Ventana Research has just released the 2012 Value Index for Data Integration, in which we evaluate the competency and maturity of vendors and products. Our firm has been researching this software category for almost a decade. Our latest benchmark research in information management found that data integration is a critical component of information management strategies, according to 55 percent of organizations. Our benchmark research on organizations using this software not only uncovers best practices and trends, but it also highlights why IT is using data integration to advance its competencies across people and processes.

of information management strategies, according to 55 percent of organizations. Our benchmark research on organizations using this software not only uncovers best practices and trends, but it also highlights why IT is using data integration to advance its competencies across people and processes.

I am excited to provide research and education on this critical information technology, which every organization needs to automate data management. The new Value Index for Data Integration looks at vendors and products and their suitability to an organization’s IT and business needs and priorities, which we tie to our benchmark research with input from organizations that are using or assessing the technology.

The Ventana Research methodology utilizes a request for proposal and assessment approach. Each value index takes over six months to complete; unlike other analyst firms, we look at the product details that have the most importance in successful adoption and support for a range of IT and business needs. We evaluated data integration vendors across seven critical categories that are essential for achieving planned benefits: usability, reliability, manageability, adaptability and capability of the products, and also the customer assurance areas of validation and TCO/ROI. We weight each category according to its priority to buyers, and sum the results to 100 percent for scoring purposes. In the process we identify best and worst practices that further refine how we assess technology vendors in each category. For instance, we place a heavy emphasis on adaptability, manageability and reliability since these are critical points of evaluation that can determine whether data integration successfully meets a broad set of data management needs across the enterprise and on the Internet. You can read the details of our methodology and process by purchasing the full 2012 Data Integration Value Index report, or by leveraging our assessment service to help guide your selections.

The Value Index analysis for data integration examines the creation and deployment of data integration processes across the enterprise and Internet. It looks at a range of business and IT-specific needs, including data modeling, integration with enterprise systems, support of information management systems, workflow and collaboration, specific support of data sources and targets, support for a variety of data including XML, content, social media and event processing. We also examine in-depth capabilities for specific types of integration with other applications and processes. Since data integration is an essential issue with information, we examined the interface to data governance, data quality and master data management, and the broader range of support for data management on an organization’s information systems.

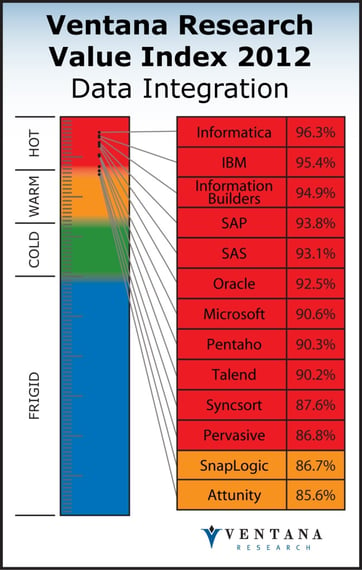

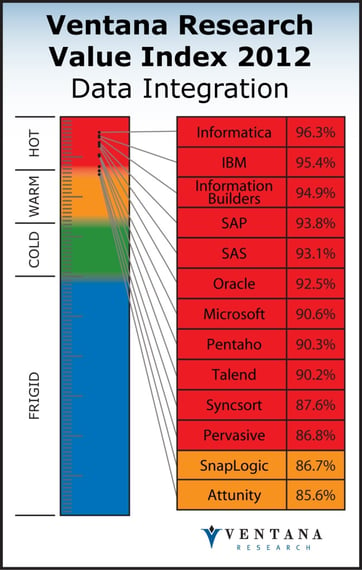

Our Value Index assesses 13 data integration software vendors and is most comprehensive in the industry. Eleven of them deserve to be rated Hot, which is the highest value level and demonstrates maturity of offerings. Informatica ranks at the top, followed by IBM, Information Builders, SAP, SAS, Oracle, Microsoft, Pentaho, Talend, Syncsort and Pervasive. Two vendors, SnapLogic and Attunity, were rated as Warm.

comprehensive in the industry. Eleven of them deserve to be rated Hot, which is the highest value level and demonstrates maturity of offerings. Informatica ranks at the top, followed by IBM, Information Builders, SAP, SAS, Oracle, Microsoft, Pentaho, Talend, Syncsort and Pervasive. Two vendors, SnapLogic and Attunity, were rated as Warm.

We note in our analysis that Informatica excelled across a majority of categories, including data integration for data quality, master data management, cloud computing and event processing. IBM follows Informatica with a strong overall set of software. Information Builders has the most robust level of adaptability. SnapLogic, which specializes in cloud computing and component-based approaches, was rated Warm, but did quite well in usability, where it was rated Hot. Many vendors have not expanded significantly to support cloud computing; SAP, SAS and Oracle are not able to compete with some of the vendors above them. Some data integration providers have new releases coming that will help them advance in 2013.

Since our last assessment a lot has changed among dedicated data integration applications, with new versions that advanced their usability, manageability, reliability and adaptability. Some providers provide more flexible integration points to data sources and targets for big data environments. Many now offer better integration with business processes and more direct support for business analytics. Many are getting better at applying analytics to data during the transformation process to support a range of big data and business process needs. In many cases, improvements in workflow and collaboration across teams distinguish the hottest vendors, whose technology is being used simultaneously around the world.

We take pride in our Value Index, and we believe it is cool to be a Hot vendor. Unlike us, IT-focused analyst firms that do not research or advise organizations have little insight to offer on data integration and overall information management that’s based on in-depth benchmark research and product evaluation. Just rating a vendor on its revenue or vision is insufficient when organizations need to assess their current environments before they determine which vendors should be examined for future needs. We are the only research firm to evaluate vendors and provide practical advice that can help organizations assess and select their own data integration software.

Congratulations to the vendors that stood up to our detailed assessment processes and granular analysis, which represent how organizations assess and select vendors. We’re proud of our objective and in-depth analysis, which we publish without review or editing by the technology vendors, unlike other analyst firms. While some vendors may object to the results, our independence provides the basis for the most trusted research in the industry. If you want further information, please download the executive summary and see how the full report and assessment service can help your organization. We look forward to offering continued guidance to buyers in this critical information technology category, and helping IT and business professionals who need to have the most efficient processes in managing data.

Regards,

Mark Smith

CEO & Chief Research Officer