The treasury function in finance departments doesn’t get a lot of attention, but it’s a fundamentally important one: to ensure that all funds are accounted for and that there is sufficient cash on hand each day to meet operating requirements. Keeping track of and managing cash, especially in larger organizations, can be complicated because of multiple bank accounts, complex financing requirements and various methods of receiving and making payments; the complexity deepens when more than one...

Read More

Topics:

Predictive Analytics,

Office of Finance,

credit,

debt,

Analytics,

CFO,

cash management,

controller,

Financial Performance Management

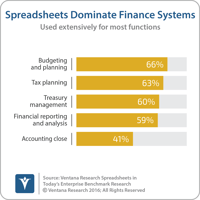

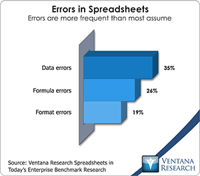

Many finance executives want to improve their department’s effectiveness in order to play a more strategic role in their company. However, frequently they find at least three serious challenges to achieving this sort of finance transformation. One is that too much time and resources are devoted to purely mechanical tasks. Another is that the information executives need is not always available immediately. A third is that they lack the data (which is unavailable or too difficult to access), the...

Read More

Topics:

Predictive Analytics,

Office of Finance,

Controller,

credit,

debt,

Kyriba Financial Performance Management,

Analytics,

Business Performance,

Financial Performance,

CFO,

cash management

Along with other aspects of the finance organization, there’s increasing emphasis on having the treasury function play more of a strategic role in the organization. Typically, Treasury is charged with keeping track of and managing cash. Especially in larger organizations, this can be complicated because of multiple bank accounts, complex financing requirements and many methods of receiving and making payments; the complexity deepens when more than one currency is used across multiple...

Read More

Topics:

Predictive Analytics,

Office of Finance,

Controller,

credit,

debt,

Analytics,

Business Performance,

Financial Performance,

CFO,

cash management,

Financial Performance Management

At this year’s Global Pricing Forum, host Nomis Solutions announced the availability of its Discretion Manager software, which supports dynamic price negotiations. The annual event brings together thought leaders and practitioners interested in pricing. Nomis currently has 17 of the largest 100 banks as customers. With more customers, this year’s event had larger attendance than last year’s.

Read More

Topics:

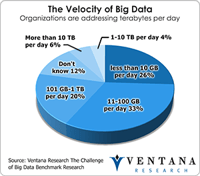

Big Data,

Sales,

Sales Performance,

Office of Finance,

credit,

financial analytics,

Nomis Solutions,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

banking,

Financial Services

Increasingly, global financial markets compete on speed, so much so that high-speed trading capabilities have become a performance differentiator for the largest financial services firms and some investment funds. Transmitting messages with quotes, prices and trade data is a core capability for currency dealers. Informatica recently introduced Ultra Messaging, which is designed to offer global currency traders an efficient, high-throughput, lower-latency (that is, faster) and more secure method...

Read More

Topics:

Sales,

GRC,

credit,

currency,

LAN,

Operational Performance,

Business Performance,

Financial Performance,

Informatica,

finance,

WAN

I recently attended the 2012 Global Pricing Forum hosted by Nomis Solutions, a provider of software and services to banking and finance companies. This annual event brings together thought leaders and practitioners in the area of pricing and revenue optimization (PRO). This technique uses analytics to sift through large data sets to tease out customer behavior characteristics, identify customer segments and quantify their price sensitivities. These complex calculations require software designed...

Read More

Topics:

Sales,

Sales Performance,

Supply Chain Performance,

Office of Finance,

credit,

financial analytics,

Nomis Solutions,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Financial Performance,

banking,

Financial Services

At first thought, it seems as if having a mountain of cash to manage is a problem most companies would like to have, but it’s a real problem nevertheless. To be sure, the large majority of companies are able to deal with their cash and short-term and longer-term monetary investments because the amounts are small enough to be manageable. Indeed, many companies, especially smaller ones, face the opposite problem and spend more time focused on their uncertain funding requirements. Still, over the...

Read More

Topics:

Performance Management,

Office of Finance,

credit,

Tax,

Business Analytics,

Business Performance,

Financial Performance,

Risk,

cash management,

GAAP