In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

BEPS,

tax department,

tax planning

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

Governance,

GRC,

Human Capital,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

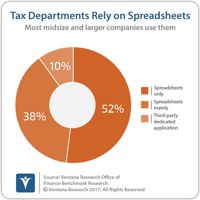

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

Governance,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Information Management,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

I’ve written before about the increasing importance of having a solid technology base for a company’s tax function, and it’s important enough for me to revisit the topic. Tax departments are entrusted with a highly sensitive and essential task in their companies. Taxes usually are the second largest corporate expense, after salaries and wages. Failure to understand this liability is expensive – either because taxes are overpaid or because of fines and interest levied for underpayment. Moreover,...

Read More

Topics:

ERP,

Governance,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Information Management,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

Technology for the Office of Finance can have transformative power. Although progress has been slow at times, today’s finance organizations are fundamentally different from those of 50 years ago. For one thing, they require far fewer resources (chiefly people) to perform basic accounting, treasury and corporate finance tasks. In addition, public corporations report results sooner – sometimes weeks sooner – than they could in the mid-20th century. And finance departments are able to harness...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

CFO,

Vertex,

FPM,

Innovation Awards

In the realm of technology that matters for business and IT, our firm as part of our responsibility continually assesses the latest technology and how it can impact organizations’ efficiency and effectiveness. Our benchmark research in technology innovation found that 87% of participants indicated the importance of increasing the organization’s value through technology innovation. Every year we take our knowledge from research and technology briefings to focus on our Technology Innovation Awards

Read More

Topics:

Big Data,

Datameer,

Mobile,

Sales,

Sales Performance,

Social Media,

Supply Chain Performance,

Sustainability,

Customer,

ESRI,

Globoforce,

GRC,

HCM,

Kronos,

Kyriba,

Location Analytics,

Marketing,

NetBase,

Office of Finance,

Overall Operational Leadership,

Peoplefluent,

Planview,

SQLstream,

VMWare,

VPI,

IT Analytics & Performance,

IT Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Mobility,

Business Performance,

CIO,

Cloud Computing,

Collaboration,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

Hortonworks,

IBM,

Informatica,

Information Applications,

Information Builders,

Information Management,

Information Technology,

KXEN,

Location Intelligence,

Operational Intelligence,

Oracle,

Workforce Performance,

Contact Center,

Datawatch,

Financial Management,

Information Optimization,

Johnson Controls Panoptix,

Roambi,

Service & Supply Chain,

Upstream Works,

Vertex,

Xactly

Taxes – both indirect (sales or value added taxes, for example) and direct (income taxes) – are one the largest expense items on the corporate income statement. In recent years it has become common for large and even midsize companies to automate their indirect tax management process, but direct tax management has remained a bastion of manual processes built on a heap of desktop spreadsheets. In previous blog posts I discussed this issue and the role of the tax data warehouse as a necessary...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

CFO,

Vertex,

FPM