The emphasis on environmental, social and governance (ESG) issues has been growing for some time. I participated in the development of the Sustainability Accounting Standards Board (SASB) as a software industry expert more than a decade ago. The rise of ESG’s profile in corporate reporting is the latest evolution of “responsible investing,” a topic that goes back centuries in the west. The modern era of responsible investing took form in the United States beginning in the 1960s and then...

Read More

Topics:

Governance,

Office of Finance,

Business Planning,

ERP and Continuous Accounting,

digital finance,

ESG,

Environmental,

Inclusion

ESG reporting is a matter that organizations – and especially publicly held corporations – will be confronting over the next several years. Ventana Research asserts that by 2025, one-half of corporations with 1,000 or more employees will have a formal ESG reporting process in place to address legal mandates or shareholder demand. The roots of ESG investing go back many decades but it has gained significant attention recently as demand in the investment world for non-accounting measures to guide...

Read More

Topics:

FP&A,

Governance,

Office of Finance,

Performance,

Reporting,

CFO,

ESG

With the announcement of Ventana Research market agenda, a new expertise in Digital Business has been launched, I will outline the areas of focus that provide insights to organizations that can be used to optimize technology, increase agility and organizational readiness. We are proud to provide expertise on digital effectiveness through our research and insights on trends and best practices.

Read More

Topics:

Performance Management,

Governance,

Business Continuity,

Risk,

Digital transformation,

Digital Business,

Digital Security,

Digital Communications,

Sustainability Management,

Work Management,

Experience Management

SYSPRO is a 35-year-old software vendor that focuses on selling enterprise resource planning (ERP) systems to midsize companies, particularly those in manufacturing and distribution. In manufacturing, SYSPRO supports make, configure and assemble, engineer to order, make to stock and job shop environments. The company attempts to differentiate itself through vertical specialization and its years of ongoing development, which can reduce the need for customization and cut the cost of initial and...

Read More

Topics:

Big Data,

SaaS,

ERP,

Governance,

Human Capital Management,

Office of Finance,

close,

Continuous Accounting,

Analytics,

CIO,

Cloud Computing,

Collaboration,

CFO,

CRM,

CEO

The topic of corporate governance received renewed attention recently after the publication of an open letter signed by 13 prominent business leaders, including Warren Buffett of Berkshire Hathaway and Jamie Dimon of JPMorgan Chase. The first principle the group advocated in the letter is the need for a truly independent board of directors. To achieve that aim, the letter suggests having the board meet regularly without the CEO and that the members of the board should have “active and direct...

Read More

Topics:

Mobile,

Governance,

Human Capital Management,

Office of Finance,

Consolidation,

Reconciliation,

CFO,

CEO,

board of directors,

accounting close

Today’s proponents of artificial intelligence (AI) tend to focus on its spectacular uses such as self-driving cars and uplifting ones such as medical treatment. AI also has the potential to aid humanity in more modest ways such as eliminating the need for individuals to do tedious repetitive work in white-collar areas. Along these lines, at its recent Vision users conference, IBM displayed an application of its Watson cognitive computing technology designed to automate important aspects of...

Read More

Topics:

Governance,

Office of Finance,

Business Performance,

Cloud Computing,

Financial Performance,

Uncategorized,

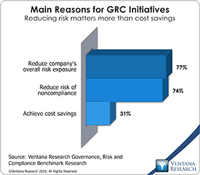

Risk & Compliance (GRC),

GRC, governance, risk, compliance, risk management

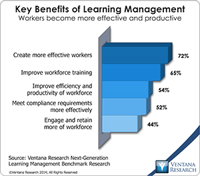

Businesses and their human resource organizations feel pressure to maximize the value of their human capital in today’s intensely competitive world. Many have made or considered investments in new applications that better exploit information to efficiently recruit, engage and retain the best talent. Advanced applications not only advance these processes but also help management assess the performance of the workforce and compensate individuals fairly so that they advance their careers and find...

Read More

Topics:

Big Data,

Predictive Analytics,

Governance,

HCM, HR, HRMS, Workforce Management, Learning Mana,

Human Capital,

Mobile Technology,

Wearable Computing,

Customer Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Uncategorized,

Financial Performance Management (FPM)

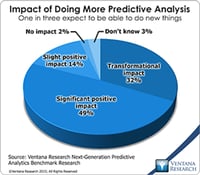

Technology innovation is accelerating faster than companies can keep up with. Many feel pressure to adopt new strategies that technology makes possible and find the resources required for necessary investments. In 2015 our research and analysis revealed many organizations upgrading key business applications to operate in the cloud and some enabling access to information for employees through mobile devices. Despite these steps, we find significant levels of digital disruption impacting every...

Read More

Topics:

Big Data,

Predictive Analytics,

Sales Performance,

Supply Chain Performance,

Governance,

Mobile Technology,

Operational Performance Management (OPM),

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Location Intelligence,

Operational Intelligence,

Uncategorized,

Workforce Performance,

Business Performance Management (BPM),

Financial Performance Management (FPM),

Information Optimization,

Sales Performance Management (SPM)

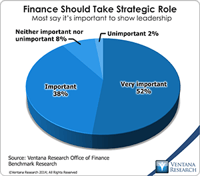

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

Governance,

GRC,

Human Capital,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational