I recently wrote that Infor aims to reinvent business applications and its new developments make it a vendor to watch. I was therefore intrigued to have a demonstration of its latest marketing products, Infor Epiphany and Infor Orbis Marketing Resource Management. These are grouped on its website under customer relationship management, and I don’t usually spend much time on this category of products since for my research it is too inwardly focused and doesn’t impact the customer experience a...

Read More

Topics:

Social Media,

Customer Experience,

Social CRM,

Cloud Computing,

Collaboration,

Customer Service,

Uncategorized,

Call Center,

Contact Center,

CRM

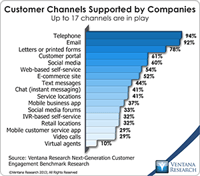

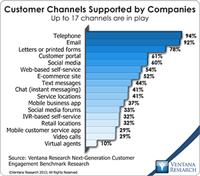

I have written lately about how digital customers change customer engagement. It’s no surprise that at the heart of this change, as well as many others that impact business, is the Internet. Along with smart mobile devices, the Internet has changed the ways consumers engage with each other and businesses. In buying products and services, digital customers prefer to research them on the Internet, then buy online or at a store. They expect all activities to happen fast, perhaps in real time....

Read More

Topics:

Sales Performance,

Social Media,

Customer Analytics,

Customer Experience,

Social CRM,

Self-service,

Operational Performance,

Analytics,

Cloud Computing,

Customer & Contact Center,

Customer Service,

Call Center,

Contact Center,

CRM

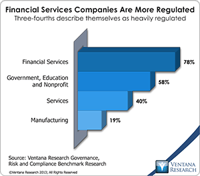

Integrated risk management (IRM) was a major theme at IBM’s recent Smarter Risk Management analyst summit in London. In the market context, IBM sees this topic as a means to differentiate its product and messaging from those of its competitors. IRM includes cloud-based offerings in operational risk analytics, IT risk analytics and financial crimes management designed for financial institutions and draws on component elements of software that IBM acquired over the past five years, notably from ...

Read More

Topics:

Supply Chain Performance,

GRC,

Office of Finance,

Chief Risk Officer,

CRO,

ERM,

OpenPages,

IT Performance,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Data Governance,

Governance, Risk & Compliance (GRC),

IBM,

Information Applications,

Information Management,

Operational Intelligence,

compliance,

Data,

Risk,

Financial Services,

FPM

Like every large technology corporation today, IBM faces an innovator’s dilemma in at least some of its business. That phrase comes from Clayton Christensen’s seminal work, The Innovator’s Dilemma, originally published in 1997, which documents the dynamics of disruptive markets and their impacts on organizations. Christensen makes the key point that an innovative company can succeed or fail depending on what it does with the cash generated by continuing operations. In the case of IBM, it puts...

Read More

Topics:

Predictive Analytics,

IT Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

Customer & Contact Center,

IBM,

Information Applications,

Data Discovery,

Discovery,

Information Discovery,

SPSS

If you stop to compare communication preferences of the past to those of today, you can’t fail to notice some major changes, especially in younger generations. Talking on the phone – fixed or mobile – is in decline, as many people now prefer text messaging, chat and social media. We rely on the Internet to search for websites, run mobile apps and use social media. We watch less TV in real time, preferring to watch what we want, when we want to watch it and to skip advertisements. The same...

Read More

Topics:

Big Data,

Sales Performance,

Social Media,

Customer Analytics,

Customer Experience,

Speech Analytics,

Operational Performance,

Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Customer Service,

Call Center,

Contact Center,

Contact Center Analytics,

CRM,

Text Analytics

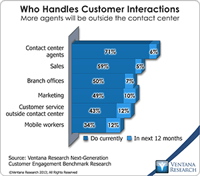

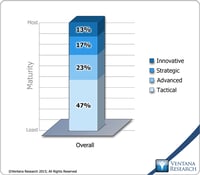

Ventana Research defines workforce optimization as a set of processes and technology for customer agents that include interaction (call) recording, quality monitoring, workforce management, training and coaching, compensation management and analytics. My benchmark research into next-generation workforce optimization set out to discover the people, processes, information and systems companies are using to get more from their customer service agents, the benefits they have gained, their plans to...

Read More

Topics:

Sales Performance,

Social Media,

Customer Experience,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Customer Service,

Financial Performance,

Call Center,

Contact Center,

Contact Center Analytics