SYSPRO is a 35-year-old software vendor that focuses on selling enterprise resource planning (ERP) systems to midsize companies, particularly those in manufacturing and distribution. In manufacturing, SYSPRO supports make, configure and assemble, engineer to order, make to stock and job shop environments. The company attempts to differentiate itself through vertical specialization and its years of ongoing development, which can reduce the need for customization and cut the cost of initial and...

Read More

Topics:

Big Data,

SaaS,

ERP,

Governance,

Human Capital Management,

Office of Finance,

close,

Continuous Accounting,

Analytics,

CIO,

Cloud Computing,

Collaboration,

CFO,

CRM,

CEO

Intacct, a cloud-based ERP vendor focused on midsize companies, recently held its annual user group meeting. Two of its products that were covered in the keynote are worth noting. One, already available, enables companies to manage their order-to-cash process in a continuous fashion, from the time a salesperson begins to engage with a prospect to the time funds are collected. The other is a custom report writer, to be available in the first quarter of 2017, that will provide business users with...

Read More

Topics:

SaaS,

Sales,

Customer Engagement,

Customer Experience,

ERP,

Human Capital Management,

Marketing,

NetSuite,

Office of Finance,

customer life cycle,

Customer Service,

billing software,

asc 606

The annual Oracle OpenWorld user group meeting provides an opportunity to step back and take a longer view of business, industry and technology trends affecting the company. Last year, after listening to Larry Ellison’s and Mark Hurd’s vision for the future of IT, I wrote that Oracle had to continue shifting its focus to business applications because the accelerating shift to cloud computing would lead corporations to outsource their IT infrastructures, services and security to third parties....

Read More

Topics:

Big Data,

Performance Management,

SaaS,

ERP,

Office of Finance,

Analytics,

Cloud Computing,

PaaS,

Digital Technology

Aria Systems provides companies with software for managing subscription or recurring revenue business models. A recurring revenue business models includes three types of selling and billing structures: a one-time transaction plus a periodic service charge; subscription-based services involving periodic charges; or a contractual relationship that charges periodically for goods and services. Aria’s cloud-based software addresses key requirements of users in the marketing, sales, operations and...

Read More

Topics:

SaaS,

Sales,

Sales Performance,

Customer Engagement,

Customer Experience,

ERP,

Marketing,

NetSuite,

Office of Finance,

Recurring Revenue,

customer life cycle,

Customer Performance,

Operational Performance,

Business Analytics,

Business Performance,

Cloud Computing,

Customer Service,

Financial Performance,

Business Performance Management (BPM),

Sales Performance Management (SPM),

billing software

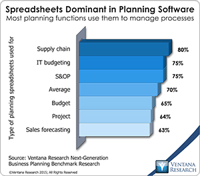

Supply and demand chain planning and execution have grown in importance over the past decade as companies have recognized that software can meaningfully enhance their competitiveness and improve their financial performance. Sales and operations planning (S&OP) is an integrated business management process first developed in the 1980s aimed at achieving better alignment and synchronization between the supply chain, production and sales functions. A properly implemented S&OP process routinely...

Read More

Topics:

Planning,

SaaS,

Sales,

Sales Performance,

Supply Chain Performance,

Forecast,

Human Capital,

Mobile Technology,

Supply Chain Planning,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Financial Performance,

Sales Performance Management (SPM),

Sales Planning,

Supply Chain,

Demand Chain,

Integrated Business Planning,

SCM Demand Planning,

S&OP

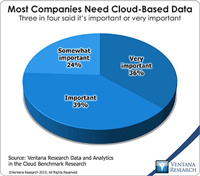

There’s a long history of companies not paying close enough attention to the contractual elements of acquiring software. Today, this extends into the world of cloud computing. Many companies are choosing to acquire software services through cloud-based providers and increasingly rely on access to cloud-based data, as is shown by our forthcoming benchmark research, in which a large majority of participating companies said that having access to data in the cloud is important or very important. As...

Read More

Topics:

SaaS,

Sales,

Customer Experience,

Governance,

contract,

e-discovery,

Customer Performance,

Operational Performance,

Cloud Computing,

Financial Performance,

Business Performance Management (BPM)

Read More

Topics:

SaaS,

Customer Experience,

NetSuite,

Office of Finance,

Recurring Revenue,

Zuora,

Customer Performance,

Operational Performance,

Business Performance,

Cloud Computing,

Customer Service,

Financial Performance,

billing software,

Intacct

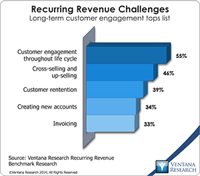

Recurring revenue is a term applied to business models that involve three types of selling and billing structures: a one-time transaction plus a periodic service charge; subscription-based services involving periodic charges; or a contractual relationship that charges periodically for goods and services. Telecommunications was the first major industry to use it, but recently the model has gained popularity in others. It is a major trend in information technology as an increasing number of...

Read More

Topics:

SaaS,

Customer Experience,

NetSuite,

Office of Finance,

Recurring Revenue,

Zuora,

Customer Performance,

Business Performance,

Cloud Computing,

Customer Service,

Financial Performance,

billing software,

Intacct

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Sales Performance,

Salesforce.com,

Supply Chain Performance,

ERP,

HCM,

Human Capital,

Office of Finance,

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

Kenandy,

PSA,

Sage Software,

Unit4,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Collaboration,

Customer & Contact Center,

Financial Performance,

Workforce Performance,

CFO,

FinancialForce,

HR,

Infor,

Workday,

HANA,

Plex,

Professional Services Automation

Like most vendors of on-premises ERP and financial management software, in moving to the cloud Oracle has focused on developing for existing and potential customers the option of multitenant software as a service (SaaS). (I’m using the term “ERP” in its most expansive sense, to include such systems employed by all types of companies for accounting and financial management rather than only systems that are used by manufacturing and distribution companies.) Oracle’s ERP Cloud Service includes ...

Read More

Topics:

Microsoft,

Mobile,

SaaS,

Sales,

Salesforce.com,

ERP,

HCM,

Human Capital,

Office of Finance,

Dynamics AX,

Dynamics GP,

Dynamics NAV Dynamics SL,

Kenandy,

PSA,

Sage Software,

Unit4,

Operational Performance,

Analytics,

Business Performance,

Cloud Computing,

Collaboration,

Customer & Contact Center,

Financial Performance,

CFO,

FinancialForce,

HR,

Infor,

Workday,

HANA,

Plex,

Professional Services Automation