Sometimes it takes a while for technology to fundamentally change how work is done. That’s because several innovations usually have to come together before a transformation can occur. For instance, Karl Benz created the first practical motorcar in 1885, but consumers would have to wait until the 1920s for the modern automobile. Computerized accounting systems originated in the 1950s but it’s only now that technologies have evolved and come together to fundamentally change how work is done.

Read More

Topics:

ERP,

Office of Finance,

close,

closing,

CFO,

controller,

Financial Performance Management,

ERP and Continuous Accounting

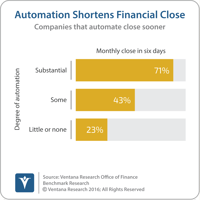

I recently attended BlackLine’s annual user conference. The company aims to automate time-consuming repetitive tasks and substantially reduce the amount of detail that individuals must handle in the department. The phrase “the devil is in the details” certainly applies to accounting, especially managing the details in the close-to-report phase of the accounting cycle, which is where BlackLine plays its role. This phase spans from all the pre-close activities to the publication of the financial...

Read More

Topics:

automation,

close,

closing,

Consolidation,

control,

effectiveness,

Reconciliation,

CFO,

compliance,

Data,

controller,

Financial Performance Management,

FPM,

Sarbanes Oxley,

Accounting,

process management,

report

Robots of the physical sort are not about to take over finance and accounting but we have arrived at the age of “Robotic Finance”. I coined this term to focus on four key technologies with transformative capabilities: artificial intelligence and machine learning, robotic process automation, bots and natural language processing and blockchain distributed ledger technology. Embracing these technologies will enable any department to redefine itself as a forward-looking strategic partner to the...

Read More

Topics:

Machine Learning,

close,

closing,

Robotic Process Automation,

Artificial intelligence,

blockchain,

AI,

Accounting,

bots

Robotic process automation (RPA) relies on programming or the application of analytical algorithms to execute the most appropriate action in an automated workflow. RPA enables business users to configure a “robot” (actually, computer software) to interact with applications or data sources to process a transaction, move or manipulate data, communicate with other digital systems and manage machine-to-machine and man-to-machine interactions. This technology is gaining increasing notice by finance...

Read More

Topics:

Operations,

automation,

close,

closing,

Continuous Accounting,

finance,

banking,

Robotic Process Automation,

Accounting

Workiva’s Wdesk, a cloud-based productivity application for handling composite documents, will have a larger role to play as companies adopt new revenue recognition standards governing accounting for contracts. The Financial Accounting Standards Board (FASB), which administers Generally Accepted Accounting Principles in the U.S. (US-GAAP), has issued ASC 606 and the International Accounting Standards Board (IASB), which administers International Financial Reporting Standards (IFRS) used in most...

Read More

Topics:

close,

closing,

XBRL,

CFO,

Document Management,

SEC,

10Q,

SEDAR,

Composite document

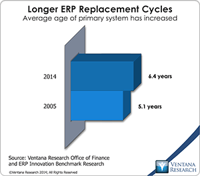

The enterprise resource planning (ERP) system is a pillar of nearly every company’s record-keeping and management of business processes. It is essential to the smooth functioning of the accounting and finance functions. In manufacturing and distribution, ERP also can help plan and manage inventory and logistics. Some companies use it to handle human resources functions such as tracking employees, payroll and related costs. Yet despite their ubiquity, ERP systems have evolved little since their...

Read More

Topics:

Big Data,

Microsoft,

SAP,

Social Media,

Supply Chain Performance,

ERP,

FP&A,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Reconciliation,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

IBM,

Oracle,

Uncategorized,

CFO,

Data,

finance,

Financial Performance Management,

FPM,

Intacct

Whatever Oracle’s cloud strategy had been the past, this year’s OpenWorld conference and trade show made it clear that the company is now all in. In his keynote address, co-CEO Mark Hurd presented predictions for the world of information technology in 2025, when the cloud will be central to companies’ IT environments. While his forecast that two (unnamed) companies will account for 80 percent of the cloud software market 10 years from now is highly improbable, it’s likely that there will be...

Read More

Topics:

Microsoft,

Predictive Analytics,

Sales Performance,

SAP,

Supply Chain Performance,

ERP,

Human Capital,

Mobile Technology,

NetSuite,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Customer Performance,

Operational Performance,

Analytics,

Business Collaboration,

Business Intelligence,

Cloud Computing,

Collaboration,

IBM,

Oracle,

Business Performance Management (BPM),

CFO,

Data,

finance,

Financial Performance Management (FPM),

Financial Performance Management,

FPM,

Intacct

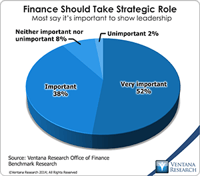

Many senior finance executives say they want their department to play a more strategic role in the management and operations of their company. They want Finance to shift its focus from processing transactions to higher-value functions in order to make more substantial contributions to the success of the organization. I use the term “continuous accounting” to represent an approach to managing the accounting cycle that can facilitate the shift by improving the performance of the accounting...

Read More

Topics:

ERP,

Office of Finance,

Reporting,

close,

closing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

CFO,

Data,

finance,

Financial Performance Management,

FPM

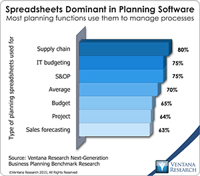

In our benchmark research at least half of participants that use spreadsheets to support a business process routinely say that these tools make it difficult for them to do their job. Yet spreadsheets continue to dominate in a range of business functions and processes. For example, our recent next-generation business planning research finds that this is the most common software used for performing 11 of the most common types of planning. At the heart of the problem is a disconnect between what...

Read More

Topics:

Planning,

Sales Performance,

ERP,

Forecast,

GRC,

Office of Finance,

Reporting,

closing,

dashboard,

enterprise spreadsheet,

Excel,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Financial Performance,

Information Management,

Data,

Risk,

application,

benchmark,

Financial Performance Management

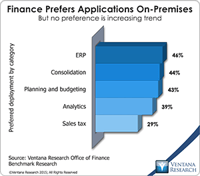

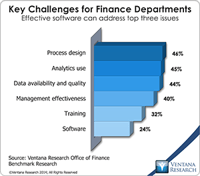

Our recently published Office of Finance benchmark research assesses a broad set of functions and capabilities of finance organizations. We asked research participants to identify the most important issues for a finance department to address in a dozen functional areas: accounting, budgeting, cost accounting, customer profitability management, external financial reporting, financial analysis, financial governance and internal audit, management accounting, product profitability management,...

Read More

Topics:

Mobile,

Planning,

Predictive Analytics,

ERP,

FP&A,

Office of Finance,

Reporting,

Self-service,

Budgeting,

close,

closing,

computing,

Controller,

dashboard,

Tax,

Analytics,

Business Intelligence,

Business Performance,

Cloud Computing,

Collaboration,

Financial Performance,

CFO,

Data,

finance,

Financial Performance Management,

FPM,

Microsoft Excel,

Spreadsheets