A core objective of my research practice and agenda is to help the Office of Finance improve its performance by better utilizing information technology. As we kick off 2014, I see five initiatives that CFOs and controllers should adopt to improve their execution of core finance functions and free up time to concentrate on increasing their department’s strategic value. Finance organizations – especially those that need to improve performance – usually find it difficult to find the resources to invest in increasing their strategic value. However, any of the first three initiatives mentioned below will enable them to operate more efficiently as well as improve performance. These initiatives have been central to my focus for the past decade. The final two are relatively new and reflect the evolution of technology to enable finance departments to deliver better results. Every finance organization should adopt at least one of these five as a priority this year.

Close faster. Because the process of closing the books is similar for all corporations, it should be seen as a universal performance benchmark. Our research finds that only 38 percent of all companies with more than 100 employees complete their quarterly or half-yearly close within five to six days of the end of the quarter (which is the generally accepted performance standard), while the remaining majority take longer. And for all the discussion over the years about the need to close faster, our most recent benchmark research on the close discovered that companies on average are taking a half-day longer to complete the process than they did five years earlier. For the most part, much of this increase appears to have been among companies that were already taking more than a business week to close. I’ve written that the close is a good litmus test for the overall effectiveness of a finance department.

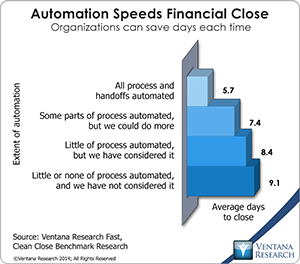

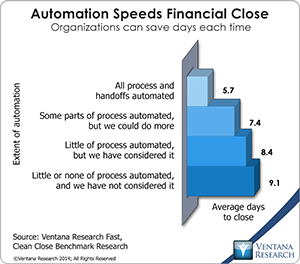

Our research into how companies close shows that its common for two companies with exactly the same characteristics (the same size, in the same industry, located in the same country) to demonstrate  big differences in how quickly they complete their accounting cycle: Company A does it in two days while company B needs nine days to get the job done. The difference is likely to be due to some interplay of people, process, information and technology. Common issues are poor process design, overuse of spreadsheets in the process, consolidation software that no longer meets current business requirements and too little automation of repetitive tasks. Our research shows the correlation between increased automation, for example, and achieving a faster close. We found that, on average, companies that have automated the process completely close in 5.7 days compared with 9.1 days for those that have automated little or none of the process. Shortening the close is important because it enables finance organizations to provide management and financial accounting information to the rest of the company sooner, reduces overtime and frees up resources that can be put to better use. Addressing such issues in a concerted program with measurable objectives is the best way to achieve progress. Moreover, in the process of shortening the close, broader issues can be addressed at their source, improving the performance of the Office of Finance. Focusing on the root causes behind too long a close process can uncover hidden issues common to many finance processes, including poor data availability and quality, poor communications and training, and too much complexity.

big differences in how quickly they complete their accounting cycle: Company A does it in two days while company B needs nine days to get the job done. The difference is likely to be due to some interplay of people, process, information and technology. Common issues are poor process design, overuse of spreadsheets in the process, consolidation software that no longer meets current business requirements and too little automation of repetitive tasks. Our research shows the correlation between increased automation, for example, and achieving a faster close. We found that, on average, companies that have automated the process completely close in 5.7 days compared with 9.1 days for those that have automated little or none of the process. Shortening the close is important because it enables finance organizations to provide management and financial accounting information to the rest of the company sooner, reduces overtime and frees up resources that can be put to better use. Addressing such issues in a concerted program with measurable objectives is the best way to achieve progress. Moreover, in the process of shortening the close, broader issues can be addressed at their source, improving the performance of the Office of Finance. Focusing on the root causes behind too long a close process can uncover hidden issues common to many finance processes, including poor data availability and quality, poor communications and training, and too much complexity.

Even if your company is closing its books within a business week, chances are there’s still room for improvement that can come from automating existing manual tasks. For instance, reconciliations are an activity where companies with as few as 250 employees are likely to find savings of time and money using technology to automate the process and enhance accuracy and auditability.

