With the announcement of Ventana Research’s 2022 Market Agenda, our expertise in Digital Business continues to advance the market need for effective investments into technology, and I will outline here the key areas of focus to provide insights to organizations that can increase their organizational resilience and workforce readiness. We are proud to provide expertise on ensuring technological effectiveness through our market research and experience in providing guidance on trends and best...

Read More

Topics:

Performance Management,

Business Continuity,

Governance, Risk & Compliance (GRC),

Digital transformation,

Digital Business,

Digital Security,

Digital Communications,

Sustainability Management,

Work Management,

Experience Management

Workiva offers Wdesk, a cloud-based productivity application for handling composite documents. I use the term “composite document” to refer to those in which text is created and edited collaboratively by multiple contributors and which incorporates tabular and numerical data from multiple sources in a controlled process. Composite documents often have formats defined by law, regulation or contract and must be created at periodic intervals. To comply with the requirement by the United States...

Read More

Topics:

Mobile Technology,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Uncategorized,

Composite Software

Through a federal rule referred to as “Overtime Rule” and part of Title 29 regulations was issued on May 18th, 2016 by the Department of Labor (DOL), the Obama administration now mandates that unless they meet criteria for exemption, employees paid less than $47,476 ($22.825 per hour) are entitled to overtime pay when they work more than 40 hours per week. The rule change, which goes into effective on December 1, 2016, is intended to apply to executive, administrative and professional...

Read More

Topics:

Sales Performance,

Supply Chain Performance,

Customer Performance,

Operational Performance,

POTUS, Department of Labor, FLSA, Part 541, Overti,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

Uncategorized

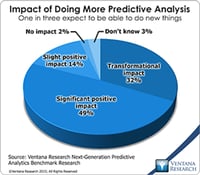

It has been more than five years since James Dixon of Pentaho coined the term “data lake.” His original post suggests, “If you think of a data mart as a store of bottled water – cleansed and packaged and structured for easy consumption – the data lake is a large body of water in a more natural state.” The analogy is a simple one, but in my experience talking with many end users there is still mystery surrounding the concept. In this post I’d like to clarify what a data lake is, review the...

Read More

Topics:

Big Data,

Predictive Analytics,

Social Media,

Business Analytics,

Business Intelligence,

Governance, Risk & Compliance (GRC),

Information Management,

Uncategorized,

Information Optimization

Organizations are facing a digital transformation, as I have written, that is rapidly changing the applications and services that businesses use to operate and deliver information. This new digital generation addresses the expectations of consumers and business partners for information and service in real time. One example of it is enterprise messaging. Recently I wrote about the shift to this technology and the challenges it poses for organizations that lack sufficient skills. However, new...

Read More

Topics:

Big Data,

Sales Performance,

Social Media,

Supply Chain Performance,

Enterprise messaging, Internet of Things, IoT, mid,

Customer Performance,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Uncategorized

Enterprise messaging is the technology backbone of communications for applications and systems within and between organizations. Both its importance and its complexity are growing as organizations increasingly have to provide real-time responses to business customers and consumers as well as their own business professionals who support them and their internal supply chains. The variety of use cases for enterprise messaging also is growing rapidly, expanding to the Internet of Things (IoT)...

Read More

Topics:

Big Data,

Social Media,

Supply Chain Performance,

Enterprise messaging, Internet of Things, IoT, mid,

Mobile Technology,

Customer Performance,

Operational Performance,

Business Performance,

Cloud Computing,

Governance, Risk & Compliance (GRC),

Information Management,

Operational Intelligence,

Uncategorized,

Information Optimization

At the 2015 technology analyst summit in Austin, Texas, analytics and business intelligence software vendor Qlik discussed recent market and product developments and explained its roadmap and strategy for 2016. Discussion topics included its Qlik Analytics Platform and QlikView 12.0, Qlik Sense and Qlik DataMarket, applications built on the platform but also how it is expanding its analytics experience for business.

Read More

Topics:

Big Data,

Mobile Technology,

Business Analytics,

Business Intelligence,

Business Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Operational Intelligence,

Uncategorized,

Information Optimization

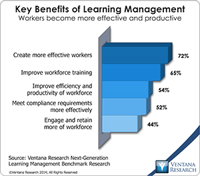

Businesses and their human resource organizations feel pressure to maximize the value of their human capital in today’s intensely competitive world. Many have made or considered investments in new applications that better exploit information to efficiently recruit, engage and retain the best talent. Advanced applications not only advance these processes but also help management assess the performance of the workforce and compensate individuals fairly so that they advance their careers and find...

Read More

Topics:

Big Data,

Predictive Analytics,

Governance,

HCM, HR, HRMS, Workforce Management, Learning Mana,

Human Capital,

Mobile Technology,

Wearable Computing,

Customer Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Uncategorized,

Financial Performance Management (FPM)

Technology innovation is accelerating faster than companies can keep up with. Many feel pressure to adopt new strategies that technology makes possible and find the resources required for necessary investments. In 2015 our research and analysis revealed many organizations upgrading key business applications to operate in the cloud and some enabling access to information for employees through mobile devices. Despite these steps, we find significant levels of digital disruption impacting every...

Read More

Topics:

Big Data,

Predictive Analytics,

Sales Performance,

Supply Chain Performance,

Governance,

Mobile Technology,

Operational Performance Management (OPM),

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Location Intelligence,

Operational Intelligence,

Uncategorized,

Workforce Performance,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Optimization,

Sales Performance Management (SPM)

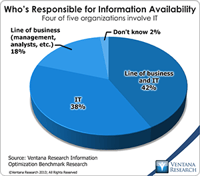

IBM redesigned its business intelligence platform, now called IBM Cognos Analytics. Expected to be released by the end of 2015, the new version includes features to help end users model their own data without IT assistance while maintaining the centralized governance and security that the platform already has. Our benchmark research into information optimization shows that simplifying access to information is important to virtually all (97%) participating organizations, but it also finds that...

Read More

Topics:

Big Data,

Mobile Technology,

Wearable Computing,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Operational Intelligence,

Uncategorized,

Visualization,

Cognos,

Information Optimization,

Risk & Compliance (GRC),

Watson,

cognos analytics