Workday Financial Management (which belongs in the broader ERP software category) appears to be gaining traction in the market, having matured sufficiently to be attractive to a large audience of buyers. It was built from the ground up as a cloud application. While that gives it the advantage of a fresh approach to structuring its data and process models for the cloud, the product has had to catch up to its rivals in functionality. The company’s ERP offering has matured considerably over the...

Read More

Topics:

Microsoft,

SAP,

ERP,

FP&A,

Human Capital,

NetSuite,

Office of Finance,

Reporting,

close,

Controller,

dashboard,

Tax,

Operational Performance,

Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

Financial Performance Management,

FPM,

Intacct,

Spreadsheets

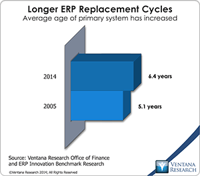

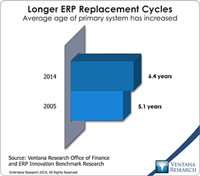

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

Supply Chain Performance,

ERP,

FP&A,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Reconciliation,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

finance,

Financial Performance Management,

FPM,

Intacct

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

Sales Performance,

SAP,

Supply Chain Performance,

ERP,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Customer Performance,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

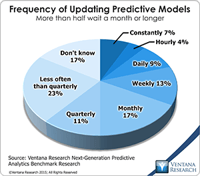

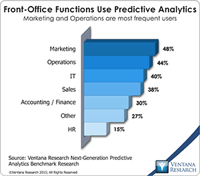

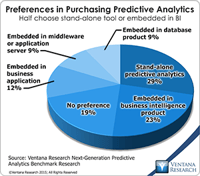

One of the key findings in our latest benchmark research into predictive analytics is that companies are incorporating predictive analytics into their operational systems more often than was the case three years ago. The research found that companies are less inclined to purchase stand-alone predictive analytics tools (29% vs 44% three years ago) and more inclined to purchase predictive analytics built into business intelligence systems (23% vs 20%), applications (12% vs 8%), databases (9% vs...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

SAS,

Social Media,

alteryx,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Operational Intelligence,

Oracle,

Information Optimization,

SPSS,

Rapidminer

Our benchmark research into predictive analytics shows that lack of resources, including budget and skills, is the number-one business barrier to the effective deployment and use of predictive analytics; awareness – that is, an understanding of how to apply predictive analytics to business problems – is second. In order to secure resources and address awareness problems a business case needs to be created and communicated clearly wherever appropriate across the organization. A business case...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

SAS,

Social Media,

alteryx,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Operational Intelligence,

Oracle,

Information Optimization,

SPSS,

Rapidminer

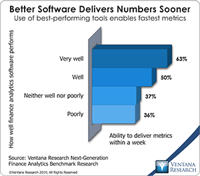

Our research into next-generation predictive analytics shows that along with not having enough skilled resources, which I discussed in my previous analysis, the inability to readily access and integrate data is a primary reason for dissatisfaction with predictive analytics (in 62% of participating organizations). Furthermore, this area consumes the most time in the predictive analytics process: The research finds that preparing data for analysis (40%) and accessing data (22%) are the parts of...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

alteryx,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Operational Intelligence,

Oracle,

Information Optimization

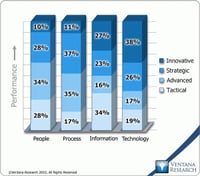

The Performance Index analysis we performed as part of our next-generation predictive analytics benchmark research shows that only one in four organizations, those functioning at the highest Innovative level of performance, can use predictive analytics to compete effectively against others that use this technology less well. We analyze performance in detail in four dimensions (People, Process, Information and Technology), and for predictive analytics we find that organizations perform best in...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

alteryx,

Operational Performance Management (OPM),

Customer Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Location Intelligence,

Oracle,

Information Optimization

To impact business success, Ventana Research recommends viewing predictive analytics as a business investment rather than an IT investment. Our recent benchmark research into next-generation predictive analytics reveals that since our previous research on the topic in 2012, funding has shifted from general business budgets (previously 44%) to line of business IT budgets (previously 19%). Now more than half of organizations fund such projects from business budgets: 29 percent from general...

Read More

Topics:

Big Data,

Microsoft,

Predictive Analytics,

alteryx,

Customer Performance,

Analytics,

Business Analytics,

Business Intelligence,

Operational Intelligence,

Oracle,

Business Performance Management (BPM),

Rapidminer

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Sales Performance,

Salesforce.com,

Supply Chain Performance,

ERP,

HCM,

Human Capital,

Office of Finance,

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

Kenandy,

PSA,

Sage Software,

Unit4,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Collaboration,

Customer & Contact Center,

Financial Performance,

Workforce Performance,

CFO,

FinancialForce,

HR,

Infor,

Workday,

HANA,

Plex,

Professional Services Automation

Like most vendors of on-premises ERP and financial management software, in moving to the cloud Oracle has focused on developing for existing and potential customers the option of multitenant software as a service (SaaS). (I’m using the term “ERP” in its most expansive sense, to include such systems employed by all types of companies for accounting and financial management rather than only systems that are used by manufacturing and distribution companies.) Oracle’s ERP Cloud Service includes ...

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Salesforce.com,

ERP,

HCM,

Human Capital,

Office of Finance,

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

Kenandy,

PSA,

Sage Software,

Unit4,

Operational Performance,

Analytics,

Business Performance,

Cloud Computing,

Collaboration,

Customer & Contact Center,

Financial Performance,

CFO,

FinancialForce,

HR,

Infor,

Workday,

HANA,

Plex,

Professional Services Automation