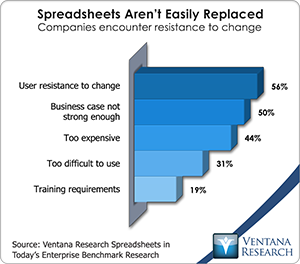

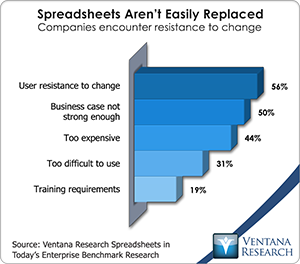

Master Excel. Our research shows that spreadsheets are a problem when used in any repetitive collaborative enterprise-wide task (for example, planning, forecasting, closing and managing sales operations).  At the same time, spreadsheets are an essential tool in business and cannot always be replaced by other software and systems. For this reason, it’s important for finance executives to ensure that the people who are designing and using spreadsheets know what they are doing. One of the root causes of spreadsheet problems is lack of competence by those designing models and analyses. Spreadsheets’ lack of transparency easily masks poor design. Typically, people are self-trained. Although they can complete assignments, the resulting spreadsheet may be inefficient, difficult to audit and brittle (difficult to change without making major modifications) and have so many vulnerabilities to mistakes and tampering that they are disasters waiting to happen. It’s common, for example, for people to create dense and complex nested logic expressions because they don’t know how to use lookup tables. Our research found that almost half (45%) of companies provide no training and just 8 percent provide regular Excel training sessions, with the rest providing only initial training or leaving it to the individual to take the initiative. Just as armies march on their stomachs, finance organizations operate in a world of spreadsheets. It makes sense to invest in the productivity of those responsible for creating spreadsheets because that investment is likely to promote productivity as well as reduce errors and the resulting rework and other costs that go with them. Along with training, testing is useful to ensure that people have the necessary skills to create spreadsheets, but almost all companies (87%) do not test their users.

At the same time, spreadsheets are an essential tool in business and cannot always be replaced by other software and systems. For this reason, it’s important for finance executives to ensure that the people who are designing and using spreadsheets know what they are doing. One of the root causes of spreadsheet problems is lack of competence by those designing models and analyses. Spreadsheets’ lack of transparency easily masks poor design. Typically, people are self-trained. Although they can complete assignments, the resulting spreadsheet may be inefficient, difficult to audit and brittle (difficult to change without making major modifications) and have so many vulnerabilities to mistakes and tampering that they are disasters waiting to happen. It’s common, for example, for people to create dense and complex nested logic expressions because they don’t know how to use lookup tables. Our research found that almost half (45%) of companies provide no training and just 8 percent provide regular Excel training sessions, with the rest providing only initial training or leaving it to the individual to take the initiative. Just as armies march on their stomachs, finance organizations operate in a world of spreadsheets. It makes sense to invest in the productivity of those responsible for creating spreadsheets because that investment is likely to promote productivity as well as reduce errors and the resulting rework and other costs that go with them. Along with training, testing is useful to ensure that people have the necessary skills to create spreadsheets, but almost all companies (87%) do not test their users.

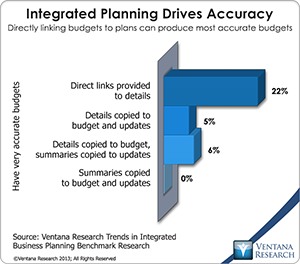

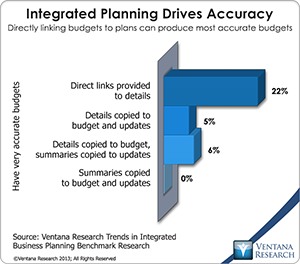

Plan – don’t just budget. I have asserted that annual budgeting should evolve into a process that’s more focused on planning the business. Many people speak of planning and budgeting as if they were the same thing, but they’re not. Budgeting is essential for control, but budgets are focused on money, not things.  So while they’re good for finance departments, budgets don’t deliver much value to the rest of the company. Business planning as practiced today is a relic, a process hemmed in by obsolete conceptions of what it should be. Individual business units make plans, but they are narrowly focused and not well integrated. Our business planning research found that companywide planning efforts are not as coordinated as they could be: Just 22 percent of the participants said they can accurately measure the impact of their plan on other parts of the business. While today’s budgeting and operational planning efforts are loosely connected, the next generation of business planning closely integrates unit-level operational plans with financial planning. At the corporate level, it shifts the emphasis from financial budgeting to business planning and performance reviews that integrate both operational and financial measures. This new approach uses available information technology to enable businesses to plan faster with less effort while achieving greater accuracy and agility. The approach addresses a deep-seated issue: Our research shows that in most companies the budget is not collaborative on an ongoing basis and therefore hinders coordination as companies adapt to changing circumstances. It doesn’t enable managers to anticipate how best to adapt to those changing circumstances, so when things change, as they always do, companies lack the sort of coordination they need to make changes quickly and maximize their performance. The data from our research shows that traditional budgeting does not promote strategic and operational alignment, which winds up hurting performance. And because companies take too long to review their results and in these reviews aren’t able to immediately determine the source of variances between their plan and actual results, they do not react quickly to seize opportunities and address issues.

