In the face of a very uncertain future, companies have been discovering the value of rapid planning and budgeting cycles. As events unfold, they’re changing expectations for the future significantly on a daily or weekly basis. However, even when the world returns to a steadier state, companies will benefit from making their planning and budgeting processes faster, easier, more relevant, more strategic, more agile and more accurate.

Read More

Topics:

Office of Finance,

IBP,

Business Planning,

CFO,

Integrated Business Planning

The Chief Financial Officer can enable her or his finance department play a more strategic role in company operations by adopting what I call profitability management. In the interest of time I’ve made this a very high-level description that’s intended to be just an introduction to the topic. Profitability management is a cross-functional effort. It integrates finance and sales to achieve an optimal balance of revenue and margin objectives. It’s an analytics-based approach designed achieve...

Read More

Topics:

Office of Finance,

Continuous Accounting,

Integrated Business Planning,

CEO, CFO, Financial Performance Management, Foreca

I like Louis Pasteur’s observation that “fortune favors the prepared mind.” So-called black swan events happen regularly and can have a very negative effect on a business. Of course, risk is inherent in any commercial undertaking; organizations don’t succeed by being overly cautious and reckless ones usually fail after awhile. Those that are consistently successful are ones that manage risk intelligently. That is, they correctly identify vulnerabilities, avoid the decisions and situations where...

Read More

Topics:

Office of Finance,

Continuous Accounting,

Integrated Business Planning,

CEO, CFO, Financial Performance Management, Foreca

The use of blockchain distributed ledgers in business processes is now a common theme in many business software vendors’ presentations. The technology has a multitude of potential uses. However, presentations about the opportunities for digital transformation always leave me wondering: How is this magic going to happen? I wonder this because the details about how data flows from point A to point B via a blockchain are critically important to blockchain utility and therefore the pace of its...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI,

forecasting,

consolidating

Ventana Research uses the term “predictive finance” to describe a forward-looking, action-oriented finance organization that places emphasis on advising its company rather than fulfilling the traditional roles of a transactions processor and reporter. Technology is driving the shift away from the traditional bean-counting role. The cumulative evolution of software advances will substantially reduce finance and accounting workloads by automating most of the mechanical, rote functions in...

Read More

Topics:

Planning,

Predictive Analytics,

Forecast,

FP&A,

Machine Learning,

Reporting,

budget,

Budgeting,

Continuous Planning,

Analytics,

Data Management,

Cognitive Computing,

Integrated Business Planning,

AI

Prophix is an established provider of financial performance management (FPM) software for planning and budgeting, forecasting, analysis and reporting, and managing the financial close and consolidation process. Its eponymous software is designed specifically for midsize companies or midsize divisions of larger corporations. These organizations are a distinctive segment of the market in that they have almost all the functional requirements of large enterprises but have fewer resources to apply...

Read More

Topics:

Planning,

Office of Finance,

Reporting,

Budgeting,

Consolidation,

Continuous Planning,

Analytics,

Business Intelligence,

Collaboration,

Financial Performance Management,

Integrated Business Planning,

accounting close,

Price and Revenue Management,

Work and Resource Management,

Sales Planning and Analytics

Ventana Research recently awarded Workday a 2016 Technology Innovation Award for its newly released application, Workday Planning, because it simplifies and streamlines the budgeting and planning processes while facilitating collaboration, deepening visibility into spending and enabling tight fiscal control. These capabilities can help a variety of user organizations in several ways.

Read More

Topics:

Big Data,

Marketing,

Office of Finance,

Budgeting,

Controller,

In-memory,

CFO,

Workday,

demand management,

Financial Performance Management,

financial reporting,

FPM,

Integrated Business Planning

Supply and demand chain planning and execution have grown in importance over the past decade as companies have recognized that software can meaningfully enhance their competitiveness and improve their financial performance. Sales and operations planning (S&OP) is an integrated business management process first developed in the 1980s aimed at achieving better alignment and synchronization between the supply chain, production and sales functions. A properly implemented S&OP process routinely...

Read More

Topics:

Planning,

SaaS,

Sales,

Sales Performance,

Supply Chain Performance,

Forecast,

Human Capital,

Mobile Technology,

Supply Chain Planning,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Sales Performance Management (SPM),

Sales Planning,

Supply Chain,

Demand Chain,

Integrated Business Planning,

SCM Demand Planning,

S&OP

Tidemark Systems offers a suite of business planning applications that enable corporations to plan more effectively. The software facilitates rapid creation and frequent updating of integrated company plans by making it easy for individual business functions to create their own plans while allowing headquarters to connect them to create a unified view. I coined the term “integrated business planning” a decade ago to highlight the potential for technology to substantially improve the...

Read More

Topics:

Planning,

Sales Performance,

Supply Chain Performance,

Customer Experience,

Human Capital,

Marketing Planning,

Reporting,

Budgeting,

Operational Performance,

Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Business Performance Management (BPM),

Business Planning,

Financial Performance Management (FPM),

Demand Planning,

Integrated Business Planning,

Project Planning

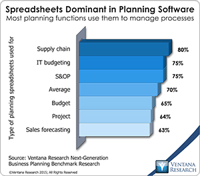

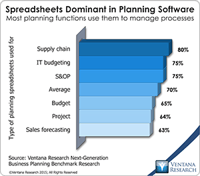

Our benchmark research on next-generation business planning finds that a large majority of companies rely on spreadsheets to manage planning processes. For example, four out of five use them for supply chain planning, and about two-thirds for budgeting and sales forecasting. Spreadsheets are the default choice for modeling and planning because they are flexible. They adapt to the needs of different parts of any type of business. Unfortunately, they have inherent defects that make them...

Read More

Topics:

Planning,

Predictive Analytics,

Marketing Planning,

Reporting,

Sales Forecasting,

Budgeting,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Financial Performance,

Business Planning,

Demand Planning,

Integrated Business Planning