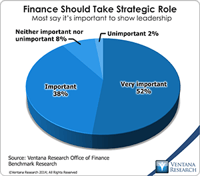

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

Last year Ventana Research released our Office of Finance benchmark research. One of the objectives of the project was to assess organizations’ progress in achieving “finance transformation.” This term denotes shifting the focus of CFOs and finance departments from transaction processing toward more strategic, higher-value functions. In the research nine out of 10 participants said that it’s important or very important for the department to take a more strategic role. This objective is both...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Performance,

CIO,

Financial Performance,

In-memory,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

When applying information technology to drive better business performance, companies and the systems integrators that assist them often underestimate the importance of organizing data management around processes. For example, companies that do not execute their quote-to-cash cycle as an end-to-end process often experience a related set of issues in their sales, marketing, operations, accounting and finance functions that stem from entering the same data into multiple systems. The inability to...

Read More

Topics:

Big Data,

Mobile,

Sales Performance,

Supply Chain Performance,

ERP,

Office of Finance,

Operations,

Management,

close,

closing,

computing,

end-to-end,

Operational Performance,

Analytics,

Business Performance,

Cloud Computing,

Data Management,

Information Applications,

Information Management,

CRM,

Data,

finance,

FPM

Midsize businesses “pay” for their use of entry-level accounting systems by not having the essential information they need readily available and by using up valuable time that could be better spent generating business, finding issues or responding to opportunities sooner or simply enhancing the efficiency of the organization. Nevertheless, the transition from an entry-level accounting package such as QuickBooks to an on-premises system can be daunting for companies whose entry-level software no...

Read More

Topics:

Sales Performance,

Customer Experience,

ERP,

Office of Finance,

end-to-end,

finance cloud,

Business Performance,

Cloud Computing,

Financial Performance,

Business Process Management,

CFO,

finance,

accounting software,

business process execution,

financial systems,

FPM

SAP is planning to acquire e-commerce company Ariba in a transaction worth about US$4.3 billion expected to close in the third quarter of this year. Ariba provides cloud-based collaborative business commerce through a Web-based trading community that enables companies to find, connect and collaborate with a global network of partners. Its Commerce Cloud is a platform that businesses can use to buy and sell goods. Currently, Ariba counts more than 700,000 companies worldwide attached to this...

Read More

Topics:

Big Data,

SAP,

ERP,

EDI,

end-to-end,

Analytics,

Cloud Computing,

Uncategorized,

CRM,

SCM

JDA Software is an established vendor of (among other categories) accounting software for the retail sector. So it is a bit ironic that the company is in the process of restating its earnings for 2008 through 2010 because of revenue recognition practices that led it to book some revenue sooner than it should have. The issue centers on certain transactions the company linked to service agreements and license revenue. As well, in 2009 and 2010 some of its license contracts included a clause...

Read More

Topics:

Performance Management,

Customer Experience,

Human Capital Management,

Office of Finance,

end-to-end,

IFRS,

JDA Software,

Business Analytics,

Financial Performance,

Governance, Risk & Compliance (GRC),

GAAP

ERP systems not only collect information about transactions, they also automate processes. The latter includes managing the handoffs between roles and enabling electronic document creation and management associated with that. Indeed, it was the promise of improving process management and process execution that spurred companies to adopt ERP in the 1990s.

Read More

Topics:

Customer Experience,

ERP,

Office of Finance,

end-to-end,

Operational Performance,

Business Performance,

Financial Performance,

Business Process Management,

CFO,

business process execution