Profitability management produces a sustainable competitive advantage but by 2025 only one-third of companies will have implemented a profitability management initiative, explains Ventana Research SVP and Research Director Robert Kugel. This brief video shows why FP&A organizations must be part of a profitability management approach to pricing and costing.

{% video_player "embed_player" overrideable=False, type='scriptV4', hide_playlist=True, viral_sharing=False, embed_button=False,...

Read More

Topics:

FP&A,

Office of Finance,

Sales Operations,

CFO,

Profitability,

Price and Revenue Management

Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

compliance,

Data,

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

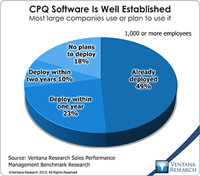

PROS Holdings, a provider of price and revenue optimization software, has an agreement in principle to acquire Cameleon Software, which offers configure, price and quote (CPQ) applications. The combined company is likely to benefit from a broader geographic presence (PROS is based in Houston while Cameleon is in Toulouse, France) for their sales and marketing efforts. However, the longer-term strategic value of the merger lies in the combination of the related categories of price optimization...

Read More

Topics:

Sales,

Sales Performance,

FP&A,

PRO,

PROS,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Financial Performance,

CFO,

CPQ,

CEO,

FPM,

Price Optimization,

Profitability

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Oracle,

CFO,

compliance,

Data,

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software

Pricing and profit margins appear to be trending topics, which is normal at this stage of the business cycle. North American companies achieved high levels of profitability coming out of the last recession by staying lean, but this trend has run its course. Margins are being squeezed, and companies are looking for ways to add to the bottom line.

Read More

Topics:

Planning,

Sales,

Sales Performance,

Office of Finance,

Operational Performance,

Analytics,

Business Performance,

Financial Performance,

costing,

FPM,

Price Optimization,

Profitability,

S&OP

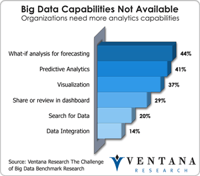

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

CFO,

Risk,

costing,

FPM,

Profitability

Profit Velocity Solutions’ PV Accelerator is an analytic application designed to enable capital-intensive companies to consistently achieve substantially wider margins and higher return on assets (ROA). Companies in industries such as specialty chemicals, building materials, integrated steel mills and silicon chip fabrication (to name just four) routinely fail to make the right decisions about pricing, production and sales management because they use analytic methods that, from an economic...

Read More

Topics:

Performance Management,

Sales,

Sales Performance,

Supply Chain Performance,

Human Capital Management,

Office of Finance,

PV Accelerator,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Cloud Computing,

Financial Performance,

Price Optimization,

Profit Velocity,

Profitability,

Software,

S&OP

This is the third in a series of blog posts on what CEOs (and for that matter, all senior corporate executives) need to know about IT and its impact on running a business. The first covered the high-level issues. As I noted, it’s not necessary for a CEO to be able to write Java code or master the intricacies of an ERP or sales compensation application. However, CEOs must grasp the basics of IT just as they must understand basic corporate finance, the production process and – at least at a high...

Read More

Topics:

Planning,

Predictive Analytics,

Sales,

Sales Performance,

Customer,

Human Capital Management,

Office of Finance,

Budgeting,

close,

closing,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Information Management,

CFO,

CEO,

FPM,

Profitability,

SPM

It’s clear that certain customers generate more profits than others, just as some products offer greater economic returns than others, as I’ve noted before. For this reason, efforts to improve customer profitability are not a new trend. Good managers have always looked for ways to achieve the highest sustainable margins. However, at some point, almost all businesses realize that increasing sustainable profitability can’t be achieved simply through increasing revenue or cutting costs. Those...

Read More

Topics:

Sales Performance,

Office of Finance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

Financial Performance,

Information Applications,

CRM,

Financial Performance Management,

Profitability

Doing one’s homework is vital in buying business software. However, unless you’re replacing a relatively simple application, it’s hard to know exactly what to evaluate. Indeed, if people in a company given this task don’t have experience in using a specific type of business application or don’t understand how new or improved functionality will help execute business processes better, they may do a poor job of assessing the available alternatives. Third-party consultants may be helpful, but their...

Read More

Topics:

Performance Management,

Sales,

Sales Performance,

Human Capital Management,

Office of Finance,

Zilliant,

Model N,

Navetti,

Nomis Solutions,

PROS Pricing,

Servigistics,

Signal Demand,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Oracle,

Vendavo,

Price Optimization,

Profitability,

Software,

Vistaar Technologies