I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial statements. The non-practitioner is likely unaware of the hair-curling amount of essential detail that the finance and accounting organization must handle in the close-to-report. Beyond its toll on efficiency, the time and attention involved in performing this work manually bedevils departments’ attempts to become a more strategic partner to the rest of the business.

In the keynotes, speakers paid a great deal of attention to the idea that eliminating easily automated detail work enables the transformation of the finance and accounting department to play a more strategic role. And I found three announcements at the user conference important.

The first announcement related to connectivity. The company is private-labeling a cloud-based integration and API management tool to expand its set of prebuilt connectors to ERP, financial management and other systems. Creating prebuilt connectors to ERP and other systems as well as facilitating the ability to integrate with any other systems its customers want is important for BlackLine’s long-term growth. In addition to its SAP Connector, Blackline has added prebuilt connectors to Oracle EBS release 12 and NetSuite. More will follow; BlackLine says it will poll customers to determine which connectors to build and in what order.

A second announcement was the general availability of a compliance application that facilitates the handling of attestations required under Sarbanes-Oxley section 302. This is not being sold as standalone software but as an extension to the BlackLine platform. Corporations have many ways of managing the testing, certifying and reporting under section 302. Currently, spreadsheets are popular because they are the default tools for general data collection tasks. Companies that use spreadsheets for compliance are the main target for this offering. Since a significant portion of what BlackLine’s reconciliation software does is the testing of financial controls and assessments, some internal audit teams (the group that typically owns the process) using spreadsheets are likely to find BlackLine Compliance an attractive option for managing section 302 compliance. Companies that use other tools for Sarbanes-Oxley compliance and BlackLine for reconciliations may find it cost-effective to use BlackLine for their section 302 compliance process, using connectors to include data fields (such as control names and descriptions) from the other compliance system in BlackLine Compliance. The advantages they may realize include tighter control of the process, easier administration and better visibility into its status.

A third key announcement was a statement of product direction. The company is intensifying its focus on using machine learning to handle easily defined and relatively simple tasks. Machine learning is best suited for tasks that are more complicated than those that can be handled by programming but not nearly as challenging as medical diagnoses or guiding self-driving vehicles. Relevant accounting processes are more like chess because they have little or no inherent ambiguity in conditions or outcomes and there are a limited set of permutations of the next steps the system should take. This describes many of the repetitive processes in accounting departments, which are performed identically even in high volumes. These two characteristics simplify training a system, reducing both user frustration and the probability of system-generated errors. The application of artificial intelligence to these tasks can meaningfully reduce accounting staff workloads, freeing up time for continuous improvement efforts.

BlackLine calls its first foray into machine learning Intelligent Matching. Where the technology finds a clear match between two sides of an intercompany transaction or reconciling bank or credit card accounts, it can do in less than a second what an accountant needs two minutes to do. Where human intervention is required, the accountant is presented with options and associated percentages of their likely match to help guide their selection. So even manual matches can be made in a shorter period.

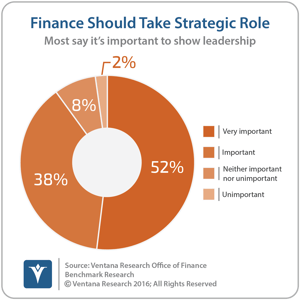

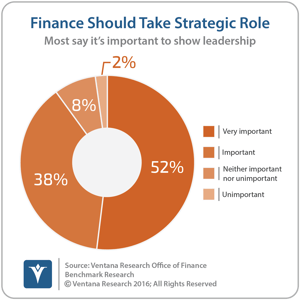

Making the finance and accounting department more of a strategic partner to the rest of the corporation was a general theme at the conference because the payoff for using BlackLine goes beyond improving efficiency. There’s been a consensus that the finance and accounting  department must play a more strategic role in its company, that it should transform from a backward-looking “bean counter” role focused mainly on processing transactions and reporting results to more of an advisor that provides executives and managers with forward-looking analyses that provide insight to improve their performance. Nine out of 10 participants in our Office of Finance benchmark research said that it’s important or very important for the department to play that role. Yet, although this sort of transformation has been a topic in finance and accounting for decades, our research has found that few companies have achieved it. One important reason for a lack of progress to realizing this objective is the time that must be devoted to performing an overabundance of easily automated busy work – work that is essential but adds limited value to a company’s performance.

