheet from my...

Read More

Topics:

ERP,

Office of Finance,

Continuous Accounting,

FASB,

IASB,

CFO,

controller,

Financial Performance Management,

Spreadsheets,

Enterprise Resource Planning,

ERP and Continuous Accounting,

revenue recognition,

Accounting,

Lease Accounting,

real estate,

Lease Management,

ASC842,

IFRS16,

leasing

For several years, I’ve commented on a range of emerging technologies that will have a profound impact on white-collar work in the coming decade. I’ve now coined the term “Robotic finance” to describe this emerging focus, which includes four key areas of technology: Artificial intelligence (AI) and machine learning (ML), robotic process automation (RPA), bots utilizing natural language processing, and blockchain distributed ledger technology (DLT), each of which I describe below. Robotic...

Read More

Topics:

ERP,

Machine Learning,

close,

Consolidation,

Continuous Accounting,

Reconciliation,

CFO,

Robotic Process Automation,

blockchain,

AI,

natural language processing,

Accounting,

RPA,

bots,

voice automation

From my perspective, supply chain management (SCM) and sales and operations planning (S&OP) are two of the most underappreciated disciplines of modern corporate management. Properly applied, they can improve performance and competitiveness by increasing customer satisfaction and reducing costs. A combination of more capable information technology with advances in operations research and analytics has made managing supply and demand chains potentially more impactful by making them more flexible...

Read More

Topics:

ERP,

Kinaxis,

Supply Chain Planning,

Analytics,

SCM,

S&OP,

Sales and Operations Planning,

warehouse management,

purchasing,

inventory management

In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

BEPS,

tax department,

tax planning