Workforce Management Value Index Reveals Strong, Competitive Field

I am happy to share some insights gleaned from our latest Value Index research, which provides our assessment of how well vendors’ offerings meet buyers’ requirements. The Ventana Research Value Index: Workforce Management 2019 is the distillation of a year of market and product research efforts by Ventana Research. Drawing on our benchmark  research and expertise, we apply a structured research methodology built on evaluation categories that are designed to reflect the real-world criteria incorporated in a request for proposal to vendors in workforce management. Using this methodology, we evaluated vendor submissions in seven categories, five relevant to the product (adaptability, capability, manageability, reliability and usability) and two related to the vendor (TCO/ROI and vendor validation). This research-based index is the first such evaluation to assess the full business value of workforce management software. You can learn more about our Value Index as an effective vendor selection and RFI/RFP tool here and participating vendors can learn more about how to use the Value Index here.

research and expertise, we apply a structured research methodology built on evaluation categories that are designed to reflect the real-world criteria incorporated in a request for proposal to vendors in workforce management. Using this methodology, we evaluated vendor submissions in seven categories, five relevant to the product (adaptability, capability, manageability, reliability and usability) and two related to the vendor (TCO/ROI and vendor validation). This research-based index is the first such evaluation to assess the full business value of workforce management software. You can learn more about our Value Index as an effective vendor selection and RFI/RFP tool here and participating vendors can learn more about how to use the Value Index here.

This Value Index report evaluates the following vendors that offer products that deliver workforce management as we define it: ADP, Ceridian, Infor, JDA Software, Kronos, NOVAtime Technology, Oracle Corporation, Reflexis Systems, SAP SuccessFactors, SumTotal Systems, Ultimate Software Group, Workday and WorkForce Software. Ten of the 13 suppliers responded fully to our requests for information and provided completed questionnaires and demonstrations to help in our analysis of their workforce management products. The following vendors declined to fully participate or did not respond to our invitation: Ceridian, Kronos and SAP SuccessFactors. To organizations evaluating these vendors, we recommend extra scrutiny as part of the software assessment because they did not make their technology or complete information available for the Value Index evaluation process; online material that was generally available was used for the analysis along with briefings and information provided. This report includes products generally available as of April 2019.

Unlike many IT analyst firms that rank vendors from an IT-only perspective or consider futures or vision over what is available in the products today, Ventana Research has designed the Value Index to provide a balanced perspective of vendors and products that is rooted in an understanding of business drivers and needs. This approach not only reduces cost and time but also minimizes the risk of making a decision that is bad for the business. Using the Value Index will enable your organization to achieve the levels of efficiency and effectiveness needed to optimize workforce management.

We did not include a number of other vendors in this Value Index evaluation because they did not satisfy the criteria that our methodology for this research requires.

We urge organizations to do a thorough job of evaluating workforce management systems and tools and offer this Value Index as both the results of our in-depth analysis of these vendors and as an evaluation methodology. The Value Index can be used to evaluate existing suppliers and also provides evaluation criteria for new projects; applying it can shorten the cycle time for an RFP.

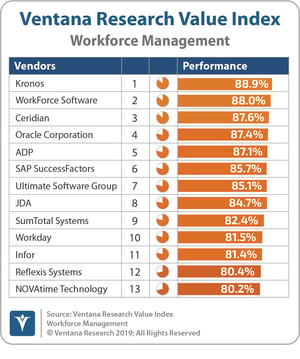

The Value Index for Workforce Management in 2019 finds Kronos first on the list with WorkForce Software in second place and Ceridian in third. Companies that score in the top three in any category earn the designation Value Index Leader. Ceridian has done so in five of the seven categories; WorkForce Software is a Value Index Leader in four categories; Kronos is a Value Index Leader in three categories; and Oracle and SAP SuccessFactors in two categories.

in third. Companies that score in the top three in any category earn the designation Value Index Leader. Ceridian has done so in five of the seven categories; WorkForce Software is a Value Index Leader in four categories; Kronos is a Value Index Leader in three categories; and Oracle and SAP SuccessFactors in two categories.

Our Value Index methodology assigns the weighting for each of the seven categories to best represent the needs of buyers. Here is our specific analysis for each of the categories.

The Capability category makes up 25 percent of this Value Index rating. It is designed to assess how well the product supports time and attendance management, absence management, forecasting and scheduling, and activity and task management across levels and roles in the workforce. We emphasized capabilities that allow customers to provide a high-quality workforce experience for their customers and employees. In this category Kronos, Ceridian and SAP SuccessFactors are Value Index Leaders.

