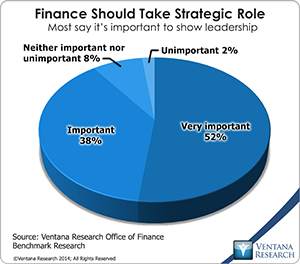

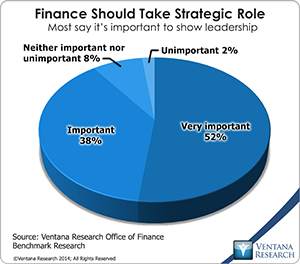

Finance transformation” refers to a longstanding objective: shifting the focus of CFOs and finance departments from transaction processing to more strategic, higher-value functions. Our upcoming Office of Finance benchmark research confirms that most of organizations want their finance department to take a more strategic role in management of the company: nine in 10 participants said that it’s important or very important. (We are using “finance” in its broadest sense, including, for example, accounting, corporate finance, financial planning and analysis, treasury and tax functions.) Finance departments have the ability and at least an implicit mandate to improve business performance and enable a corporation to execute strategy more effectively. Yet the research shows that becoming strategic is a work in progress. Most departments handle the basics well, but half fall short in areas that can contribute significantly to the performance of their company. More than three-fourths of participants said they perform accounting, external financial reporting, financial analysis, budgeting and management accounting well or very well. But only half said that about their ability to do product and customer profitability management, strategic and long-range planning and business development.

Finance transformation” refers to a longstanding objective: shifting the focus of CFOs and finance departments from transaction processing to more strategic, higher-value functions. Our upcoming Office of Finance benchmark research confirms that most of organizations want their finance department to take a more strategic role in management of the company: nine in 10 participants said that it’s important or very important. (We are using “finance” in its broadest sense, including, for example, accounting, corporate finance, financial planning and analysis, treasury and tax functions.) Finance departments have the ability and at least an implicit mandate to improve business performance and enable a corporation to execute strategy more effectively. Yet the research shows that becoming strategic is a work in progress. Most departments handle the basics well, but half fall short in areas that can contribute significantly to the performance of their company. More than three-fourths of participants said they perform accounting, external financial reporting, financial analysis, budgeting and management accounting well or very well. But only half said that about their ability to do product and customer profitability management, strategic and long-range planning and business development.

We asked research participants to identify the three most important issues finance departments confront in a dozen functional areas: accounting, budgeting, cost accounting, customer profitability management, external financial reporting, financial analysis, financial governance and internal audit, management accounting, product profitability management, strategic and long-range planning, tax management and treasury and cash management. We gave as choices for issues analytics, data availability and quality, management effectiveness, process design, software and training. As a whole, participants did not point to a single overarching issue. On average, none of the six issues was selected by more than half of participants, and the difference in frequency between the top three issues - process, analytics and data - were statistically insignificant. The identification of these top three as important issues confronting Finance is consistent with other research we have done. On the other hand, software was the issue least frequently named, chosen by just 24 percent. Yet failure to use highly capable software and reliance on spreadsheets often are root causes of process, analytics and data issues. The inability to recognize the importance of technology in supporting finance processes is an ongoing barrier to improving the performance of finance departments. The research provides several examples.

We find that the best-performing finance organizations adopt a total quality management approach to finance and accounting. As with manufacturing operations, the objective in any finance department process should be to design quality into the process (for example, addressing root causes that drive errors in calculations and accounting classifications) and ensuring consistent execution of that process. A poorly designed process is often the heart of a problem that results in unnecessary work in the finance organization or in its impact on customer-facing roles or other aspects of company operations. Yet inconsistent execution can offset the benefits of a well-designed process, which is why software with built-in workflow addresses the root causes of issues that arise when processes are managed with spreadsheets and email.

We find that the best-performing finance organizations adopt a total quality management approach to finance and accounting. As with manufacturing operations, the objective in any finance department process should be to design quality into the process (for example, addressing root causes that drive errors in calculations and accounting classifications) and ensuring consistent execution of that process. A poorly designed process is often the heart of a problem that results in unnecessary work in the finance organization or in its impact on customer-facing roles or other aspects of company operations. Yet inconsistent execution can offset the benefits of a well-designed process, which is why software with built-in workflow addresses the root causes of issues that arise when processes are managed with spreadsheets and email.

