Fall is a busy time for software industry analysts. It’s a season filled with vendors’ user conferences and some industry conferences. Throughout the course of attending these events I’ve come to the realization that big vendors are often considered the Rodney Dangerfield of the software industry: They get no respect. What I mean by no respect is revealed in snarky social media comments, less enthusiastic coverage by tech media than smaller vendors get and a general sense that big vendors don’t...

Read More

Topics:

Sales,

Software

When it comes to making a business case for software investments, many people fail to recognize that the case itself is just one part of what amounts to an internal sales and marketing effort that they must perform well to be successful. Focusing only on the numbers and assumptions in a spreadsheet is not enough. Making a successful business case requires an understanding of the audience’s perspective and motivations. Since the individuals who will review the business case may not be...

Read More

Topics:

Planning,

Sales Performance,

Supply Chain Performance,

ERP,

Office of Finance,

Research,

budgeting and planning,

ROI,

Operational Performance,

Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Workforce Performance,

CFO,

CRM,

business plan,

capital spending,

Financial Performance Management,

FPM,

SCM,

Software

Profit Velocity Solutions’ PV Accelerator is an analytic application designed to enable capital-intensive companies to consistently achieve substantially wider margins and higher return on assets (ROA). Companies in industries such as specialty chemicals, building materials, integrated steel mills and silicon chip fabrication (to name just four) routinely fail to make the right decisions about pricing, production and sales management because they use analytic methods that, from an economic...

Read More

Topics:

Performance Management,

Sales,

Sales Performance,

Supply Chain Performance,

Human Capital Management,

Office of Finance,

PV Accelerator,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Cloud Computing,

Financial Performance,

Price Optimization,

Profit Velocity,

Profitability,

Software,

S&OP

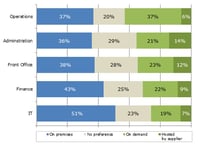

Salesforce.com’s recent Dreamforce user conference got me wondering about how far the market for cloud-based software has come. To answer that question, I looked to our own research. For the past several years Ventana Research has routinely asked participants in its benchmark research what preference, if any, they have for deploying software they use to support the activity we are benchmarking. The choices we offer are on-premises, software as a service (SaaS – that is, in the cloud), hosted on...

Read More

Topics:

SaaS,

Sales,

Sales Performance,

Salesforce.com,

Supply Chain Performance,

Operational Performance,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

Workforce Performance,

Software

Doing one’s homework is vital in buying business software. However, unless you’re replacing a relatively simple application, it’s hard to know exactly what to evaluate. Indeed, if people in a company given this task don’t have experience in using a specific type of business application or don’t understand how new or improved functionality will help execute business processes better, they may do a poor job of assessing the available alternatives. Third-party consultants may be helpful, but their...

Read More

Topics:

Performance Management,

Sales,

Sales Performance,

Human Capital Management,

Office of Finance,

Zilliant,

Model N,

Navetti,

Nomis Solutions,

PROS Pricing,

Servigistics,

Signal Demand,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Oracle,

Vendavo,

Price Optimization,

Profitability,

Software,

Vistaar Technologies

As Workday continues to expand and the likelihood of its IPO becomes a more frequent topic of discussion, so does the movement of ERP systems to the cloud. Thus far, only a minority of companies have chosen to put their ERP and accounting systems in the cloud, but the numbers are growing and there’s evidence of success. NetSuite, for example, reported a 26 percent increase in its revenues to $145 million in the nine months up to Sept. 30, 2011. To be sure, this is not close to Salesforce.com’s...

Read More

Topics:

Microsoft,

Sales,

Supply Chain Performance,

ERP,

NetSuite,

Office of Finance,

Dynamics,

Epicor,

Lawson,

QAD,

Operational Performance,

Business Performance,

Cloud Computing,

Financial Performance,

IBM,

Oracle,

Workforce Performance,

Infor,

financial software,

Intacct,

PeopleSoft,

Software

As its name suggests, demand-based pricing is a method that uses the buyer’s demand, based on an estimate of a good’s or service’s perceived value to the buyer, as the central element in setting price. Pricing strategies are most important because they can have a disproportionate impact (positive and negative) on a company’s bottom line. Managing prices has always been an activity of keen interest, but it has become even more so over the past decade as a result of the constrained pricing...

Read More

Topics:

Performance Management,

Sales,

Sales Performance,

Human Capital Management,

Office of Finance,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Price Optimization,

Profitability,

Software

I was reminded by a recent piece in InformationWeek about the need to manage the mounting cost of software more carefully that this issue never seems to become old news. I have read variations of it in IT trade publications for two decades now, reminding me of the quip attributed to Mark Twain: Everyone talks about the weather, but nobody ever seems to do anything about it. (Like many of Twain’s “quotes,” he wasn’t the author of this one either.) I believe that at the heart of this issue is a...

Read More

Topics:

assets,

Office of Finance,

Portfolio Management,

contract management,

Business Performance,

Financial Performance,

Software