I am happy to offer some insights on SAS drawn from our latest Value Index research, which provides an analytic representation of our assessment of how well vendors’ offerings meet buyers’ requirements. The Ventana Research Value Index: Analytics and Business Intelligence 2019 is the distillation of a year of market and product research efforts by Ventana Research. We utilized a structured research methodology that includes evaluation categories designed to reflect the breadth of the real-world...

Read More

Topics:

Data Science,

SAS,

Mobile Technology,

Analytics,

Business Intelligence,

Cloud Computing,

Collaboration,

Digital Technology

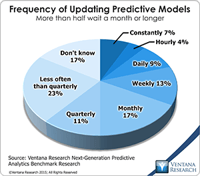

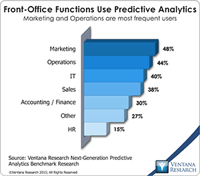

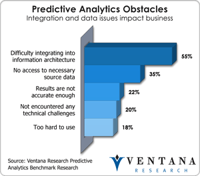

One of the key findings in our latest benchmark research into predictive analytics is that companies are incorporating predictive analytics into their operational systems more often than was the case three years ago. The research found that companies are less inclined to purchase stand-alone predictive analytics tools (29% vs 44% three years ago) and more inclined to purchase predictive analytics built into business intelligence systems (23% vs 20%), applications (12% vs 8%), databases (9% vs...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

SAS,

Social Media,

alteryx,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Operational Intelligence,

Oracle,

Information Optimization,

SPSS,

Rapidminer

Our benchmark research into predictive analytics shows that lack of resources, including budget and skills, is the number-one business barrier to the effective deployment and use of predictive analytics; awareness – that is, an understanding of how to apply predictive analytics to business problems – is second. In order to secure resources and address awareness problems a business case needs to be created and communicated clearly wherever appropriate across the organization. A business case...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

SAS,

Social Media,

alteryx,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Operational Intelligence,

Oracle,

Information Optimization,

SPSS,

Rapidminer

Many businesses are close to being overwhelmed by the unceasing growth of data they must process and analyze to find insights that can improve their operations and results. To manage this big data they find a rapidly expanding portfolio of technology products. A significant vendor in this market is SAS Institute. I recently attended the company’s annual analyst summit, Inside Intelligence 2014 (Twitter Hashtag #SASSB). SAS reported more than $3 billion in software revenue for 2013 and is known...

Read More

Topics:

Big Data,

Predictive Analytics,

SAS,

Event Stream,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Customer & Contact Center,

Data Management,

Information Applications,

Information Management,

Location Intelligence,

Operational Intelligence,

Discovery

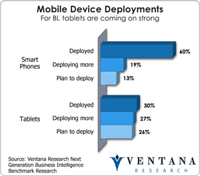

Ventana Research recently completed the most comprehensive evaluation of mobile business intelligence products and vendors available anywhere today. The evaluation includes 16 technology vendors’ offerings on smartphones and tablets and use across Apple, Google Android, Microsoft Surface and RIM BlackBerry that were assessed in seven key categories: usability, manageability, reliability, capability, adaptability, vendor validation and TCO and ROI. The result is our Value Index for Mobile...

Read More

Topics:

Big Data,

MicroStrategy,

Mobile,

Mobile Business Intelligence,

Pentaho,

Sales Performance,

SAP,

SAS,

Tableau,

Jaspersoft,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Customer & Contact Center,

IBM,

Information Builders,

Oracle,

Workforce Performance,

Yellowfin,

Roambi,

Value Index,

arcplan,

Logi Analytics,

Qlik

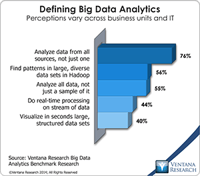

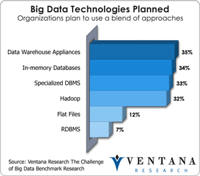

Users of big data analytics are finally going public. At the Hadoop Summit last June, many vendors were still speaking of a large retailer or a big bank as users but could not publically disclose their partnerships. Companies experimenting with big data analytics felt that their proof of concept was so innovative that once it moved into production, it would yield a competitive advantage to the early mover. Now many companies are speaking openly about what they have been up to in their business...

Read More

Topics:

Big Data,

Datameer,

Sales Performance,

SAS,

Supply Chain Performance,

Teradata,

alteryx,

IT Performance,

Operational Performance,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

IBM,

Information Applications,

Location Intelligence,

Operational Intelligence,

Workforce Performance,

Strata+Hadoop

I recently attended SAS’s European analyst event, where I went to focus on new developments around customer intelligence, an application of big data that SAS includes in its high-performance analytics and visual analytics. SAS offers an amazing number and range of products that is hard to keep track of, so I was glad to get a sense that now it is focusing more on business solutions built with data visualization and discovery, big data, data management, cloud computing, marketing analytics...

Read More

Topics:

SAS,

Social Media,

Customer Analytics,

Customer Experience,

Customer Feedback Management,

Social CRM,

Speech Analytics,

Voice of the Customer,

Mobile Apps,

Self-service,

Analytics,

Business Analytics,

Cloud Computing,

Collaboration,

Customer & Contact Center,

Customer Service,

Call Center,

Contact Center,

Contact Center Analytics,

CRM,

Desktop Analytics,

Text Analytics,

Unified Communications,

Workforce Force Optimization

Teradata recently gave me a technology update and a peek into the future of its portfolio for big data, information management and business analytics at its annual technology influencer summit. The company continues to innovate and build upon its Teradata 14 releases and its new processing technology. Since my last analysis of Teradata’s big data strategy, it has embraced technologies like Hadoop with its Teradata Aster Appliance, which won our 2012 Technology Innovation Award in Big Data....

Read More

Topics:

Big Data,

MicroStrategy,

SAS,

Tableau,

Teradata,

Customer Excellence,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

CIO,

Cloud Computing,

Customer & Contact Center,

In-Memory Computing,

Information Applications,

Information Management,

Location Intelligence,

Operational Intelligence,

CMO,

Discovery,

Intelligent Memory,

Teradata Aster,

Strata+Hadoop

SAS Institute held its 24th annual analyst summit last week in Steamboat Springs, Colorado. The 37-year-old privately held company is a key player in big data analytics, and company executives showed off their latest developments and product roadmaps. In particular, LASR Analytical Server and Visual Analytics 6.2, which is due to be released this summer, are critical to SAS’ ability to secure and expand its role as a preeminent analytics vendor in the big data era.

Read More

Topics:

Big Data,

Sales Performance,

SAS,

Supply Chain Performance,

LASR,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

Financial Performance,

Location Intelligence,

Operational Intelligence,

SAS institute

I recently attended the annual SAS analyst summit to hear the latest company, product and customer growth news from the multi-billion-dollar analytics software provider. This global giant continues to grow its business and solutions to help with fraud prevention, marketing and risk. It lets users apply its analytic and statistical technology in practical applications for business. SAS can meet midsized businesses’ demand with packaging and pricing to ensure it is not seen as only affordable to...

Read More

Topics:

Big Data,

Predictive Analytics,

Sales Performance,

SAS,

Fraud,

GRC,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Cloud Computing,

Customer & Contact Center,

Data Integration,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Operational Intelligence,

Risk