department must play a more strategic role in its company, that it should transform from a backward-looking “bean counter” role focused mainly on processing transactions and reporting results to more of an advisor that provides executives and managers with forward-looking analyses that provide insight to improve their performance. Nine out of 10 participants in our Office of Finance benchmark research said that it’s important or very important for the department to play that role. Yet, although this sort of transformation has been a topic in finance and accounting for decades, our research has found that few companies have achieved it. One important reason for a lack of progress to realizing this objective is the time that must be devoted to performing an overabundance of easily automated busy work – work that is essential but adds limited value to a company’s performance.

Our research suggests that time-consuming tasks with limited business value limit the time organizations can devote to making necessary changes to enhance the strategic value and performance of the department. For example, the research found that departments that have substantially automated routine tasks are more likely to play an active role in the company’s management (70% that have automated versus 47% that haven’t) and are also more than twice as likely to promote analytical and process excellence (70% versus 31%). Finance department transformation requires top-to-bottom change management: commitment to becoming more strategic from the top of the organization down and freeing up staff time to promote necessary change from the bottom up.

Dealing with details manually presents accounting departments with challenges. For one, the work must be performed in a short period to minimize the time it takes to close the books. For another, the department must take care to ensure that the financial statements are accurate and consistent with accounting principles. Companies that are required to file their financial statements with the U.S. Securities and Exchange Commission have a further  imperative: Under the Sarbanes-Oxley Act, executives must personally sign off on the accuracy of the numbers and criminal liability attaches to them. BlackLine’s mission is to provide accounting departments the ability to reduce the amount of detail work by automating as much of the rote, repetitive work performed in the close-to-report cycle as possible.

imperative: Under the Sarbanes-Oxley Act, executives must personally sign off on the accuracy of the numbers and criminal liability attaches to them. BlackLine’s mission is to provide accounting departments the ability to reduce the amount of detail work by automating as much of the rote, repetitive work performed in the close-to-report cycle as possible.

One reason why departments have fallen short of their goal to become more strategic is that the technology that they use has been inadequate for the task. Our research finds that two-thirds (67%) of midsize and larger companies use spreadsheets either mainly or exclusively to manage their close-to-report process. There is a correlation between the degree to which companies use spreadsheets in this process and the time it takes to close: Heavy users of spreadsheets take more than two days longer than those that use spreadsheets rarely or never.

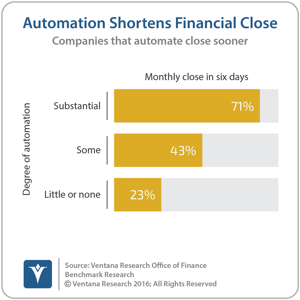

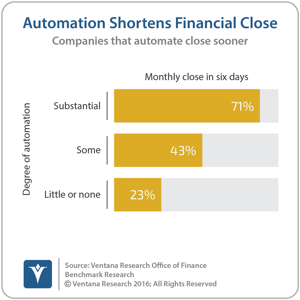

Automation of the process, on the other hand, speeds closing: 71 percent of companies that have automated substantially all their close processes are able to close within six business days compared to 43 percent that use some and just 23 percent that use little or no automation. This applies to the full range of activities of the department, not just the close-to-report cycle.

Our research has found that finance and accounting departments have been slow to embrace technology and score low on innovation. Our Office of Finance research finds that -4.png?width=300&name=vr_Office_of_Finance_27_finance_lags_innovation(1)-4.png) about 60 percent of finance departments operate at the lowest, tactical level of performance and just 5 percent are at the highest, innovative level. Technology’s centrality to improving performance is why people today speak of the “digital transformation” of finance and accounting.

about 60 percent of finance departments operate at the lowest, tactical level of performance and just 5 percent are at the highest, innovative level. Technology’s centrality to improving performance is why people today speak of the “digital transformation” of finance and accounting.