Usability is also necessary for meeting a wide range of the business needs of executives, line managers, workers, analysts and those responsible for administration of workforce management. The weighting for this category, in which Ceridian, WorkForce Software and Kronos are the top three vendors, is 20 percent of the Value Index score. Vendors’ products are evaluated in this category on the support they provide for the range of roles in the workforce management process — executives, managers, analysts, users and IT administration. The research finds usability improvements in the areas of forecasting and scheduling in response to managers’ expectations of a more visual, graphical and intuitive experience with WFM products.

Adaptability is weighted at 10 percent. This category assesses the degree to which system functioning and the applications can be shaped to customer specifications via configurability and customization while still maintaining integrity of integration across the business, processes, application and data. Adaptability is also related to the ability to readily integrate with other systems — for example, payroll and related business processes such as learning and development and relevant compliance processes — and support bidirectional data flows with other processes and systems such as those related to the customer experience. SAP SuccessFactors, Oracle and Ceridian are the highest-rated vendors in this category.

Manageability, which includes administration, security and licensing, is weighted at 10 percent of this Value Index. Scores in this category are strong and reflect the fact that IT administration and application and overall security considerations are typically very prominent in WFM system selection, especially when the IT function is involved in selection, and subsequently in deployment and application support. Ceridian, WorkForce Software and Workday are the top three vendors in this category.

For workforce management processes to operate efficiently and for workers to engage the applications, the software on which they run must be able to scale and perform reliably on existing architectures; Reliability is weighted at 10 percent of the Value Index. Oracle, Kronos and Ceridian are the Value Index Leaders in this category, providing the highest level of confidence they can operate at any level of expectations 24 hours a day.

In TCO/ROI, a category that evaluates vendor support for buyer investment evaluation by providing information, tools and services to help with the business case, makes up 15 percent of the Value Index score. Value Leaders Ultimate Software, ADP and WorkForce Software do a good job of providing to potential customers these materials and tools so they in turn can effectively get funding for WFM system initiatives. However, our analysis showed that many vendors struggle to provide the tools and information on product benefits and costs directly or on their website that organizations need to make a sound buying decision.

The Validation category contributes 10 percent to the overall Value Index score. The leaders here are WorkForce Software and ADP, with Infor and JDA tied for third. This assessment finds wide variation in the level of detail that vendors provide regarding many areas including the product roadmap, customer success, services and support. A lack of information about a vendor’s product support is a challenge that an organization looking to evaluate and select a WFM product simply should not have to face. After all, a vendor’s success is about not just technology but also its relationship with the customer and the support it provides.

