I recently wrote that companies are struggling to provide omnichannel customer experiences and digital customer service is now seen as a business differentiator. To address these issues, organizations need to change how they use people and processes, and deploy innovative technologies that can support new initiatives. To provide an enterprise-wide solution, contact center systems fall into four categories: communications, business applications, analytics and self-service. Our benchmark research into next-generation contact center systems in the cloud shows which types of systems companies have deployed, which they plan to deploy in the next 24 months and whether they prefer them to be on-premises or cloud-based.

Overall the research shows a preference for on-premises systems, with fewer than half (44%) of participants prefer to deploy systems on their own premises. However significant numbers are moving to the cloud with more than one-fourth (28%) using a private cloud, somewhat fewer (22%) using a public cloud and one-fifth (19%) using a hybrid combination of on-premises and cloud-based systems. Noting that 22 percent expressed no preference, we conclude that while cloud-based systems are considered a serious option, organizations are influenced by the number of on-premises systems they have in place and choose the deployment option for new systems based on factors such as capabilities, usability and cost, specific to each purchase. More detailed analysis shows variations across the four categories.

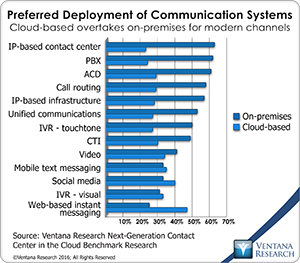

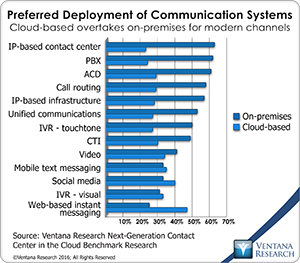

Communications Systems

The contact center market is mature, and  the foundation of many centers is telephony systems such as call routing, ACD and IP-based telephony. However, the research shows that as customers demand other channels of engagement, companies plan to deploy more digital channels such as instant messaging, unified communication, text messaging, video and visual IVR. For these channels we find a shift away from on-premises systems, with companies preferring to deploy systems such as instant messaging, video and social media as cloud-based services. The findings lead us to conclude that most companies will continue to use on-premises systems already in place until they reach the end of life when they are likely to be replaced by cloud-based systems; in the short term these will be supplemented with new cloud-based systems.

the foundation of many centers is telephony systems such as call routing, ACD and IP-based telephony. However, the research shows that as customers demand other channels of engagement, companies plan to deploy more digital channels such as instant messaging, unified communication, text messaging, video and visual IVR. For these channels we find a shift away from on-premises systems, with companies preferring to deploy systems such as instant messaging, video and social media as cloud-based services. The findings lead us to conclude that most companies will continue to use on-premises systems already in place until they reach the end of life when they are likely to be replaced by cloud-based systems; in the short term these will be supplemented with new cloud-based systems.

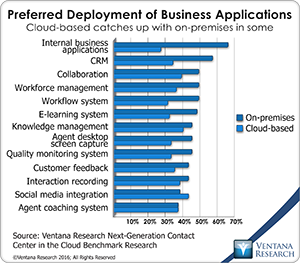

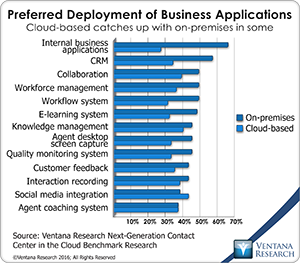

Business Applications

The research shows that companies have deployed an array of business applications; the most common are call recording, business-specific applications and CRM, and the least common are workflow, social media integration and agent desktop systems. It also shows an intent to purchase systems to support specific business needs; the most commonly planned systems are workflow, social media integration and e-learning. The results show no clear pattern in which deployment options companies use. With the exception of internal business applications and CRM, there is a fairly even split between on-premises and cloud-based. We conclude that companies buy business applications on a case-by-case basis, which creates a bias toward on-premises systems because vendors in domains other than CRM have been slow in moving to the cloud.

The research shows that companies have deployed an array of business applications; the most common are call recording, business-specific applications and CRM, and the least common are workflow, social media integration and agent desktop systems. It also shows an intent to purchase systems to support specific business needs; the most commonly planned systems are workflow, social media integration and e-learning. The results show no clear pattern in which deployment options companies use. With the exception of internal business applications and CRM, there is a fairly even split between on-premises and cloud-based. We conclude that companies buy business applications on a case-by-case basis, which creates a bias toward on-premises systems because vendors in domains other than CRM have been slow in moving to the cloud.

