ESG reporting is a matter that organizations – and especially publicly held corporations – will be confronting over the next several years. Ventana Research asserts that by 2025, one-half of corporations with 1,000 or more employees will have a formal ESG reporting process in place to address legal mandates or shareholder demand. The roots of ESG investing go back many decades but it has gained significant attention recently as demand in the investment world for non-accounting measures to guide...

Read More

Topics:

FP&A,

Governance,

Office of Finance,

Performance,

Reporting,

CFO,

ESG

The use of blockchain distributed ledgers in business processes is now a common theme in many business software vendors’ presentations. The technology has a multitude of potential uses. However, presentations about the opportunities for digital transformation always leave me wondering: How is this magic going to happen? I wonder this because the details about how data flows from point A to point B via a blockchain are critically important to blockchain utility and therefore the pace of its...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

Ventana Research uses the term “predictive finance” to describe a forward-looking, action-oriented finance organization that places emphasis on advising its company rather than fulfilling the traditional roles of a transactions processor and reporter. Technology is driving the shift away from the traditional bean-counting role. The cumulative evolution of software advances will substantially reduce finance and accounting workloads by automating most of the mechanical, rote functions in...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI

Prophix is an established provider of financial performance management (FPM) software for planning and budgeting, forecasting, analysis and reporting, and managing the financial close and consolidation process. Its eponymous software is designed specifically for midsize companies or midsize divisions of larger corporations. These organizations are a distinctive segment of the market in that they have almost all the functional requirements of large enterprises but have fewer resources to apply...

Read More

Topics:

Planning,

Office of Finance,

Reporting,

Budgeting,

Consolidation,

Continuous Planning,

Analytics,

Business Intelligence,

Collaboration,

Financial Performance Management,

Integrated Business Planning,

accounting close,

Price and Revenue Management,

Work and Resource Management,

Sales Planning and Analytics

Centage recently released Budget Maestro Version 9, a complete revamping of its longstanding budgeting application designed for midsize companies. The software, now offered as a multitenant cloud-based offering, delivers several structural improvements that can enhance the effectiveness of a company’s planning processes and at the same time is easier to use. Budget Maestro Version 9 is designed to support what Centage is calling a “Smart Budgets” approach to replace traditional budgeting. This...

Read More

Topics:

Planning,

Reporting,

Budgeting,

Consolidation,

Analytics,

Business Planning,

headcount planning

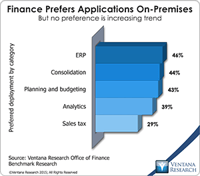

The ERP market is set to undergo a significant transformation over the next five years. At the heart of this transformation is the decade-long evolution of a set of technologies that are enabling a major shift in the design of ERP systems – the most significant change since the introduction of client/server systems in the 1990s. Some ERP software vendors increasingly are utilizing in-memory computing, mobility, in-context collaboration and user interface design to differentiate their...

Read More

Topics:

Performance Management,

ERP,

FP&A,

Human Capital,

Office of Finance,

Reporting,

Consolidation,

Reconciliation,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Uncategorized,

Financial Performance Management,

FPM

Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

Human Capital,

NetSuite,

Office of Finance,

Reporting,

close,

Controller,

dashboard,

Tax,

Operational Performance,

Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

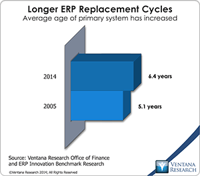

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

Supply Chain Performance,

ERP,

FP&A,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Reconciliation,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

finance,

Financial Performance Management,

FPM,

Intacct

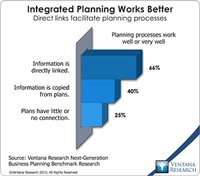

Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Sales Performance,

Supply Chain Performance,

Customer Experience,

Human Capital,

Marketing Planning,

Reporting,

Budgeting,

Operational Performance,

Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Business Performance Management (BPM),

Business Planning,

Financial Performance Management (FPM),

Demand Planning,

Integrated Business Planning,

Project Planning

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

Sales Performance,

SAP,

Supply Chain Performance,

ERP,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Customer Performance,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct