Businesses always see a lag between when technology makes some advance possible and when a majority of companies actually adopt it. There’s even a longer lag between the emergence of an advance in a business process or technique and the time it takes to become mainstream. When we write our research agendas at the top of each year, we have to strike a balance between focusing on the new and different, which is still many years away from general acceptance, and the mainstream, which has been...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Sales Performance,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

Workforce Performance,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

As I’ve noted before, it’s common for CFOs of companies that are transitioning from being a small to a midsize business (that is, when they grow past about 100 employees) to find that the entry-level accounting package that they have been using no longer fits their needs. This software may be inexpensive to purchase and easy to use but it lacks many of the customization and business process management capabilities that become increasingly important as organizations grow. The transition from...

Read More

Topics:

Planning,

Salesforce.com,

ERP,

Human Capital Management,

Office of Finance,

Reporting,

close,

closing,

Operational Performance,

Business Performance,

Cloud Computing,

Financial Performance,

Workforce Performance,

Financial Performance Management,

FinancialForce.com

This is the third in a series of blog posts on what CEOs (and for that matter, all senior corporate executives) need to know about IT and its impact on running a business. The first covered the high-level issues. As I noted, it’s not necessary for a CEO to be able to write Java code or master the intricacies of an ERP or sales compensation application. However, CEOs must grasp the basics of IT just as they must understand basic corporate finance, the production process and – at least at a high...

Read More

Topics:

Planning,

Predictive Analytics,

Sales,

Sales Performance,

Customer,

Human Capital Management,

Office of Finance,

Budgeting,

close,

closing,

PRO,

Operational Performance,

Analytics,

Business Analytics,

Business Performance,

Customer & Contact Center,

Financial Performance,

Information Management,

CFO,

CEO,

FPM,

Profitability,

SPM

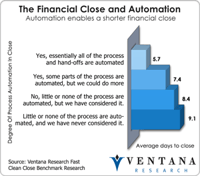

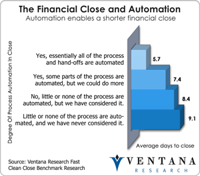

Earlier this year we published our Trends in Developing the Fast, Clean Close benchmark research findings. The most significant was that, on average, it takes longer for companies to close their books today than it did five years ago. In 2007, nearly half (47%) we closing their quarters within five or six days, but now only 38 percent can do it as quickly.

Read More

Topics:

Office of Finance,

close,

closing,

Consolidation,

Controller,

effectiveness,

XBRL,

Business Performance,

Financial Performance,

CFO,

Data,

Document Management,

Financial Performance Management,

FPM

If you’re considering purchasing a financial performance management (FPM) suite, you shouldn’t overlook a recent entrant in the category, Tagetik (which sort of rhymes with “magnetic”). The company, which was founded in 1986 and is based in Lucca, Italy, began by focusing mainly on Europe, but has extended its efforts in the United States in the past two years. Tagetik 4.0 is an elegant implementation of a financial performance management suite running on Microsoft’s SharePoint infrastructure.

Read More

Topics:

Big Data,

Planning,

Office of Finance,

Reporting,

Budgeting,

close,

Consolidation,

Controller,

SharePoint,

XBRL,

Business Analytics,

Business Collaboration,

Business Performance,

Dashboards,

Financial Performance,

Workforce Performance,

CFO,

Tagetik,

FPM

People used to use the phrase “the last mile” solely to refer to a condemned prisoner’s path to execution. Then the telecommunications industry picked it up to describe that part of a circuit between a major trunk line and a subscriber. Later still a defunct software company, Movaris (now part of Trintech), used the phrase in an analogy to refer to the set of activities that take place between when a company closes its books and the point where it finishes its external reporting activities,...

Read More

Topics:

Customer Experience,

Governance,

GRC,

Office of Finance,

Reporting,

audit,

close,

Consolidation,

Controller,

XBRL,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

compliance,

FPM,

SEC

What’s a fast, free and reasonably reliable way of gauging the effectiveness of a finance department’s management? It’s the number of days it takes it to close the books. Companies that take six days or fewer after the end of the period to close their monthly, quarterly or semiannual accounts demonstrate a basic level of effectiveness that those that take longer do not. In my judgment, finance executives should regard a slow close as a negative key performance indicator pointing to...

Read More

Topics:

Sales Performance,

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Business Intelligence,

Business Performance,

Financial Performance,

Governance, Risk & Compliance (GRC),

CFO,

Data,

Document Management,

Financial Performance Management

We started Ventana Research a decade ago, with the objective of providing the highest quality in business-focused information technology research available. We were particularly interested in offering fact-based market research that would focus on the practical needs of getting the most value from technology in business and IT functions. Since then many of the observations we make and much of the advice we offer are grounded in our benchmark research. In a field that often blurs the distinction...

Read More

Topics:

Research,

close,

Uncategorized,

benchmark,

S&OP

I recently attended Vision 2012, IBM’s conference for users of its financial governance, risk management and performance optimization software. From my perspective, two points are particularly worth noting with respect to the finance portion of the program. First, IBM has assembled a financial performance management suite capable of supporting core finance processes as well as more innovative ones. It continues to build out the scope of this suite’s capabilities to enhance ease of use, deepen...

Read More

Topics:

Performance Management,

close,

closing,

IFRS,

Analytics,

IBM,

Uncategorized,

GAAP

For at least a couple of decades completing the financial close within five or six business days after the end of the period has been accepted as a best practice. As such, that creates an expectation that finance organizations that take longer should work to reduce their closing intervals. In updating our last benchmark research on the closing process, Ventana Research has found this not to be the case. In fact, the latest research shows that many companies are taking longer to close today than...

Read More

Topics:

Office of Finance,

close,

Consolidation,

Controller,

XBRL,

Business Analytics,

Financial Performance,

Governance, Risk & Compliance (GRC),

Information Management,

CFO,

Data,

Document Management,

Financial Performance Management