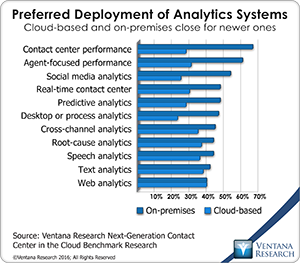

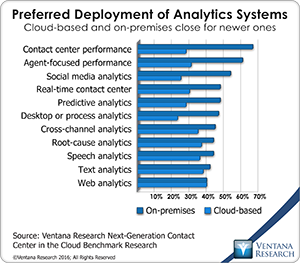

Analytics

Overall, organizations said that among the  four categories of systems analytics will have the greatest impact on customer experience, as companies seek comprehensive views of the customer and the ability to map customer journeys. However, the research shows that few companies are close to achieving either goal. The adoption of analytics is still relatively immature, primarily being systems that can analyze structured data: real-time contact center, agent and overall contact center performance analytics. It also reveals intentions to improve this situation, with overall levels of planned investments being higher than in the three other categories; the top priorities are social media, Web, speech and cross-channel analytics. In terms of deployment options, the results show that early adopters have tended toward on-premises systems, but the trend is to deploy more advanced systems capable of processing unstructured data in the cloud. Companies that don’t know their customers struggle to provide service that meets customer expectations. Cloud-based analytics systems provide opportunity for organizations of all sizes to gain more value from the totality of their customer-related data.

four categories of systems analytics will have the greatest impact on customer experience, as companies seek comprehensive views of the customer and the ability to map customer journeys. However, the research shows that few companies are close to achieving either goal. The adoption of analytics is still relatively immature, primarily being systems that can analyze structured data: real-time contact center, agent and overall contact center performance analytics. It also reveals intentions to improve this situation, with overall levels of planned investments being higher than in the three other categories; the top priorities are social media, Web, speech and cross-channel analytics. In terms of deployment options, the results show that early adopters have tended toward on-premises systems, but the trend is to deploy more advanced systems capable of processing unstructured data in the cloud. Companies that don’t know their customers struggle to provide service that meets customer expectations. Cloud-based analytics systems provide opportunity for organizations of all sizes to gain more value from the totality of their customer-related data.

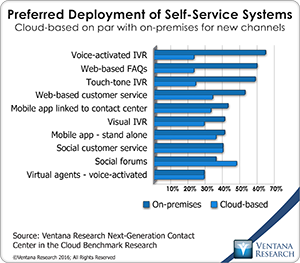

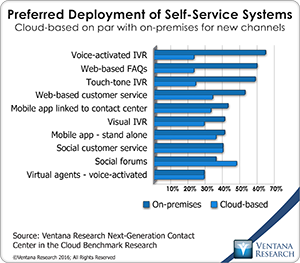

Self-Service Systems

For customer self-service the research shows a pattern of adoption similar to that for communications systems. Most companies have deployed conventional self-service systems such as Web-based FAQs, online customer service and touch-tone IVR on-premises. The adoption of digital systems is less common; few companies have deployed mobile customer-service apps, virtual voice-activated agents or visual IVR. As stated earlier this will change: About one-third of companies plan to deploy social media forums, stand-alone mobile apps, social customer service and mobile apps connected to the contact center. Once more the research shows that as companies adopt advanced digital systems they are equally or more likely to deploy them in the cloud.

For customer self-service the research shows a pattern of adoption similar to that for communications systems. Most companies have deployed conventional self-service systems such as Web-based FAQs, online customer service and touch-tone IVR on-premises. The adoption of digital systems is less common; few companies have deployed mobile customer-service apps, virtual voice-activated agents or visual IVR. As stated earlier this will change: About one-third of companies plan to deploy social media forums, stand-alone mobile apps, social customer service and mobile apps connected to the contact center. Once more the research shows that as companies adopt advanced digital systems they are equally or more likely to deploy them in the cloud.

Overall the research finds many companies, especially very large ones, running on-premises, telephony-focused centers, predominantly supported by CRM systems. Because of consumer demand these companies are adding advanced digital channels but not always in an integrated manner, and it is increasingly likely they will do this using cloud-based systems. The cloud is also opening up the opportunity for smaller companies, or groups within larger companies, to create multichannel contact centers. In general, most companies have some way to go before they can provide omnichannel experiences – engagement across multiple channels that are managed using the same rules and data sources so that customers receive personalized, consistent responses on any channel. The research also shows more companies moving to cloud-based vendors that provide fully integrated systems. I expect this trend to continue and so recommend that companies wanting to transition to omnichannel engagement assess how cloud-based contact center vendors can help those efforts.

Regards,

Richard J. Snow

VP & Research Director, Customer

Follow Me on Twitter and Connect with me on LinkedIn