Workiva’s Wdesk, a cloud-based productivity application for handling composite documents, will have a larger role to play as companies adopt new revenue recognition standards governing accounting for contracts. The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP), has issued ASC 606 and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most...

Read More

Topics:

close,

closing,

XBRL,

CFO,

Document Management,

SEC,

10Q,

SEDAR,

Composite document

Because my research practice is centered on important business issues where technology is a key part of a solution, my written perspectives tend to focus on technology. However, it’s almost never the case that a company can just implement some application and fully resolve a business issue. Some progress may be achieved by using more effective tools, but in most cases results will fall short of what’s possible unless people, process and information issues are addressed as well. This is...

Read More

Topics:

Office of Finance,

Reconciliation,

Business Performance,

Financial Performance,

Data,

Document Management

At its recent 2014 analyst day Ceridian showed the progress it has made on its Ceridian and Dayforce human capital management (HCM) platform since last year’s launch of its broader HCM portfolio. Ceridian’s overall HCM business, which the company says had revenue of $950 million in 2013 and now has more than 100,000 customers, consists largely of payroll-related products and services such as tax filing and payroll cards, but also benefits, human resources and workforce management products.

Read More

Topics:

Mobile,

SaaS,

Social Media,

HCM,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Workforce Performance,

Ceridian,

Document Management,

HR,

Talent Management

Reconciling accounts at the end of a period is one of those mundane finance department tasks that are ripe for automation. Reconciliation is the process of comparing account data (at the balance or item level) that exists either in two accounting systems or in an accounting system and somewhere else (such as in a spreadsheet or on paper). The purpose of the reconciling process is to identify things that don’t match (as they must in double-entry bookkeeping systems) and then assess the nature...

Read More

Topics:

Office of Finance,

automation,

close,

closing,

Consolidation,

Controller,

effectiveness,

Reconciliation,

XBRL,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management,

FPM

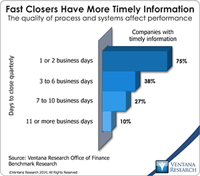

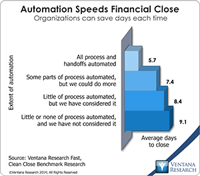

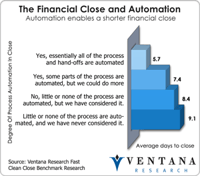

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance,

Financial Performance,

CFO,

Data,

Document Management,

Financial Performance Management,

FPM

What’s a fast, free and reasonably reliable way of gauging the effectiveness of a finance department’s management? It’s the number of days it takes it to close the books. Companies that take six days or fewer after the end of the period to close their monthly, quarterly or semiannual accounts demonstrate a basic level of effectiveness that those that take longer do not. In my judgment, finance executives should regard a slow close as a negative key performance indicator pointing to...

Read More

Topics:

Sales Performance,

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management

For at least a couple of decades completing the financial close within five or six business days after the end of the period has been accepted as a best practice. As such, that creates an expectation that finance organizations that take longer should work to reduce their closing intervals. In updating our last benchmark research on the closing process, Ventana Research has found this not to be the case. In fact, the latest research shows that many companies are taking longer to close today than...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

CFO,

Data,

Document Management,

Financial Performance Management

Ventana Research recently completed an update to our last benchmark research on the financial closing process. It shows that many companies are taking longer to close today than they did five years ago. Whereas nearly half (47%) were able to close their quarter or half-year period within six business days five years ago, just 38 percent are able to do so in our latest benchmark. Similarly, five years ago 70 percent of companies were able to complete their monthly close in six days; today only...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Mobility,

Business Performance,

Cloud Computing,

Financial Performance,

CFO,

Data,

Document Management,

Financial Performance Management

At this year’s user conference, it was clear that change is afoot at MarkLogic, whose technology platform enables users to access information more easily accessible within applications and devices. Last month the board of directors appointed a new CEO, Ken Bado, created the new position of chief marketing officer (CMO) and named a head of global services and alliances, all within three weeks. The Silicon Valley software company has been growing in the last several years but appears not fast...

Read More

Topics:

Sales Performance,

Supply Chain Performance,

MarkLogic,

Reporting,

XML,

IT Performance,

Operational Performance,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Workforce Performance,

Content Management,

Document Management,

Information Platform,

Search

Turning data into information for taking actions and making decisions has bedeviled businesses throughout the computer age. Many organizations have data in dozens of applications and legacy systems along with many reports in various business intelligence systems. The challenge is to get data from each of the reports and assemble it into contextualized views of information for particular business needs. In our benchmark research on what we call information applications, only 11 percent of...

Read More

Topics:

Sales Performance,

Sustainability,

Reporting,

Business Technology Innovation,

IT Performance,

Operational Performance,

Business Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Workforce Performance,

Datawatch,

Document Management