For interactions with customers to go well, organizations must manage an ever-increasing array of engagement channels. Our research finds that organizations expect to see interaction volumes increase on all channels, especially digital ones such as text-based messaging, chat, mobile and social apps. Unfortunately, the systems that manage these channels are typically disparate and uncoordinated and may not use the same underlying technology. This makes it difficult for organizations to...

Read More

Topics:

Customer Experience,

Voice of the Customer,

business intelligence,

embedded analytics,

Analytics,

Collaboration,

Data Governance,

Data Preparation,

Information Management,

Internet of Things,

Contact Center,

Data,

Digital Technology,

Digital Commerce,

blockchain,

natural language processing,

data lakes,

Intelligent CX,

Subscription Management,

agent management,

extended reality,

AI & Machine Learning

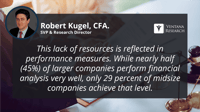

The financial planning and analysis (FP&A) group is the linchpin of any transformation effort in the Office of Finance. Our recently completed Office of Finance benchmark research was conducted against the backdrop of the idea that finance organizations must play a more strategic role in the management of the modern organization. This transformation envisions a finance department that’s more of a partner to the rest of the company — one that is less focused on “bean counting,” instead directing...

Read More

Topics:

Office of Finance,

embedded analytics,

Analytics,

Financial Performance Management,

robotic finance,

Predictive Planning

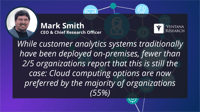

Using customer analytics effectively involves several challenges. Organizations must make it a business priority, cultivate leadership and set a course for ensuring data and analytics are being processed and governed effectively. But effectiveness also requires technology that will assist in the effective operations and management of customers and help an organization achieve its goals.

Read More

Topics:

Customer Experience,

Voice of the Customer,

embedded analytics,

Analytics,

Business Intelligence,

Collaboration,

Data Governance,

Data Preparation,

Information Management,

Contact Center,

Data,

Digital Technology,

Digital Commerce,

blockchain,

natural language processing,

data lakes,

Intelligent CX,

Conversational Computing,

collaborative computing,

mobile computing,

Subscription Management,

agent management,

extended reality,

AI & Machine Learning