With the announcement of Ventana Research market agenda, a new expertise in Digital Business has been launched, I will outline the areas of focus that provide insights to organizations that can be used to optimize technology, increase agility and organizational readiness. We are proud to provide expertise on digital effectiveness through our research and insights on trends and best practices.

Read More

Topics:

Performance Management,

Governance,

Business Continuity,

Risk,

Digital transformation,

Digital Business,

Digital Security,

Digital Communications,

Sustainability Management,

Work Management,

Experience Management

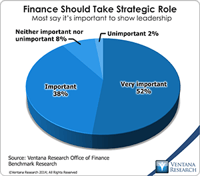

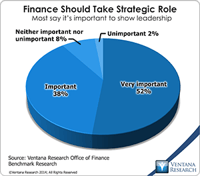

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

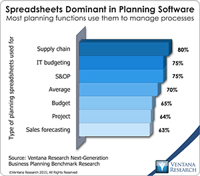

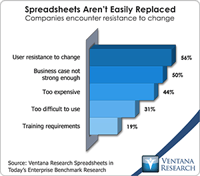

In our benchmark research at least half of participants that use spreadsheets to support a business process routinely say that these tools make it difficult for them to do their job. Yet spreadsheets continue to dominate in a range of business functions and processes. For example, our recent next-generation business planning research finds that this is the most common software used for performing 11 of the most common types of planning. At the heart of the problem is a disconnect between what...

Read More

Topics:

Planning,

Sales Performance,

ERP,

Forecast,

GRC,

Office of Finance,

Reporting,

closing,

dashboard,

enterprise spreadsheet,

Excel,

Customer Performance,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Intelligence,

Business Performance,

Financial Performance,

Information Management,

Data,

Risk,

application,

benchmark,

Financial Performance Management

Last year Ventana Research released our Office of Finance benchmark research. One of the objectives of the project was to assess organizations’ progress in achieving “finance transformation.” This term denotes shifting the focus of CFOs and finance departments from transaction processing toward more strategic, higher-value functions. In the research nine out of 10 participants said that it’s important or very important for the department to take a more strategic role. This objective is both...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Performance,

CIO,

Financial Performance,

In-memory,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

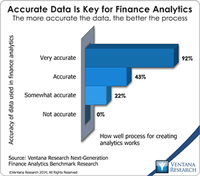

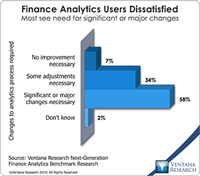

Our research consistently finds that data issues are a root cause of many problems encountered by modern corporations. One of the main causes of bad data is a lack of data stewardship – too often, nobody is responsible for taking care of data. Fixing inaccurate data is tedious, but creating IT environments that build quality into data is far from glamorous, so these sorts of projects are rarely demanded and funded. The magnitude of the problem grows with the company: Big companies have more...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

Information Applications,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

The proliferation of chief “something” officer (CxO) titles over the past decades recognizes that there’s value in having a single individual focused on a specific critical problem. A CxO position can be strategic or it can be the ultimate middle management role, with far more responsibilities than authority. Many of those handed such a title find that it’s the latter. This may be because the organization that created the title is unwilling to invest the necessary powers and portfolio of...

Read More

Topics:

GRC,

Office of Finance,

Chief Risk Officer,

CRO,

ERM,

OpenPages,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Data Governance,

Financial Performance,

IBM,

compliance,

Data,

Risk,

Financial Services,

FPM

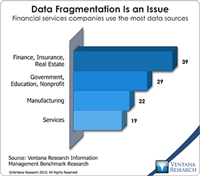

Business computing has undergone a quiet revolution over the past two decades. As a result of having added, one-by-one, applications that automate all sorts of business processes, organizations now collect data from a wider and deeper array of sources than ever before. Advances in the tools for analyzing and reporting the data from such systems have made it possible to assess financial performance, process quality, operational status, risk and even governance and compliance in every aspect of a...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

Information Management,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

Our benchmark research on enterprise spreadsheets explores the pitfalls that await companies that use desktop spreadsheets such as Microsoft Excel in repetitive, collaborative enterprise-wide processes. Because people are so familiar with Excel and therefore are able to quickly transform their finance or business expertise into a workable spreadsheet for modeling, analysis and reporting, desktop spreadsheets became the default choice. Individuals and organizations resist giving up their...

Read More

Topics:

Sales Performance,

GRC,

Office of Finance,

Reporting,

enterprise spreadsheet,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Applications,

Information Management,

Workforce Performance,

Risk,

benchmark,

Financial Performance Management

Senior finance executives and finance organizations that want to improve their performance must recognize that technology is a key tool for doing high-quality work. To test this premise, imagine how smoothly your company would operate if all of its finance and administrative software and hardware were 25 years old. In almost all cases the company wouldn’t be able to compete at all or would be at a substantial disadvantage. Having the latest technology isn’t always necessary, but even though...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

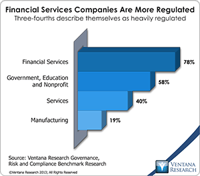

Integrated risk management (IRM) was a major theme at IBM’s recent Smarter Risk Management analyst summit in London. In the market context, IBM sees this topic as a means to differentiate its product and messaging from those of its competitors. IRM includes cloud-based offerings in operational risk analytics, IT risk analytics and financial crimes management designed for financial institutions and draws on component elements of software that IBM acquired over the past five years, notably from ...

Read More

Topics:

Supply Chain Performance,

GRC,

Office of Finance,

Chief Risk Officer,

CRO,

ERM,

OpenPages,

IT Performance,

Operational Performance,

Business Analytics,

Business Collaboration,

Business Performance,

Cloud Computing,

Customer & Contact Center,

Data Governance,

Governance, Risk & Compliance (GRC),

IBM,

Information Applications,

Information Management,

Operational Intelligence,

compliance,

Data,

Risk,

Financial Services,

FPM