I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

process management,

report

Financial analysts typically classify real estate as a fixed cost. Strictly speaking, that’s correct, but looking at it this way leads many organizations to overlook opportunities to more carefully manage their real estate and other occupancy expenses. The changes in lease accounting that are going into effect have caused some organizations to reexamine their leasing policies and how they organize their lease accounting processes. They should take an even broader approach and consider ways to...

Read More

Topics:

Office of Finance,

Continuous Planning,

Financial Performance Management,

Operations & Supply Chain,

ERP and Continuous Accounting,

Accounting,

Lease Accounting,

ASC842,

IFRS16

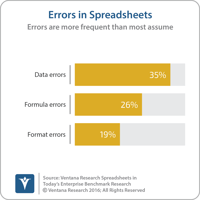

Accountants love electronic spreadsheets – and for good reason. They’re a powerful and versatile personal productivity tool and just about everyone knows how to use them. Spreadsheets are the default software tool for accountants because they enable autonomy (you don’t need to ask IT for anything) and they’re free (so you don’t have to make a business case to authorize buying something). Some accountants humorously (but earnestly) invoke the line “you’ll have to pry this spreadsheet from my...

Read More

Topics:

ERP,

Office of Finance,

Continuous Accounting,

FASB,

IASB,

CFO,

controller,

Financial Performance Management,

Spreadsheets,

Enterprise Resource Planning,

ERP and Continuous Accounting,

revenue recognition,

Accounting,

Lease Accounting,

real estate,

Lease Management,

ASC842,

IFRS16,

leasing

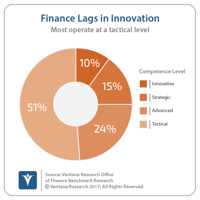

Robots of the physical sort are not about to take over finance and accounting but we have arrived at the age of “Robotic Finance”. I coined this term to focus on four key technologies with transformative capabilities: artificial intelligence and machine learning, robotic process automation, bots and natural language processing and blockchain distributed ledger technology. Embracing these technologies will enable any department to redefine itself as a forward-looking strategic partner to the...

Read More

Topics:

Machine Learning,

close,

closing,

Robotic Process Automation,

Artificial intelligence,

blockchain,

AI,

Accounting,

bots

For several years, I’ve commented on a range of emerging technologies that will have a profound impact on white-collar work in the coming decade. I’ve now coined the term “Robotic finance” to describe this emerging focus, which includes four key areas of technology: Artificial intelligence (AI) and machine learning (ML), robotic process automation (RPA), bots utilizing natural language processing, and blockchain distributed ledger technology (DLT), each of which I describe below. Robotic...

Read More

Topics:

ERP,

Machine Learning,

close,

Consolidation,

Continuous Accounting,

Reconciliation,

CFO,

Robotic Process Automation,

blockchain,

AI,

natural language processing,

Accounting,

RPA,

bots,

voice automation

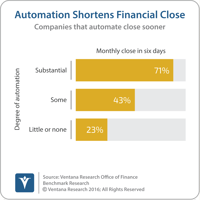

Robotic process automation (RPA) relies on programming or the application of analytical algorithms to execute the most appropriate action in an automated workflow. RPA enables business users to configure a “robot” (actually, computer software) to interact with applications or data sources to process a transaction, move or manipulate data, communicate with other digital systems and manage machine-to-machine and man-to-machine interactions. This technology is gaining increasing notice by finance...

Read More

Topics:

Operations,

automation,

close,

closing,

Continuous Accounting,

finance,

banking,

Robotic Process Automation,

Accounting

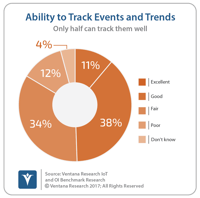

The application of artificial intelligence (AI) and machine learning (ML) to business computing will have a profound impact on white collar professions. This is especially true in heavily rules-based functions such as accounting. Companies recognize the transformational potential of AI and ML, but the progression and pace of the adoption of these technologies is unclear. Some applications of AI and ML are already in use but others are a decade or more away from replacing human tasks.

Read More

Topics:

Big Data,

Machine Learning,

Office of Finance,

Analytics,

CFO,

finance,

CEO,

AI,

accountants,

NLP,

Accounting