The traditional office of finance has five main organs: accounting keeps the books; financial planning and analysis (FP&A) analyzes performance and manages the forward-looking activities of the company such as planning, budgeting and forecasting; corporate finance raises outside money; treasury takes care of the cash and bank accounts, and tax. The modern office of finance requires a sixth: Finance IT (FIT).

For years people have been talking about finance transformation — that is, the remaking of the finance department into an organization that functions as a strategic asset to the corporation. Such a department is strategic because it provides greater visibility and insight into how the company and each of its business units is performing and insight into how to optimize that going forward. Its focus is on what’s happening next and not merely on what just happened. It doesn’t only explain past results but uses that context to provide insight into choices among next-step options and their ramifications.

This sort of finance department provides perspective on the big picture, backed by details, rather than obsessing over the details — that is, counting beans. It’s a department that spends almost all its time deriving business meaning from the numbers because it doesn’t have to spend time gathering data and making certain that the numbers used in its analyses and reports are correct.

Information technology is essential to achieving such a transformation, which is why more recently it’s referred to as “digital transformation.” Technology is central to the smooth functioning of finance and accounting. It’s therefore essential that the office of finance have a high degree of competence with technology. Unfortunately, those skilled in accounting and financial analysis aren’t necessarily technology experts. And without a fundamental understanding of how the tools in use work, it can be difficult for a department to make good technology purchasing decisions or design technology-driven processes that enhance effectiveness. It may not even be able to use the technology assets it owns.

For that reason, corporations must have a Finance IT group made up of individuals who are well grounded in core finance and accounting disciplines but also knowledgeable when it comes to software and information technology. Such groups are increasingly common. Our latest Office of Finance benchmark research, Change in the Office of Finance, shows an increase in the share of companies that have this group: 59 percent compared to 45 percent in 2015.

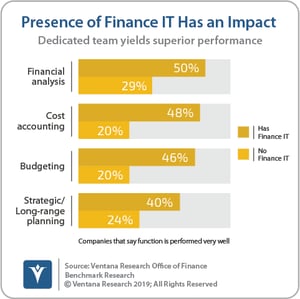

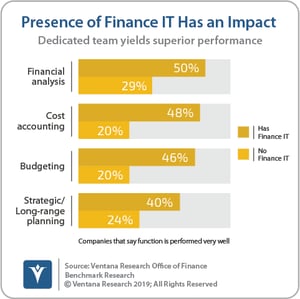

The research underscores the value of having a FIT group. The data shows that there are correlations between having a dedicated unit and having a high-performing finance organization. For example, 50 percent of the companies with FIT report that they perform financial analysis very well compared to 29 percent that lack one. There’s a similar significant difference in correlations for a range of functional areas: 48 percent of companies with FIT perform cost accounting very well compared to 20 percent of organizations without. In budgeting and fiscal control, the comparison is 46 percent to 20 percent. Companies with FIT are better informers: 60 percent of organizations with this capability provide timely information to the rest of the company is timely, compared to only one-third (32%) of those without one.

percent of organizations without. In budgeting and fiscal control, the comparison is 46 percent to 20 percent. Companies with FIT are better informers: 60 percent of organizations with this capability provide timely information to the rest of the company is timely, compared to only one-third (32%) of those without one.

FIT will become even more essential as the pace of technology innovation in Finance accelerates in the coming decade. Innovations in areas such as artificial intelligence, blockchain and the internet of things increasingly are incorporated into core software applications such as ERP. To be effective, finance departments must adopt a “fast-follower” approach to technology adoption. Fast followers don’t operate at the bleeding edge of IT innovation, but they are poised to incorporate technology innovations as soon as they have proven to be practical. To make this a reality, it’s necessary to have a standing group with clout that stays abreast of relevant technologies and anticipates their introduction into departmental processes.

FIT can lead this effort. In the past, there might have been no penalty for a department having a wait-and-see attitude, reacting slowly to opportunities to exploit technology capabilities when they become practical rather than seeking them out. Increasingly, though, delaying the application of technology to finance department processes is having negative consequences. For example, companies that delayed applying automation to the new revenue-recognition standards paid for the delay with heavier-than-necessary workloads. In the coming decade, midsize and larger companies must have a FIT group to remain competitive.