Technology is essential for a successful evolution of the department. To that end, BlackLine has embraced a continuous accounting approach in its product management and customer success efforts. Continuous accounting has three pillars. One is using technology to enable the department to spread workloads continuously over accounting periods, rather than bunching them up at the end. Some refer to this approach as a continuous close. The objective is to enable a shorter monthly or quarterly close period while de-stressing the department during the close. The second is using technology to ensure that data integrity is maintained end to end in a process. Designing business processes this way eliminates the need for accountants to check, verify and reconcile data, which saves time and reduces period-end workloads. The third pillar is continuous improvement.

Excessive amounts of time spent managing myriad details has prevented departments from transforming. Several of the customer presentations at the conference confirmed that too much busy work gets in the way of improving the department’s performance. “I’m too busy to figure out how to save time” is the ironic challenge that CFOs and controllers face. Continuous accounting is a practical management approach that creates a path for digital transformation. Incremental, step-by-step initiatives that provide time savings free up time to invest in further initiatives.

Technology is essential for the successful adoption and application of continuous accounting. And using technology to substantially reduce manual workloads in the accounting department can enable finance departments to play a more strategic role in the management of their company. BlackLine has software that enables companies to begin the process of being more strategic and supports a continuous improvement program in the department. I recommend that CFOs and controllers – especially those at companies that take more than a business week to complete their accounting close – make using technology more effectively a priority. As part of this process, I recommend they assess BlackLine to support greater automation and control of their close.

Regards,

Robert Kugel

SVP & Research Director

department must play a more strategic role in its company, that it should transform from a backward-looking “bean counter” role focused mainly on processing transactions and reporting results to more of an advisor that provides executives and managers with forward-looking analyses that provide insight to improve their performance. Nine out of 10 participants in our Office of Finance benchmark research said that it’s important or very important for the department to play that role. Yet, although this sort of transformation has been a topic in finance and accounting for decades, our research has found that few companies have achieved it. One important reason for a lack of progress to realizing this objective is the time that must be devoted to performing an overabundance of easily automated busy work – work that is essential but adds limited value to a company’s performance.

department must play a more strategic role in its company, that it should transform from a backward-looking “bean counter” role focused mainly on processing transactions and reporting results to more of an advisor that provides executives and managers with forward-looking analyses that provide insight to improve their performance. Nine out of 10 participants in our Office of Finance benchmark research said that it’s important or very important for the department to play that role. Yet, although this sort of transformation has been a topic in finance and accounting for decades, our research has found that few companies have achieved it. One important reason for a lack of progress to realizing this objective is the time that must be devoted to performing an overabundance of easily automated busy work – work that is essential but adds limited value to a company’s performance. imperative: Under the Sarbanes-Oxley Act, executives must personally sign off on the accuracy of the numbers and criminal liability attaches to them. BlackLine’s mission is to provide accounting departments the ability to reduce the amount of detail work by automating as much of the rote, repetitive work performed in the close-to-report cycle as possible.

imperative: Under the Sarbanes-Oxley Act, executives must personally sign off on the accuracy of the numbers and criminal liability attaches to them. BlackLine’s mission is to provide accounting departments the ability to reduce the amount of detail work by automating as much of the rote, repetitive work performed in the close-to-report cycle as possible.-4.png?width=300&name=vr_Office_of_Finance_27_finance_lags_innovation(1)-4.png) about 60 percent of finance departments operate at the lowest, tactical level of performance and just 5 percent are at the highest, innovative level. Technology’s centrality to improving performance is why people today speak of the “digital transformation” of finance and accounting.

about 60 percent of finance departments operate at the lowest, tactical level of performance and just 5 percent are at the highest, innovative level. Technology’s centrality to improving performance is why people today speak of the “digital transformation” of finance and accounting.