Effective capital planning and capital investment are vital to a company’s long-term success. The choices a company makes in this regard – how much to invest and in which facilities or projects – almost always have a profound impact on its competitiveness and performance. Because they have limited financial resources, well-managed companies take pains to ensure that these decisions support their long-term strategies and are made as rationally as possible. To do this they must have a disciplined...

Read More

Topics:

Office of Finance,

Business Performance,

Financial Performance,

CEO, CFO, Financial Performance Management, Foreca

Like many other industry observers I’ve heard overblown claims for information technology for decades. However, I’ve also observed that – eventually – reality catches up with vision. Finance and accounting departments are particularly resistant to change, yet because almost no corporations use adding machines or typewriters any more, it’s clear that transformative change can happen. Nonetheless, because users of business computing systems are inundated with “it’s better than ever” promotions by...

Read More

Topics:

Social Media,

Supply Chain Performance,

Human Capital,

Mobile Technology,

Office of Finance,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Financial Performance

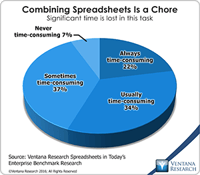

Ventana Research coined the term “enterprise spreadsheet” in 2004 to describe a variety of software applications that add a desktop spreadsheet’s user interface (usually that of Microsoft Excel) to components that address the issues that arise when desktop spreadsheets are used in repetitive, collaborative enterprise processes. Enterprise spreadsheets are designed to provide the best of both worlds in that they offer the ease of use and flexibility of desktop spreadsheets while overcoming their...

Read More

Topics:

Sales Performance,

Supply Chain Performance,

Office of Finance,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

Financial Performance,

Information Management,

Financial Performance Management (FPM)

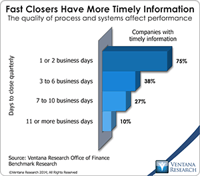

It strikes me that the motto of successful salespeople – “ABC: Always Be Closing!” – could apply equally to corporate controllers, albeit in the accounting sense. For a while now I’ve been advocating continuous accounting, a holistic approach to managing the finance and accounting function that, in part, emphasizes using technology to distribute workloads more evenly over an accounting period – in effect to always be closing rather than waiting until the end of the month or quarter. Continuous...

Read More

Topics:

Office of Finance,

Business Performance,

Financial Performance

Imagine how the third Monday in next January looks to leaders in the sales department. That’s the first day of the annual sales kickoff and the excitement level won’t get any higher. New products and services are in the works, lucrative customer contracts are up for renewal, alliance partners are in the house, and qualified opportunities are already flowing through your pipeline. The executive team is expecting big things from sales in the new year and has approved hiring additional people to...

Read More

Topics:

Sales,

Sales Performance,

Human Capital,

Human Capital Management,

Mobile Technology,

CRO,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Financial Performance,

Operational Intelligence

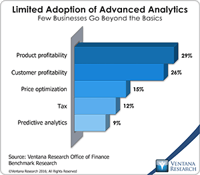

Vendavo is a vendor of business-to-business (B2B) price and revenue optimization software, which I have written about. A major focus of the conference sessions this year at the company’s annual user group meeting was on practical approaches to successful price optimization initiatives. While this category of software has been achieving increasing acceptance, penetration is still limited in the B2B segment, which includes, for example, industrial goods and services.

Read More

Topics:

Big Data,

Sales Performance,

Customer Performance,

Operational Performance,

Business Analytics,

Business Performance,

Financial Performance,

Vendavo, price, pricing, optimization, revenue, cu

Unit4, a Netherlands-based vendor of financial management software focused mainly on midsize companies, recently acquired prevero, a German vendor of performance management and business intelligence software. The acquisition reflects a convergence of transactional and analytic business applications, which I have written about. ERP and financial management software vendors increasingly are adding analytic capabilities – especially in financial performance management (FPM) – to the core functions...

Read More

Topics:

Office of Finance,

Business Analytics,

Business Performance,

Financial Performance

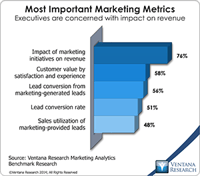

It often seems to business-to-business (B2B) marketers as if the only people who understand them are other B2B marketers. They feel that salespeople don’t get what they do day-to-day, that friends and family don’t understand what they do for a living, and most of all that the executives to whom they report have no interest in what they do – that is, until the last day of the quarter. Then they require that B2B marketers deliver positive, lead-generating and revenue-producing results in reports...

Read More

Topics:

Big Data,

Sales Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Operational Intelligence,

Hive9 Marketing Performance Management

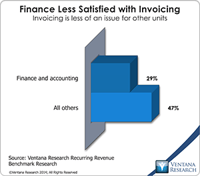

Invoicing and billing are mundane business activities that hardly anyone outside of the accounting department cares about, but they are where the back office meets the front office. How well a company handles the process of getting paid by its customers can have an impact on its relationships with them. Like most of the details of business process execution, the impact of substandard invoicing and billing is rarely obvious or even of interest to senior management. That said, like trimming scrap...

Read More

Topics:

Sales Performance,

Office of Finance,

Customer Performance,

Business Performance,

Cloud Computing,

Financial Performance

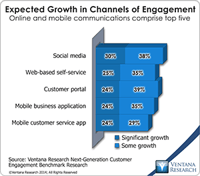

In July Salesforce officially closed on its purchase of digital commerce platform provider Demandware for US$2.8 billion. Salesforce’s executives were interested in acquiring a digital commerce platform, and they claim that Demandware was routinely mentioned in their due diligence of the market. So out came Marc Benioff’s and Salesforce checkbook, and they paid. Handsomely. For that sizeable investment, Salesforce will add Demandware’s SaaS-delivered digital commerce capabilities to its...

Read More

Topics:

Social Media,

Mobile Technology,

Office of Finance,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Financial Performance,

Operational Intelligence,

Uncategorized,

Omnichannel, Commerce, Digital kDigital