The term "corporate spend" usually refers to the incidental but still significant outlays organizations make to support operations. Especially in nonmanufacturing industries, purchases of indirect goods and business services – such as computers, office supplies, furniture and services – as well as travel and entertainment can represent a significant percentage of total costs. Technology has evolved to the point where executives – especially the chief financial officer – need to take an...

Read More

Topics:

ERP,

Financial Performance Management (FPM),

digital finance

Software that automates the full scope of the accounting close, including reconciliations, consolidation and reporting, has grown more capable and affordable over the past five years. By enabling consistent process management that captures best practices, and by automating rote, repetitive activities to boost staff productivity, these applications enable organizations to shorten the close, make the process more efficient and reduce the risk of material errors by strengthening accounting...

Read More

Topics:

Office of Finance,

Financial Performance Management (FPM),

ERP and Continuous Accounting,

digital finance

Host Analytics recently announced it will now go by the name Planful. The change formally signifies a new chapter in an evolution that began with the company’s acquisition by Vector Capital a year ago and the accession of a new CEO, Grant Halloran. Planful executives say the new name better represents its focus, which is on what Ventana Research calls continuous planning, as well as its focus on the associated processes of forecasting, analysis, consolidation and reporting.

Read More

Topics:

Office of Finance,

Continuous Planning,

Financial Performance Management (FPM),

Operations & Supply Chain,

robotic finance,

Predictive Planning

Here are some insights on SAP drawn from our latest Value Index research, which provides an analytic assessment of how well vendor offerings address buyers’ requirements. The Ventana Research Value Index on Sales Performance Management 2019 is the distillation of a year of market and product research efforts by Ventana Research. We evaluated SAP and eight other vendors in seven categories, five product-related adaptability, capability, manageability, reliability and usability) and two...

Read More

Topics:

Sales,

Customer Experience,

Office of Finance,

Analytics,

Contact Center,

Data,

Financial Performance Management (FPM),

Sales Performance Management,

Digital Technology,

Digital Commerce,

Predictive Planning,

Conversational Computing,

collaborative computing,

mobile computing,

Subscription Management,

agent management,

intelligent sales,

AI & Machine Learning

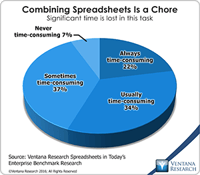

Ventana Research coined the term “enterprise spreadsheet” in 2004 to describe a variety of software applications that add a desktop spreadsheet’s user interface (usually that of Microsoft Excel) to components that address the issues that arise when desktop spreadsheets are used in repetitive, collaborative enterprise processes. Enterprise spreadsheets are designed to provide the best of both worlds in that they offer the ease of use and flexibility of desktop spreadsheets while overcoming their...

Read More

Topics:

Sales Performance,

Supply Chain Performance,

Office of Finance,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

Financial Performance,

Information Management,

Financial Performance Management (FPM)

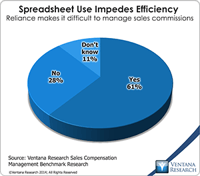

For several years I have been advocating that sales organizations adapt their processes and applications to optimize both sales performance and the customer experience. For details see my research agenda for last year. However, it appears that not many sales organizations have responded to this challenge; many can barely maintain their quarterly sales forecasts and monthly pipeline, track progress toward quotas and ensure that sales commissions are processed promptly and paid accurately. A...

Read More

Topics:

Predictive Analytics,

Sales Performance,

Mobile Technology,

Customer Performance,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Uncategorized,

Financial Performance Management (FPM),

Sales, SFA, SPM, Sales Performance Management, Sal

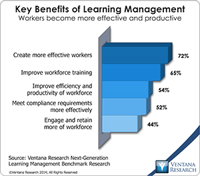

Businesses and their human resource organizations feel pressure to maximize the value of their human capital in today’s intensely competitive world. Many have made or considered investments in new applications that better exploit information to efficiently recruit, engage and retain the best talent. Advanced applications not only advance these processes but also help management assess the performance of the workforce and compensate individuals fairly so that they advance their careers and find...

Read More

Topics:

Big Data,

Predictive Analytics,

Governance,

HCM, HR, HRMS, Workforce Management, Learning Mana,

Human Capital,

Mobile Technology,

Wearable Computing,

Customer Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Uncategorized,

Financial Performance Management (FPM)

Technology innovation is accelerating faster than companies can keep up with. Many feel pressure to adopt new strategies that technology makes possible and find the resources required for necessary investments. In 2015 our research and analysis revealed many organizations upgrading key business applications to operate in the cloud and some enabling access to information for employees through mobile devices. Despite these steps, we find significant levels of digital disruption impacting every...

Read More

Topics:

Big Data,

Predictive Analytics,

Sales Performance,

Supply Chain Performance,

Governance,

Mobile Technology,

Operational Performance Management (OPM),

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Location Intelligence,

Operational Intelligence,

Uncategorized,

Workforce Performance,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Optimization,

Sales Performance Management (SPM)

Using information technology to make data useful is as old as the Information Age. The difference today is that the volume and variety of available data has grown enormously. Big data gets almost all of the attention, but there’s also cryptic data. Both are difficult to harness using basic tools and require new technology to help organizations glean actionable information from the large and chaotic mass of data. “Big data” refers to extremely large data sets that may be analyzed computationally...

Read More

Topics:

Big Data,

Data Science,

Planning,

Predictive Analytics,

Sales Performance,

Social Media,

Supply Chain Performance,

FP&A,

Human Capital,

Marketing,

Office of Finance,

Operational Performance Management (OPM),

Budgeting,

Connotate,

cryptic,

equity research,

Finance Analytics,

Kofax,

Statistics,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Business Performance Management (BPM),

Datawatch,

Financial Performance Management (FPM),

Kapow,

Sales Performance Management (SPM)

Stibo Systems has been providing product information management (PIM) software for decades. Its work has helped many organizations worldwide take control of their product information by developing a master definition that can be published across many channels from Web to digital to print. We recognized its work with customers Delta Faucet and Masco Corp. in our 2015 Ventana Research Leadership Award in Information Management. In 2014 Stibo Systems customer Brady Corp. won a similar award for...

Read More

Topics:

Master Data Management,

Sales,

Sales Performance,

Supply Chain Performance,

Customer Experience,

MDM,

Mobile Technology,

PIM,

Stibo Systems,

Customer Performance,

Operational Performance,

Business Performance,

Cloud Computing,

Financial Performance,

Information Management,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Optimization,

Product Information Management