Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

compliance,

Data,

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

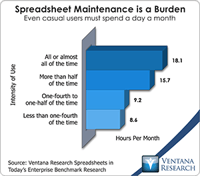

Host Analytics has introduced AirliftXL, a new feature of its cloud-based financial performance management (FPM) suite that enables its software to translate users’ spreadsheets into the Host Analytics format. I find it significant in three respects. First, it can substantially reduce the time and resources it takes for a company to go live in adopting the Host Analytics suite, lowering the cost of implementation and accelerating time to value. Second, it enables Host Analytics users who have...

Read More

Topics:

Modeling,

Office of Finance,

Reporting,

closing,

Consolidation,

Controller,

Host Analytics,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Cloud Computing,

Financial Performance,

Workforce Performance,

CFO,

Financial Performance Management,

FPM

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Oracle,

CFO,

compliance,

Data,

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software

Anaplan’s software is designed to help organizations across finance, sales and operations improve accuracy, timeliness and collaboration in their business analytics and planning. I recently attended the company’s first user conference, Hub 2013, in San Francisco, which featured customer success stories and latest on product information. Anaplan has built its business on the subtleties of modeling and planning that are shared between sales, operations and finance departments, and it enables them...

Read More

Topics:

Big Data,

Planning,

Sales Performance,

Supply Chain Performance,

FP&A,

Modeling,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

Workforce Performance,

CFO,

finance,

Sales Planning

For the past several years Ventana Research has focused more on analytics and their importance to improving business performance. We’ve done extensive benchmark research in business analytics, detailing how they are used generally in business and in major functional areas of companies as well as their application in specific industries. We adopted this focus because technology advances are changing the landscape of analytics. Its use in business management, for example, is getting new scrutiny...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Sales Performance,

Supply Chain Performance,

Human Capital Management,

Modeling,

Office of Finance,

Budgeting,

driver-based,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

In-memory,

Workforce Performance,

best pracices,

business value,

cash management,

challenge,

financial planning

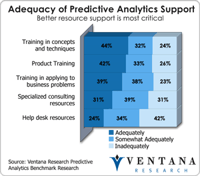

Our benchmark research on business analytics finds that just 13 percent of companies overall and 11 percent of finance departments use predictive analytics. I think advanced analytics – especially predictive analytics – should play a larger role in managing organizations. Making it easier to create and consume advanced analytics would help organizations broaden their integration in business planning and execution. This was one of the points that SPSS, an IBM subsidiary that provides analytics,...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Marketing,

Modeling,

Sales Forecasting,

Analytics,

IBM,

Uncategorized,

SPSS

Management decision-making typically involves a three-step process of inform, analyze and act. In the earliest days of what came to be known as business intelligence, developers created decision support systems that provided information and analytics to help executives and high-level managers choose the best course of action. Working with numbers rather than gut instinct still is viewed as a best practice. After all, a pilot who doesn’t trust his or her instruments is heading for an accident.

Read More

Topics:

Big Data,

Performance Management,

Planning,

Sales Performance,

Supply Chain Performance,

Modeling,

Office of Finance,

Budgeting,

closed loop,

contingency planning,

driver-based,

driver-based planning,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

In-memory,

Workforce Performance,

best pracices,

business value,

cash management,

challenge,

financial planning

I thought of writing a note on this topic when multinational corporations started to withdraw their deposits from eurozone banks, but the pessimism that event engendered was short-lived. Now, as the monetary crisis deepens in Europe, it’s perhaps time to ask what your company would do if parts of its financial system implodes. You may think that your company will not be affected because it doesn’t do business with the eurozone. Or you may believe that it’s unlikely to happen and therefore not...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Sales Performance,

Social Media,

Supply Chain Performance,

Modeling,

Office of Finance,

Budgeting,

contingency planning,

crisis,

driver-based,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Mobility,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

Workforce Performance,

best pracices,

business value,

cash management,

challenge,

financial planning

I believe that one of the more important analytical applications that a company can implement is profitability management. IBM Cognos offers Profitability Modeling and Optimization as part of its Cognos 10 offering that my colleague has assessed. As I’ve noted, most people in a corporation are focused on profitability, but not necessarily in a way that optimizes results across the organization in a day-to-day, consistent fashion. Those responsible for each component piece that contributes to...

Read More

Topics:

Performance Management,

Sales Performance,

Forecast,

Modeling,

Office of Finance,

enterprise profitability management,

Operational Performance,

Business Analytics,

Business Performance,

Financial Performance,

IBM,

Workforce Performance,

Cognos,

Financial Services,

Profitability

I hadn’t thought about the exact definition of “driver-based planning” until the question came up in the context of our planning benchmark research showing that only 6% of companies with more than 100 employees do driver-based planning. Broadly defined, the term could be applied to the use of any spreadsheet-planning model because these almost always have built-in volume-times-price formulas, which are components of driver-based plans. However, this is not what most people have in mind when...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Sales Performance,

Modeling,

Office of Finance,

Budgeting,

driver-based,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Financial Performance,

Workforce Performance,

best pracices,

business value,

cash management,

challenge,

financial planning