Tableau Software is growing fast. Tableau has taken a “land and expand” strategy that drives what they call the democratization of analytics within organizations. Tableau has enjoyed first mover advantage in the area of exploratory analytics called visual discovery, a growing type of business analytics that allows companies to easily visualize data in a descriptive manner, but the company is facing competition as deep-pocket companies such as IBM, SAP and others become more aggressive in the space.

Tableau’s big advantages are that its software is easy to use, can access many data sources, and lacks the complexity of a traditional OLAP cube, which necessitates predefined schemas, materialized views and pre-aggregation of data. Our next-generation business intelligence benchmark research finds that usability is the most critical criterion in the choice of next-generation BI tools, and in usability, Tableau is an industry juggernaut. The company’s VizQL technology obviates the need for an analyst to understand technologies like SQL, and instead lets users explore data from multiple sources using drag-and-drop, point-and-click and pinch-and-tap techniques. No code, no complexity.

Tableau’s big advantages are that its software is easy to use, can access many data sources, and lacks the complexity of a traditional OLAP cube, which necessitates predefined schemas, materialized views and pre-aggregation of data. Our next-generation business intelligence benchmark research finds that usability is the most critical criterion in the choice of next-generation BI tools, and in usability, Tableau is an industry juggernaut. The company’s VizQL technology obviates the need for an analyst to understand technologies like SQL, and instead lets users explore data from multiple sources using drag-and-drop, point-and-click and pinch-and-tap techniques. No code, no complexity.

With Tableau’s 8.0 release, code-named the Kraken, currently in beta, the story gets more compelling. The Kraken takes the software beyond the business user and into the IT department – the home of BI giants. New ease–of-use features such as better infographics, text justification and rich text formatting got applause at Tableau’s customer conference in San Diego earlier this month, where Tableau announced three specific features that help equip it for battle with traditional BI vendors.

The first is the ability to author, customize and share reports through a  browser interface. This brings much of the functionality that was available only on Tableau Desktop to the Tableau Server environment. It gives users anywhere, anytime access, and increases manageability within the environment. Visualizations can be shared through a link, then picked up by another author in an iterative and collaborative process. Administrators can make sure dashboard proliferation doesn’t overwhelm users.

browser interface. This brings much of the functionality that was available only on Tableau Desktop to the Tableau Server environment. It gives users anywhere, anytime access, and increases manageability within the environment. Visualizations can be shared through a link, then picked up by another author in an iterative and collaborative process. Administrators can make sure dashboard proliferation doesn’t overwhelm users.

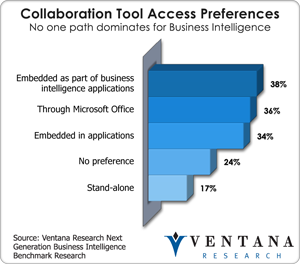

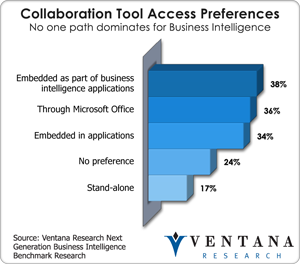

One big advancement is Tableau’s ability to embed its software in other companies’ portals or web applications through a JavaScript API. Many companies should pick up on this advancement to partner with Tableau to embed analytics into their applications. Our research shows that the market has yet to decide how next-generation BI will be delivered, with approximately even splits between those expecting it to go through a BI application (38%), end-user application (34%) and office productivity suite (36%). Anecdotally, we are seeing an uptick in embedded BI arrangements, such as Workday embedding Datameer and Kronos embedding MicroStrategy. Given Tableau’s visualization sophistication, I anticipate it will get a lot of traction here.

Tableau announced support for Salesforce.com and Google Analytics at the conference. The Google move was soon extended to include Google’s BigQuery, which is based on Google’s Dremel real-time distributed query technology, which works in conjunction with Google’s MapReduce. Cloudera recently announced a similar approach to big-data ad-hoc analytics with its Impala initiative, and it chose Tableau as the first company to integrate. These partnerships say a lot about Tableau’s potential partnering power, which I anticipate will become a more important part of the company’s overall strategy.

While the conference announcements were extensive, and in many ways impressive, the battle for the hearts and minds of both IT departments and business users still remains. Tableau comes from the business side, and it remains to be seen is how powerful the usability argument is in the face of the risk and compliance issues that face IT. Tableau may encounter resistance as it moves closer to the IT department in order to enable multidepartment rollouts. IT often has long-term relationships with large software providers, and these providers are now bringing their own tools to market. These include such tools as SAP’s Visual Intelligence (a.k.a. Visi), and IBM Cognos Insight, which I recently blogged about. In many ways it is easier for IT to convince business to use these tools than for business users to make that argument to IT. The outcome of the battle depends on how quickly companies like SAP and IBM can catch up. Tableau says its R&D as a percentage is much higher than that of its competitors, but the question is whether that percentage is big enough to compete with the deep pockets of competitors that surround it. My assumption is that competitors will ultimately catch up, and then its ultimate success will come down to how large a footprint Tableau has established and the loyalty of its user base.

In sum, Tableau has an impressive offering, and the 8.0 beta release is another step forward. The company is advancing a new era of interactive visual discovery of data. Its partnerships and links to multiple data sources make it difficult to ignore in the business intelligence space. The advancements mentioned above as well as Tableau’s focus on things such as cohort analytics and quasi-experimental design approaches gives the company a fair amount of runway with respect to core analytics in the organization. However, it needs to start putting more statistical prowess into the application, starting with basic descriptive statistics, including significance testing such as t-test and chi-squared tests. While it is great to have cool pictures and graphs, if users cannot find real differences in the data, the software’s value is limited. Also, in order to meet its ambition of truly democratizing analytics, it needs to build out or embed basic analytic training modules. This will be key in getting from the What of the data to the So What of the data. Addressing this skills gap, as I wrote about in a blog post earlier this year, is one of the most important areas of focus for companies and suppliers playing in the analytics space. Suppliers that focus only on the tools themselves and ignore data sources and people aspects will see diminishing returns.

Tableau is well on its way into IT departments with its latest advancements, but it still needs to better address things such as write-back, data management and higher-level analytics if it hopes to compete with broader BI portfolios. Competitors in this market are not standing still; they are beginning to morph into more operation-oriented analytical systems.

Business users and departments considering exploratory analytics tools for their companies should definitely consider Tableau. For IT departments with broader responsibility, Tableau is also worth a look. Tableau is a leader in this emerging space, and with its continued investment in R&D, its strengthening partnerships, and a singular focus on bringing analytics to the business populous, it is addressing many core analytics needs within today’s organization. Tableau is an important company to watch.

Regards,

Tony Cosentino

VP and Research Director