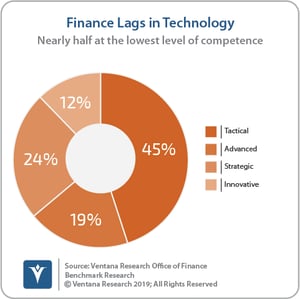

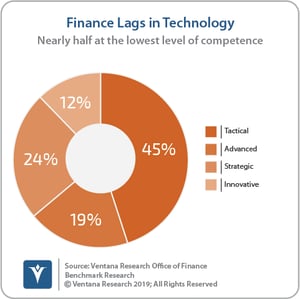

The research finds notable and long-overdue improvement in the execution of basic departmental functions. That’s encouraging but from my perspective, this poses a challenge to CFOs and finance executives. It means that what was once an average level of performance is now substandard. Moreover, the improvements we found were mostly gains in efficiency, not effectiveness, and efficiency alone isn’t enough. The results show that the department continues to lag in executing higher-value measures such as the use of analytics and engagement with the rest of the organization, in part due to an inability to utilize information technology more effectively. Our research still finds that finance and accounting departments lag in their capacity to use technology. Our Performance Index finds only 12 percent of participants at the highest Innovative level  of competence in their use of technology, while nearly half (45%) are at the lowest tactical level.

of competence in their use of technology, while nearly half (45%) are at the lowest tactical level.

Competence in using technology is associated with better performance in the Office of Finance. A large majority of companies (88%) at the Innovative level perform accounting very well compared to 44 percent that are at the Tactical level. Similarly, 69 percent of Innovative companies perform budgeting and fiscal control very well versus just 18 percent that are Tactical. Nearly two-thirds (64%) of Innovative companies do cost accounting very well, while 28 percent of Tactical organizations achieve that level of performance. Analytics work better too: 64 percent of Innovative companies perform analytics very well compared to 28 percent of those that are at the Tactical level. Innovative companies are better at reporting: 63 percent of them provide timely information to the rest of the company, while only 36 percent of Tactical companies do so.

A fast-follower approach to technology adoption is now a necessity because the future is already here. For instance, artificial intelligence (AI) enables an increasing set of capabilities that utilize natural language comprehension. This makes it possible, for example, for an employee to speak or type a command in whatever way he or she wants and leave it to the system to understand its meaning and then automatically orchestrate a business process involving multiple screens and multiple systems. This sort of automation increases departmental productivity and substantially reduces the time and cost of training employees. Artificial intelligence isn’t about to eliminate the need for accountants and robots aren’t about to take over the department. On the contrary, technology increasingly will eliminate the soul-deadening robotic work associated with accounting.

The recent benchmark research found notable and long-overdue improvement in the execution of basic departmental functions. That’s encouraging but it isn’t enough. Information technology will transform how finance departments operate more over the next 10 years than it has over the past 50. To enable their companies to remain competitive in this environment, Finance departments must become fast followers in adopting new technology. A fast-follower organization isn’t a technology laggard. It just waits until early adopters have demonstrated a technology’s feasibility and then adopts it as soon as practical. Beyond its demonstrated ability to improve the performance of the department, Finance IT is essential to enabling finance and accounting departments to be fast followers in applying innovative technology to achieve digital transformation objectives.

Ventana Research has been conducting research on the Office of Finance for 15 years against the backdrop of the idea that finance organizations must play a more strategic role in the management of the modern corporation. This latest research investigates the extent to which CFOs and finance departments are moving to a more strategic role in management of the company through use of technology. It also investigates the directions and rate of adoption of next-generation technologies that enable Finance to gain strategic insights on processes of importance to them and the entire organization. And it examines the efficiency and effectiveness of critical finance processes including accounting, consolidation, budgeting, planning, reporting, tax, treasury and other functions of the CFO. Those interested in learning more about this benchmark research can do so at www.ventanaresearch.com/benchmark/office_of_finance/office_of_finance.

Regards,

Robert Kugel

percent of organizations without. In budgeting and fiscal control, the comparison is 46 percent to 20 percent. Companies with FIT are better informers: 60 percent of organizations with this capability provide timely information to the rest of the company is timely, compared to only one-third (32%) of those without one.

percent of organizations without. In budgeting and fiscal control, the comparison is 46 percent to 20 percent. Companies with FIT are better informers: 60 percent of organizations with this capability provide timely information to the rest of the company is timely, compared to only one-third (32%) of those without one.  of competence in their use of technology, while nearly half (45%) are at the lowest tactical level.

of competence in their use of technology, while nearly half (45%) are at the lowest tactical level.