I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

process management,

report

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management,

FPM

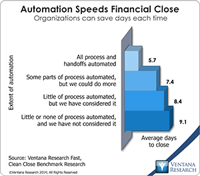

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance,

Financial Performance,

CFO,

Data,

Document Management,

Financial Performance Management,

FPM