So while they’re good for finance departments, budgets don’t deliver much value to the rest of the company. Business planning as practiced today is a relic, a process hemmed in by obsolete conceptions of what it should be. Individual business units make plans, but they are narrowly focused and not well integrated. Our business planning research found that companywide planning efforts are not as coordinated as they could be: Just 22 percent of the participants said they can accurately measure the impact of their plan on other parts of the business. While today’s budgeting and operational planning efforts are loosely connected, the next generation of business planning closely integrates unit-level operational plans with financial planning. At the corporate level, it shifts the emphasis from financial budgeting to business planning and performance reviews that integrate both operational and financial measures. This new approach uses available information technology to enable businesses to plan faster with less effort while achieving greater accuracy and agility. The approach addresses a deep-seated issue: Our research shows that in most companies the budget is not collaborative on an ongoing basis and therefore hinders coordination as companies adapt to changing circumstances. It doesn’t enable managers to anticipate how best to adapt to those changing circumstances, so when things change, as they always do, companies lack the sort of coordination they need to make changes quickly and maximize their performance. The data from our research shows that traditional budgeting does not promote strategic and operational alignment, which winds up hurting performance. And because companies take too long to review their results and in these reviews aren’t able to immediately determine the source of variances between their plan and actual results, they do not react quickly to seize opportunities and address issues.

Adopt price optimization and profitability management. For companies that close within a week, have mastered Excel and focus more on planning than budgeting, price optimization presents a new frontier on which to improve company performance. Price and revenue optimization (PRO) is a business discipline used to create demand-based pricing; it applies market segmentation techniques to achieve strategic objectives such as increasing profitability or market share. PRO first came into wide use in the airline and hospitality industries in the 1980s as a way of maximizing returns from less flexible travelers (such as people on business trips) while minimizing unsold inventory by selling incremental seats on flights or hotel room nights at discounted prices to more discretionary buyers (typically vacationers). Today, PRO is a well-developed part of any business strategy in the travel industry and is increasingly used in others. Optimization is not maximization, since the objective of the former is to achieve the best trade-off between sometimes mutually exclusive goals and their constraints. Focusing solely on profit maximization may result in wider margins but lower sales and profits, for example. Optimizing price means using analytics to gain a better understanding of customers’ price sensitivity in order to achieve the best mix of price and volume consistent with the company’s strategy. This allows businesses to achieve the highest possible margins consistent with their volume and mix objectives. Analytical software is available that enables companies to implement and manage a PRO strategy, which I covered in an earlier perspective.

Manage taxes more effectively. Corporations’ largest tax outlays fall into two main categories, indirect and direct. Indirect taxes are those collected by an intermediary such as a retailer or wholesaler and then paid to government entities. This includes sales and use tax (in the United States), goods and services tax (in Canada) and value-added tax (in Europe and other regions). A large percentage of midsize and larger corporations in North America use software to manage their indirect taxes. In the U.S., such indirect taxes are difficult to handle because of the complex and overlapping tax jurisdictions, changes in rates as well as the definitions of what’s taxable at which rates. The issue is not just calculating the amounts at the time of the transaction, but also being able to mount an audit defense as inexpensively as possible at some point in the future. If your company is not using a third party to manage its indirect tax calculations, 2014 would be a great year to start, especially if your business operates in areas where the tax authorities are most aggressive. Direct – or income – taxes are another matter. Because of their size and complexity, many midsize and almost all larger organizations need to automate more of their tax provisioning process using dedicated software rather than spreadsheets. Corporations that operate in multiple income tax jurisdictions with only moderate complexity in their corporate structure can save considerable amounts of time, have better insight into their tax positions and improve their audit defense posture by switching from spreadsheets.

Senior finance executives often spend time fighting fires rather than addressing their root causes to prevent new ones. Companies that take more than one business week to close must determine why it’s taking them so long and address those issues. The same causes behind a longer-than-necessary close are likely to be at work in all or most finance processes. Further, providing employees with Excel training and testing will improve their productivity and the quality of work they perform. And if nothing else, taking a fresh look at planning and budgeting can identify ways to streamline the process, freeing up time to invest in efforts that will improve the department’s performance. Finally, finance departments that already operate efficiently should focus on ways to play a more strategic role in their company’s business, particularly by managing pricing analytics and improving their tax provisioning acumen.

Regards,

Robert Kugel – SVP Research