There were two noteworthy themes in SAP CEO Bill McDermott’s keynote at this year’s Sapphire conference. One was customer assurance; that is, placing greater emphasis on making the implementation of even complex business software more predictable and less of an effort. This theme reflects the maturing of the enterprise applications business as it transitions from producing highly customized software to providing configurable, off-the-rack purchases. Implementing ERP will never be simple, as I have noted, but as companies increasingly adopt multitenant software as a service (SaaS), vendors will need to make their implementations as repeatable as possible and enable flexible configuration of parameters and processes that substantially reduce the billable hours required to complete a deployment. “Customer assurance” is an important stake in the ground, but it will be an empty concept unless there is complete overhaul of the entire value chain to take it beyond good intentions. Otherwise, customer assurance will be an ongoing rearguard action to overcome technology-driven challenges and disincentives for improvement. Business applications must be re-engineered to facilitate implementation, substantially reduce the likelihood of implementation errors and facilitate subsequent changes to adapt to changing business conditions. Moreover, software vendors’ partners will need to demonstrate that they can reliably cut a substantial number of billable hours per implementation engagement. This will require partners to restructure their business models. Neither of these changes will be easy to accomplish. To its credit SAP has set a course for increasing the simplicity of using its core ERP and financial management software. Getting there soon would greatly enhance its ability to retain if not gain customers in these mature markets.

McDermott’s second notable touch point was the “digital boardroom,” a wall-size set of monitors displaying a broad array of current company data (including some in real time) in easy-to-understand visualizations and in  alphanumeric format. The digital boardroom demonstration contained not just the standard set of drill-down and drill-around capabilities but also the ability to work interactively with data to do what-if scenario planning and analysis. While some might view it as only eye candy, the immediacy of the data and the ability explore potential outcomes based on different conditions or actions would represent a substantial breakthrough in the use of data and analytics by senior executives.

alphanumeric format. The digital boardroom demonstration contained not just the standard set of drill-down and drill-around capabilities but also the ability to work interactively with data to do what-if scenario planning and analysis. While some might view it as only eye candy, the immediacy of the data and the ability explore potential outcomes based on different conditions or actions would represent a substantial breakthrough in the use of data and analytics by senior executives.

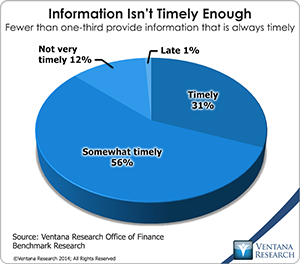

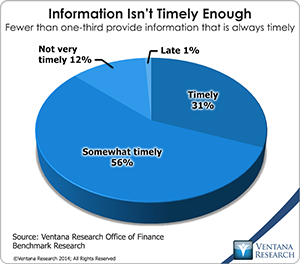

The idea behind the digital boardroom is sound: Boards of directors, executives and management need up-to-date information to help them understand the current state of the business, its opportunities and challenges. However, in our benchmark research on the Office of Finance fewer than one-third of companies said that the information they receive is timely. In the past, somewhat timely information might have been the best one could expect but no longer. Analyses and plans based on out-of-date information may not be actionable. However, the business value of the digital boardroom will be an empty promise unless companies address the root causes of the timeliness issue. They include scattered information, a heavy dependence on desktop spreadsheets for aggregating and analyzing data, and limited penetration of advanced analytics. Our research also shows that fewer than half of finance departments use relatively straightforward analytic techniques such as product and customer profitability, only 22 percent employ economic and market data and trends in their analysis, and just 12 percent use predictive analytics. SAP’s existing and planned software can help address these shortcomings, but it cannot overcome the data management issues that prevent companies from having timely information or the lack of analytical skills and training that also hamper a company’s ability to present incisive, action-oriented analyses and prescriptive models in a digital boardroom.

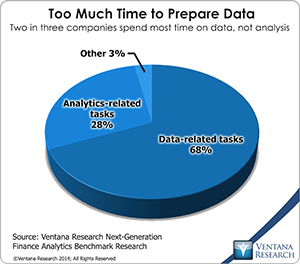

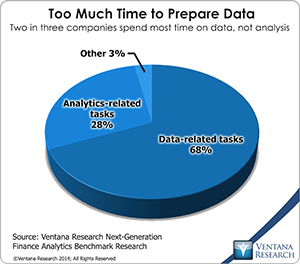

One of SAP’s objectives in demonstrating the digital boardroom is to make senior executives aware of what’s possible. Ideally this would be a potent source of “demand pull” – directives from the top to enhance a company’s systems and modeling capabilities by addressing data, training, process and systems requirements. SAP’s enterprise software generally and its Universal Journal in particular can begin to address the technology and  some of the data issues. But experience makes me reluctant to assume the best. It seems likely that for the time being the numbers and analyses that wind up being displayed in a digital boardroom will be created using the same crude, time-consuming methods. Our next-generation finance analytics research finds that two-thirds (68%) of individuals spend the greatest amount of their time on data-related tasks in preparing for analysis while only 28 percent are able to focus on the analysis itself. One can hope that data environments will improve and that users will switch to dedicated analytic software from desktop spreadsheets, but applications vendors should focus on adapting to shoddy IT environments rather than hoping that customers will change their behavior. SAP also will need to ensure that the full range of its analytics and business intelligence software is readily integrated with the digital boardroom. Doing this must include its newly acquired technology from Roambi, which provides mobile support for smartphones and tablets.

some of the data issues. But experience makes me reluctant to assume the best. It seems likely that for the time being the numbers and analyses that wind up being displayed in a digital boardroom will be created using the same crude, time-consuming methods. Our next-generation finance analytics research finds that two-thirds (68%) of individuals spend the greatest amount of their time on data-related tasks in preparing for analysis while only 28 percent are able to focus on the analysis itself. One can hope that data environments will improve and that users will switch to dedicated analytic software from desktop spreadsheets, but applications vendors should focus on adapting to shoddy IT environments rather than hoping that customers will change their behavior. SAP also will need to ensure that the full range of its analytics and business intelligence software is readily integrated with the digital boardroom. Doing this must include its newly acquired technology from Roambi, which provides mobile support for smartphones and tablets.

The ERP and financial management software categories are currently in a process of transformation, as I have written, one that will be as sweeping as the shift to client/server applications in the 1990s. The trend to cloud-based multitenant architectures gets the most attention, but real-time information availability, a more productive and pleasant user experience, improved in-context collaboration and a lower total lifetime cost of ownership will be key factors in determining winners and losers. Aware that they are vulnerable to disruption, established vendors – including SAP – have been adapting. Statements of direction are useful for communicating with customers and the market generally. However, SAP needs to accelerate its pace of development to arrive at the transformed state it promises if it is to remain competitive.

Regards,

Robert Kugel

Senior Vice President Research