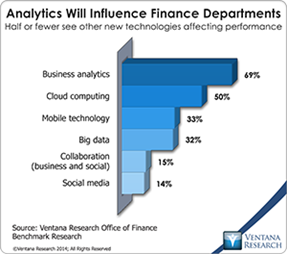

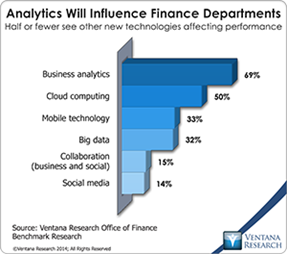

The research also points to a good deal of skepticism (or ignorance) on the part of executives generally and finance professionals in particular about the role that technology can play in making the finance organization a more effective, strategic organization. While two-thirds said that business analytics will significantly influence their future performance, only half that many asserted that mobile technology and big data will be influential. Only half said that cloud computing can affect their performance, and just 15 percent said that about technology that promotes collaboration. (I have written that collaboration is an essential aspect of how work is performed in finance departments.)

One possible reason why technology fails to impress finance departments is that software companies have done a poor job of marketing to them. There is a lasting memory of the Y2K fizzle and the stoking of misplaced fears of the impact of the Sarbanes-Oxley Act. For the most part, new technology is promoted as new and better with little regard to the tangible, practical benefits that address finance departments’ needs. This omission fails to engage a departmental culture that is resistant to change and averse to being “sold” anything.

One of the most important roles that a finance department has is providing the rest of the company with analysis and perspective on business results to enable them to understand “the why behind the what.” Here, too, using the right software can be a critical factor. Desktop spreadsheets are indispensable, but they are not always the right choice for analysis. Because they are two-dimensional grids, spreadsheets have a limited ability to manipulate data in multiple dimensions such as by business unit, product family, currency, geography and time (to name several of the most common). Pivot tables can be helpful, but they offer a limited ability to manage dimensions and are time-consuming. Replacing desktop spreadsheets with the right software usually is necessary to address analytics issues.

Data quality and availability are common issues in all of our benchmark research and usually stem from a variety of sources. Here, too, the inappropriate use of desktop spreadsheets is a factor that often goes unrecognized. When data is extracted from enterprise systems and then subjected to further analysis and reporting using spreadsheets, errors and inconsistencies inevitably follow.

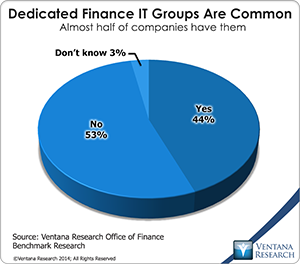

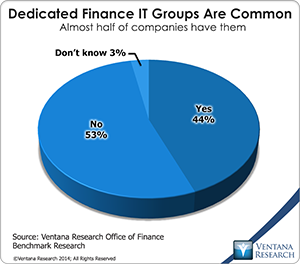

Creating a high-performing finance organization requires attention to the full range of people issues (such as leadership and communications) as well as process design and management (especially in designing in consistency in execution and designing out opportunities for mistakes and other process defects). Along with these, technology competence is essential to an effective finance organization. Companies with 500 or more employees benefit from having a dedicated group that understands the requirements of the finance function and how information technology can best address those needs. (Those with fewer than 500 employees would also benefit, but it’s usually not a practical option.) The good news is that almost half of companies (44%) have such as group, but, of course, a majority do not. The research also shows that having such a finance IT group reduces the likelihood that the department will experience issues with the software the department uses or the analytics they employ in a range of processes and functions. Twice as many of those in the research that lack a finance IT function reported issues with the software they use for managing a range of finance and analytical functions, and two-thirds (68%) more often they reported issues with the analytics they use than those that have a finance IT group.

Creating a high-performing finance organization requires attention to the full range of people issues (such as leadership and communications) as well as process design and management (especially in designing in consistency in execution and designing out opportunities for mistakes and other process defects). Along with these, technology competence is essential to an effective finance organization. Companies with 500 or more employees benefit from having a dedicated group that understands the requirements of the finance function and how information technology can best address those needs. (Those with fewer than 500 employees would also benefit, but it’s usually not a practical option.) The good news is that almost half of companies (44%) have such as group, but, of course, a majority do not. The research also shows that having such a finance IT group reduces the likelihood that the department will experience issues with the software the department uses or the analytics they employ in a range of processes and functions. Twice as many of those in the research that lack a finance IT function reported issues with the software they use for managing a range of finance and analytical functions, and two-thirds (68%) more often they reported issues with the analytics they use than those that have a finance IT group.

Over the past several decades finance executives have done an excellent job of making the Office of Finance far more efficient through the use of technology. ERP and financial performance management systems have enabled companies to grow without having to add finance department head count. However, the Office of Finance now must focus on using technology to improve its effectiveness and the value it provides the rest of the company. Faster closing, increasing financial data timeliness, using advanced analytics and automating repetitive departmental tasks are all ways that information technology can enhance the performance of the finance department. Changes in the technology underpinnings of finance-focused applications will support efforts by CFOs and senior finance executives to forge more a strategic partnership role with the rest of the organization and reshape the mission of their department. They will put the CFO and the Office of Finance in position to enhance the potential and performance of business.

Regards,

Robert Kugel – SVP Research