In 2013, the Organization for Economic Cooperation and Development (OECD) published a report titled “Action Plan on Base Erosion and Profit Shifting” (commonly referred to as “BEPS”), which describes the challenges national governments face in enforcing taxation in an increasingly global environment with a growing share of digital commerce. Country-by-country (CbC) Reporting has developed in response to the concerns raised in the report. To date, 65 countries (including all members of the...

Read More

Topics:

ERP,

GRC,

audit,

finance transformation,

LongView,

Tax,

Business Analytics,

Oracle,

CFO,

Vertex,

FPM,

BEPS,

tax department,

tax planning

Ventana Research awarded our Governance, Risk and Compliance (GRC) Business Innovation Award for 2016 to IBM for IBM Regulatory Compliance Analytics, powered by Watson (IRCA). This application of cognitive analytics is designed to streamline the identification of potential regulatory requirements and suggest methods for compliance. In so doing the cloud-based system can cut the time and cost of compliance while creating an effective means of ongoing management and control of compliance...

Read More

Topics:

GRC,

Machine Learning,

Office of Finance,

Dodd-Frank,

Risk Analytics,

compliance,

finance,

Financial Services,

Watson

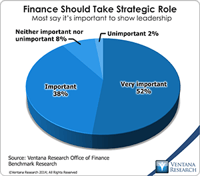

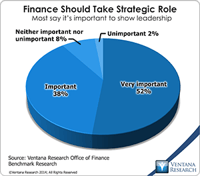

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

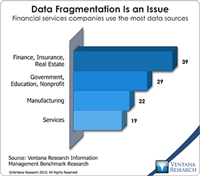

The steady march of technology’s ability to handle ever more complicated tasks has been a constant since the beginning of the information age in the 1950s. Initially, computers in business were used to automate simple clerical functions, but as systems have become more capable, information technology has been able to substitute for increasingly higher levels of human skill and experience. A turning point of sorts was reached in the 1990s when ERP, business intelligence and business process...

Read More

Topics:

Sustainability,

ERP,

Governance,

GRC,

Human Capital,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

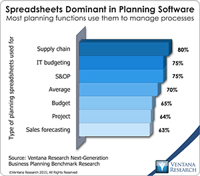

In our benchmark research at least half of participants that use spreadsheets to support a business process routinely say that these tools make it difficult for them to do their job. Yet spreadsheets continue to dominate in a range of business functions and processes. For example, our recent next-generation business planning research finds that this is the most common software used for performing 11 of the most common types of planning. At the heart of the problem is a disconnect between what...

Read More

Topics:

Planning,

Sales Performance,

ERP,

Forecast,

GRC,

Office of Finance,

Reporting,

closing,

dashboard,

enterprise spreadsheet,

Excel,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Financial Performance,

Information Management,

Data,

Risk,

application,

benchmark,

Financial Performance Management

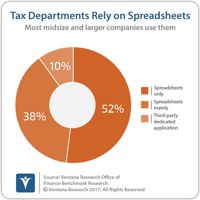

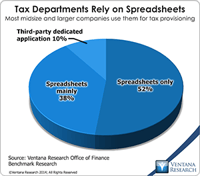

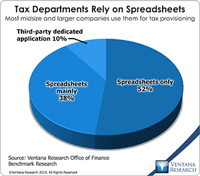

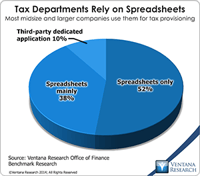

One of the issues in handling the tax function in business, especially where it involves direct (income) taxes, is the technical expertise required. At the more senior levels, practitioners must be knowledgeable about accounting and tax law. In multinational corporations, understanding differences between accounting and legal structures in various localities and their effects on tax liabilities requires more knowledge. Yet when I began to study the structures of corporate tax departments, I was...

Read More

Topics:

Big Data,

ERP,

Governance,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Information Management,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

Last year Ventana Research released our Office of Finance benchmark research. One of the objectives of the project was to assess organizations’ progress in achieving “finance transformation.” This term denotes shifting the focus of CFOs and finance departments from transaction processing toward more strategic, higher-value functions. In the research nine out of 10 participants said that it’s important or very important for the department to take a more strategic role. This objective is both...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Performance,

CIO,

Financial Performance,

In-memory,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

I’ve written before about the increasing importance of having a solid technology base for a company’s tax function, and it’s important enough for me to revisit the topic. Tax departments are entrusted with a highly sensitive and essential task in their companies. Taxes usually are the second largest corporate expense, after salaries and wages. Failure to understand this liability is expensive – either because taxes are overpaid or because of fines and interest levied for underpayment. Moreover,...

Read More

Topics:

ERP,

Governance,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Information Management,

Oracle,

CFO,

Risk & Compliance (GRC),

Vertex,

FPM,

Innovation Awards,

Thomson-Reuters multinational

Longview Solutions has a longstanding presence in the financial performance management (FPM) software market and was rated a Hot vendor in our most recent FPM Value Index. Several years ago it began offering a tax provision and planning application. I think it’s worthwhile to focus on the tax category because it’s less well known than others in finance and is an engine of growth for Longview. We expect larger corporations increasingly to adopt software to manage direct (income) taxes to improve...

Read More

Topics:

ERP,

GRC,

Office of Finance,

audit,

finance transformation,

LongView,

Tax,

Analytics,

Business Analytics,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

FPM,

Innovation Awards

The proliferation of chief “something” officer (CxO) titles over the past decades recognizes that there’s value in having a single individual focused on a specific critical problem. A CxO position can be strategic or it can be the ultimate middle management role, with far more responsibilities than authority. Many of those handed such a title find that it’s the latter. This may be because the organization that created the title is unwilling to invest the necessary powers and portfolio of...

Read More

Topics:

GRC,

Office of Finance,

Chief Risk Officer,

CRO,

ERM,

OpenPages,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Data Governance,

Financial Performance,

IBM,

compliance,

Data,

Risk,

Financial Services,

FPM