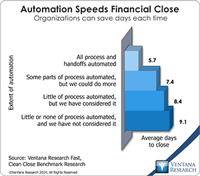

A core objective of my research practice and agenda is to help the Office of Finance improve its performance by better utilizing information technology. As we kick off 2014, I see five initiatives that CFOs and controllers should adopt to improve their execution of core finance functions and free up time to concentrate on increasing their department’s strategic value. Finance organizations – especially those that need to improve performance – usually find it difficult to find the resources to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Sales Performance,

Supply Chain Performance,

Office of Finance,

Budgeting,

close,

dashboard,

PRO,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Customer & Contact Center,

Financial Performance,

In-memory,

CFO,

Supply Chain,

CEO,

demand management,

Financial Performance Management,

FPM,

S&OP

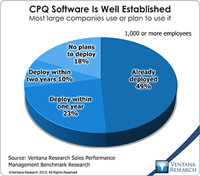

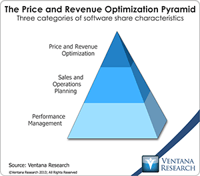

PROS Holdings, a provider of price and revenue optimization software, has an agreement in principle to acquire Cameleon Software, which offers configure, price and quote (CPQ) applications. The combined company is likely to benefit from a broader geographic presence (PROS is based in Houston while Cameleon is in Toulouse, France) for their sales and marketing efforts. However, the longer-term strategic value of the merger lies in the combination of the related categories of price optimization...

Read More

Topics:

Sales,

Sales Performance,

FP&A,

PRO,

PROS,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Financial Performance,

CFO,

CPQ,

CEO,

FPM,

Price Optimization,

Profitability

People who don’t spend much time analyzing the software market may have trouble understanding the differences between products in a given software category or the difference between two categories. This happens because vendors and commentators use the same words to describe different depths of functionality and degrees of comprehensiveness in one type of application. As well, there can be multiple categories of software that address the same general business issues but are designed for...

Read More

Topics:

Performance Management,

Sales Performance,

Supply Chain Performance,

Office of Finance,

dashboard,

PRO,

Operational Performance,

Business Analytics,

Business Performance,

Financial Performance,

CFO,

Supply Chain,

CEO,

demand management,

FPM,

S&OP

At this year’s Global Pricing Forum, host Nomis Solutions announced the availability of its Discretion Manager software, which supports dynamic price negotiations. The annual event brings together thought leaders and practitioners interested in pricing. Nomis currently has 17 of the largest 100 banks as customers. With more customers, this year’s event had larger attendance than last year’s.

Read More

Topics:

Big Data,

Sales,

Sales Performance,

Office of Finance,

credit,

financial analytics,

Nomis Solutions,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

banking,

Financial Services

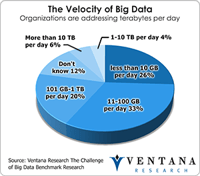

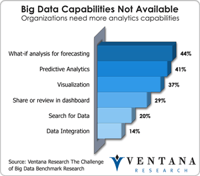

One of the most important IT trends over the past decade has been the proliferation of ever wider and deeper sets of information sources that businesses use to collect, track and analyze data. While structured numerical data remains the most common category, organizations are also learning to exploit semistructured data (text, for example) as well as more complex data types such as voice and image files. They use these analytics increasingly in every aspect of their business – to assess...

Read More

Topics:

Planning,

Predictive Analytics,

Customer,

Human Capital Management,

Office of Finance,

Budgeting,

close,

closing,

Finance Analytics,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

CFO,

Risk,

costing,

FPM,

Profitability

This is the third in a series of blog posts on what CEOs (and for that matter, all senior corporate executives) need to know about IT and its impact on running a business. The first covered the high-level issues. As I noted, it’s not necessary for a CEO to be able to write Java code or master the intricacies of an ERP or sales compensation application. However, CEOs must grasp the basics of IT just as they must understand basic corporate finance, the production process and – at least at a high...

Read More

Topics:

Planning,

Predictive Analytics,

Sales,

Sales Performance,

Customer,

Human Capital Management,

Office of Finance,

Budgeting,

close,

closing,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Information Management,

CFO,

CEO,

FPM,

Profitability,

SPM

I recently attended the 2012 Global Pricing Forum hosted by Nomis Solutions, a provider of software and services to banking and finance companies. This annual event brings together thought leaders and practitioners in the area of pricing and revenue optimization (PRO). This technique uses analytics to sift through large data sets to tease out customer behavior characteristics, identify customer segments and quantify their price sensitivities. These complex calculations require software designed...

Read More

Topics:

Sales,

Sales Performance,

Supply Chain Performance,

Office of Finance,

credit,

financial analytics,

Nomis Solutions,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Financial Performance,

banking,

Financial Services