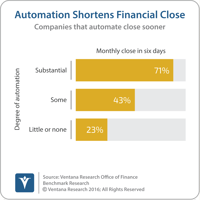

The global pandemic crisis was, in effect, an unrehearsed stress test measuring the resiliency of the department. The crisis highlighted the importance of sustaining confidence in the accuracy and control of accounting processes, not just efficiency. Virtualizing the close means using technology to substantially reduce the amount of manual processing and paper involved needed to complete the accounting close. Finance and accounting organizations that can operate in a virtual mode are better...

Read More

Topics:

Office of Finance,

Continuous Accounting,

Fast close,

CFO,

Digital Technology

The Chief Financial Officer can enable her or his finance department play a more strategic role in company operations by adopting what I call profitability management. In the interest of time I’ve made this a very high-level description that’s intended to be just an introduction to the topic. Profitability management is a cross-functional effort. It integrates finance and sales to achieve an optimal balance of revenue and margin objectives. It’s an analytics-based approach designed achieve...

Read More

Topics:

Office of Finance,

Continuous Accounting,

Integrated Business Planning,

CEO, CFO, Financial Performance Management, Foreca

For decades I’ve heard people talk about cutting audit costs to reduce administrative overhead but based on my observations, I was skeptical — mostly because, until recently, the documented success stories haven’t been about going from good to great so much as going from awful to average. That’s changing. I recently wrote about a company that had set out to cut its external auditor’s fees. The benefits it had accrued are significant, including a reduction in staff time devoted to the audit. I...

Read More

Topics:

Office of Finance,

audit,

Continuous Accounting,

Financial Performance,

CFO

I like Louis Pasteur’s observation that “fortune favors the prepared mind.” So-called black swan events happen regularly and can have a very negative effect on a business. Of course, risk is inherent in any commercial undertaking; organizations don’t succeed by being overly cautious and reckless ones usually fail after awhile. Those that are consistently successful are ones that manage risk intelligently. That is, they correctly identify vulnerabilities, avoid the decisions and situations where...

Read More

Topics:

Office of Finance,

Continuous Accounting,

Integrated Business Planning,

CEO, CFO, Financial Performance Management, Foreca

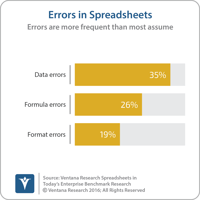

Accountants love electronic spreadsheets – and for good reason. They’re a powerful and versatile personal productivity tool and just about everyone knows how to use them. Spreadsheets are the default software tool for accountants because they enable autonomy (you don’t need to ask IT for anything) and they’re free (so you don’t have to make a business case to authorize buying something). Some accountants humorously (but earnestly) invoke the line “you’ll have to pry this spreadsheet from my...

Read More

Topics:

ERP,

Office of Finance,

Continuous Accounting,

FASB,

IASB,

CFO,

controller,

Financial Performance Management,

Spreadsheets,

Enterprise Resource Planning,

ERP and Continuous Accounting,

revenue recognition,

Accounting,

Lease Accounting,

real estate,

Lease Management,

ASC842,

IFRS16,

leasing

For several years, I’ve commented on a range of emerging technologies that will have a profound impact on white-collar work in the coming decade. I’ve now coined the term “Robotic finance” to describe this emerging focus, which includes four key areas of technology: Artificial intelligence (AI) and machine learning (ML), robotic process automation (RPA), bots utilizing natural language processing, and blockchain distributed ledger technology (DLT), each of which I describe below. Robotic...

Read More

Topics:

ERP,

Machine Learning,

close,

Consolidation,

Continuous Accounting,

Reconciliation,

CFO,

Robotic Process Automation,

blockchain,

AI,

natural language processing,

Accounting,

RPA,

bots,

voice automation

Robotic process automation (RPA) relies on programming or the application of analytical algorithms to execute the most appropriate action in an automated workflow. RPA enables business users to configure a “robot” (actually, computer software) to interact with applications or data sources to process a transaction, move or manipulate data, communicate with other digital systems and manage machine-to-machine and man-to-machine interactions. This technology is gaining increasing notice by finance...

Read More

Topics:

Operations,

automation,

close,

closing,

Continuous Accounting,

finance,

banking,

Robotic Process Automation,

Accounting

SYSPRO is a 35-year-old software vendor that focuses on selling enterprise resource planning (ERP) systems to midsize companies, particularly those in manufacturing and distribution. In manufacturing, SYSPRO supports make, configure and assemble, engineer to order, make to stock and job shop environments. The company attempts to differentiate itself through vertical specialization and its years of ongoing development, which can reduce the need for customization and cut the cost of initial and...

Read More

Topics:

Big Data,

SaaS,

ERP,

Governance,

Human Capital Management,

Office of Finance,

close,

Continuous Accounting,

Analytics,

CIO,

Cloud Computing,

Collaboration,

CFO,

CRM,

CEO

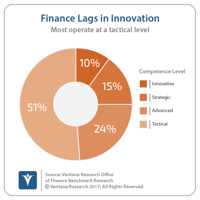

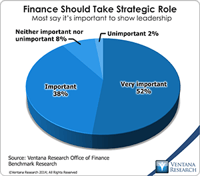

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM