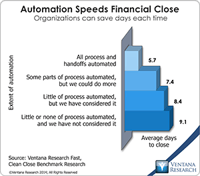

I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

process management,

report

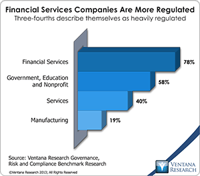

Ventana Research awarded our Governance, Risk and Compliance (GRC) Business Innovation Award for 2016 to IBM for IBM Regulatory Compliance Analytics, powered by Watson (IRCA). This application of cognitive analytics is designed to streamline the identification of potential regulatory requirements and suggest methods for compliance. In so doing the cloud-based system can cut the time and cost of compliance while creating an effective means of ongoing management and control of compliance...

Read More

Topics:

GRC,

Machine Learning,

Office of Finance,

Dodd-Frank,

Risk Analytics,

compliance,

finance,

Financial Services,

Watson

ADP recently held its annual analyst day in the company’s new innovation center in the Chelsea district of Manhattan. The location emphasized what ADP wanted to get across to the analyst community at the event: that it intends to become a significant vendor of human capital management (HCM) software based in the cloud. ADP hopes to broaden its business from being largely an outsourcing vendor of payroll and related services (such as for auto dealers) to one that provides software for a range of...

Read More

Topics:

Big Data,

Mobile,

Social Media,

HCM,

Human Capital Management,

Office of Finance,

Predictive,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Mobility,

Workforce Performance,

compliance,

HR,

HRMS,

Healthcare Compliance

Tagetik provides financial performance management software. One particularly useful aspect of its suite is the Collaborative Disclosure Management (CDM). CDM addresses an important need in finance departments, which routinely generate highly formatted documents that combine words and numbers. Often these documents are assembled by contributors outside of the finance department; human resources, facilities, legal and corporate groups are the most common. The data used in these reports almost...

Read More

Topics:

Big Data,

Mobile,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

Finance Financial Applications Financial Close,

IFRS,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

compliance,

Data,

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Profitability,

SEC Software

The proliferation of chief “something” officer (CxO) titles over the past decades recognizes that there’s value in having a single individual focused on a specific critical problem. A CxO position can be strategic or it can be the ultimate middle management role, with far more responsibilities than authority. Many of those handed such a title find that it’s the latter. This may be because the organization that created the title is unwilling to invest the necessary powers and portfolio of...

Read More

Topics:

GRC,

Office of Finance,

Chief Risk Officer,

CRO,

ERM,

OpenPages,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Data Governance,

Financial Performance,

IBM,

compliance,

Data,

Risk,

Financial Services,

FPM

In the past year Kronos announced a major release of its Workforce Central suite and more recently, made an announcement regarding a major investment that should help keep the company well capitalized. Kronos is one of the largest vendors of workforce management systems, providing time and attendance, labor scheduling, absence management, HR management, payroll and recruiting applications. In 2013 the company grew to almost US$1 billion in revenue, selling to companies around the globe and...

Read More

Topics:

Mobile,

Social Media,

Governance,

HCM,

Kronos,

Office of Finance,

Technology Innovation Award,

Business Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

Workforce Performance,

compliance,

HR,

HRMS,

Risk & Compliance (GRC),

Value Index,

Workforce Management,

Social

Integrated risk management (IRM) was a major theme at IBM’s recent Smarter Risk Management analyst summit in London. In the market context, IBM sees this topic as a means to differentiate its product and messaging from those of its competitors. IRM includes cloud-based offerings in operational risk analytics, IT risk analytics and financial crimes management designed for financial institutions and draws on component elements of software that IBM acquired over the past five years, notably from ...

Read More

Topics:

Supply Chain Performance,

GRC,

Office of Finance,

Chief Risk Officer,

CRO,

ERM,

OpenPages,

IT Performance,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Data Governance,

Governance, Risk & Compliance (GRC),

IBM,

Information Applications,

Information Management,

Operational Intelligence,

compliance,

Data,

Risk,

Financial Services,

FPM

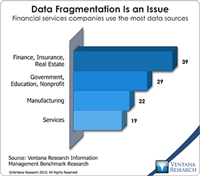

All the hubbub around big data and analytics has many senior finance executives wondering what the big deal is and what they should do about it. It can be especially confusing because much of what’s covered and discussed on this topic is geared toward technologists and others working outside of Finance, in areas such as sales, marketing and risk management. But finance executives need to position their organization to harness this technology to support the strategic goals of their company. To...

Read More

Topics:

Big Data,

Performance Management,

Predictive Analytics,

Customer Experience,

Fraud,

Governance,

GRC,

Office of Finance,

audit,

Controller,

Analytics,

Business Analytics,

Business Performance,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

Operational Intelligence,

CFO,

compliance,

finance,

Risk,

Financial Performance Management,

financial risk management

Read More

Topics:

Sales Performance,

Office of Finance,

eDiscovery,

Exterro,

Operational Performance,

Business Performance,

Data Governance,

Data Management,

Financial Performance,

Informatica,

Information Applications,

Information Management,

Workforce Performance,

compliance,

Data,

Information,

Risk

Oracle continues to enrich the capabilities of its Hyperion suite of applications that support the finance function, but I wonder if that will be enough to sustain its market share and new generation of expectations. At the recent Oracle OpenWorld these new features were on display, and spokespeople described how the company will be transitioning its software to cloud deployment. Our 2013 Financial Performance Management Value (FPM) Index rates Oracle Hyperion a Warm vendor in my analysis,...

Read More

Topics:

Big Data,

Mobile,

Planning,

Social Media,

ERP,

Human Capital Management,

Modeling,

Office of Finance,

Reporting,

Budgeting,

close,

closing,

Consolidation,

Controller,

driver-based,

Finance Financial Applications Financial Close,

Hyperion,

IFRS,

Tax,

XBRL,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Oracle,

CFO,

compliance,

Data,

benchmark,

Financial Performance Management,

financial reporting,

FPM,

GAAP,

Integrated Business Planning,

Price Optimization,

Profitability,

SEC Software