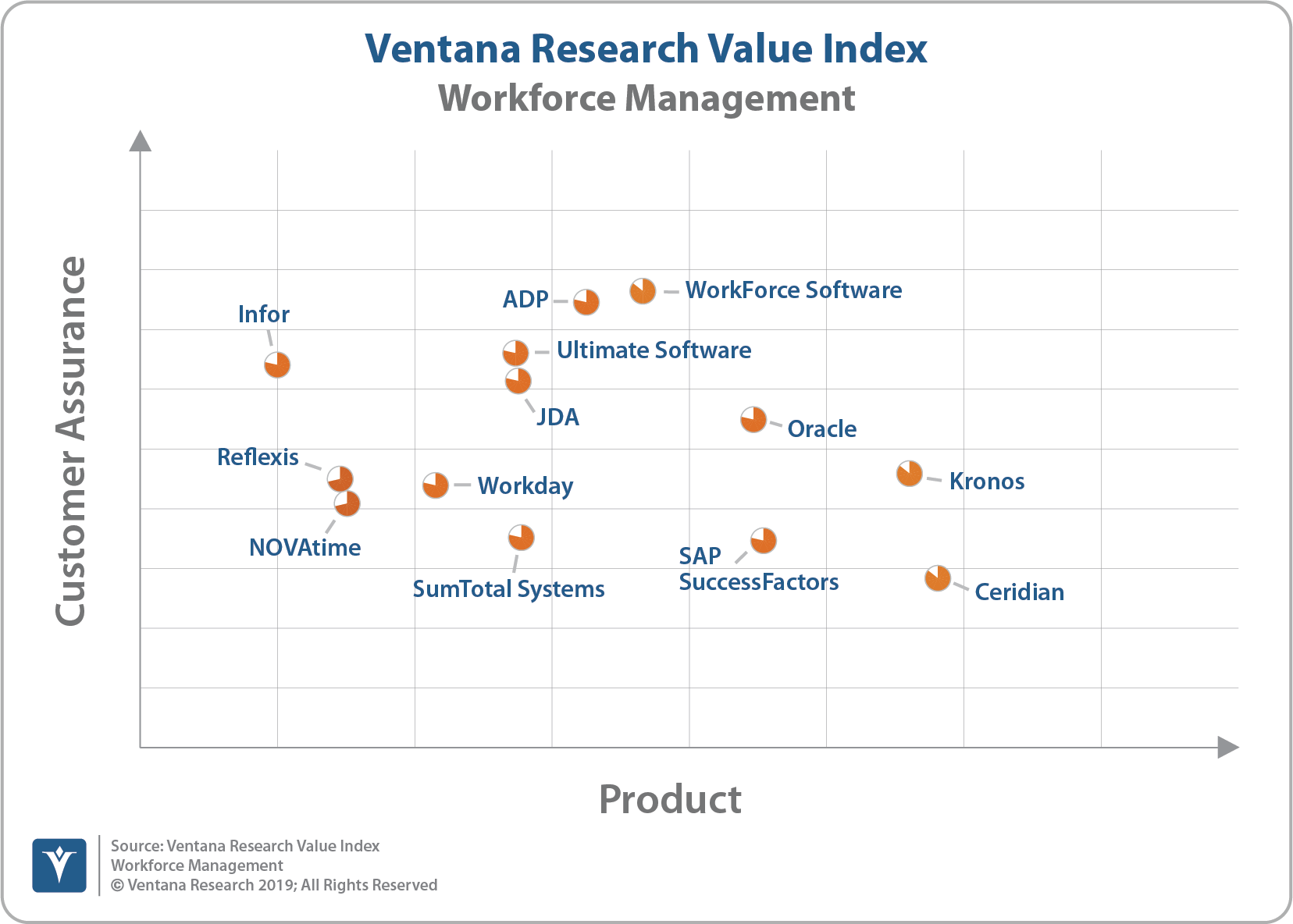

As noted above, this Ventana Research Value Index evaluates the software in seven key categories. The chart below places the product-related and customer assurance scores on the X and Y axes respectively to provide a visual representation of our Value Index scores. Vendors whose products scored higher in aggregate in the five product categories place farther to the right; the combination of scores for the two customer assurance categories determines their placement on the vertical axis. In short, vendors that place closer to the upper-right on this chart scored higher than those closer to the lower-left. The vendors that rank the highest overall on the aggregated product axis, which has a maximum potential score of 75 percent, are Value Index Leaders Ceridian, Kronos and SAP SuccessFactors. The vendors that rank the highest overall on the customer assurance axis, which has a maximum potential score of 25 percent, are Value Index Leaders WorkForce Software, ADP and Ultimate Software.

We warn that close vendor scores should not be taken to imply that the packages evaluated are functionally identical or equally well suited for use by every organization or for a specific process. Although there is a high degree of commonality in how organizations handle workforce management, there are many idiosyncrasies and differences in how they do these functions that can make one vendor’s offering a better fit than another’s with a particular organization’s needs.

After more than a decade of technology advances, all the products we evaluated are feature-rich, but not all the capabilities they offer are equally valuable to users. Moreover, the existence of too many capabilities may be a negative factor for an organization if it introduces unnecessary complexity. Nonetheless, one company may decide that a larger number of options is a plus, especially if some of them match its established practices or better support a new initiative that is driving the purchase of new software.

Other factors besides features and functions or assessments about the vendor can turn out to be a deciding factor. For example, a company may face budget constraints such that the TCO evaluation can tip the balance to one vendor or another. This is where the Value Index methodology and the appropriate weighting can be applied to determine the best fit of vendors and products to your specific needs.

Our firm has made every effort to encompass in this Value Index the functional requirements and capabilities of our Workforce Management blueprint, which we believe reflects what a well-crafted RFP should contain. Even so, there may be additional areas that affect which vendor and products best fit your particular requirements. Therefore, while this research is complete as it stands, utilizing it in your own organizational context is critical to ensure that products deliver the highest level of support for your projects in this area. You can get more details as well as the Value Index Market Report on our site.

Authors:

Ventana Research

Ventana Research, now part of Information Services Group (ISG), is the most authoritative and respected market research and advisory services firm focused on improving business outcomes through optimal use of people, processes, information and technology. Since our beginning, our goal has been to provide insight and expert guidance on mainstream and disruptive technologies. In short, we want to help you become smarter and find the most relevant technology to accelerate your organization's goals.