To help companies improve the efficiency and effectiveness of their payroll management processes, we have assembled our 2015 Value Index for Payroll Management. It evaluates vendors of payroll management software to provide a guide for selecting the right application to suit specific needs. The executive summary is available for download, and this analysis provides a snapshot of the findings. Ventana Research defines payroll management as all activities associated with paying employees correctly and efficiently. This set of processes crosses the human resources and finance functions; deployed properly it provides employees with access to their payroll information as well as improving payroll management effectiveness.

Our benchmark research on payroll management optimization finds that the majority (54%) of organizations have a priority to improve the efficiency of their payroll management processes.  Almost as many (44%) cited a more strategic aim for payroll management: increasing the productivity of the workforce. Indeed, more generally almost three in four organizations (71%) said it is very important to improve the productivity of their workforce. Further evidence of this lies in the finding that the most-often cited driver (48%) motivating organizations to consider investments in payroll management is a demand for higher employee productivity.

Almost as many (44%) cited a more strategic aim for payroll management: increasing the productivity of the workforce. Indeed, more generally almost three in four organizations (71%) said it is very important to improve the productivity of their workforce. Further evidence of this lies in the finding that the most-often cited driver (48%) motivating organizations to consider investments in payroll management is a demand for higher employee productivity.

For many years payroll was a separate process inside organizations, and payroll management often has been a stand-alone application or service. However, with the growth of integrated systems for human capital management, vendors of payroll management software have started to develop systems that integrate payroll applications with talent management and workforce management systems. Such integration can enable organizations to create a single employee record that managers can use to reach important goals such as satisfying compliance requirements, tracking all aspects of compensation and better aligning pay to performance. This, the research finds, most have not done. For example, currently fewer than one in 12 (8%) have integrated payroll management with their talent management system, and although 22 percent said they plan to do that in the next 12 to 18 months, fully half of organizations have no such plan. Similarly, 29 percent reported having a dedicated workforce management system, but only one in five have integrated their payroll management system with it.

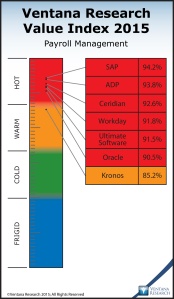

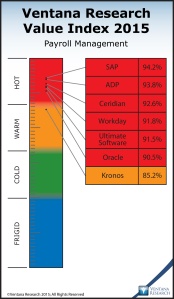

The 2015 Value Index for Payroll Management uses the Ventana Research methodology, a framework that evaluates application vendors and their products in seven categories of requirements. Five are product-related, assessing usability, manageability, reliability, capability and adaptability, while two quantify the customer assurance issues of vendor validation and total cost of ownership and return on investment (TCO/ROI). To assess functionality, one of the components of capability, we applied the Ventana Research payroll management methodology and blueprint, which links the business process of payroll management to an organization’s information technology. We also applied best practices from our payroll management benchmark research that statistically look at the market of using payroll management applications in organizations. We weighted the seven categories and their importance in assessing vendors and their applications. This Value Index report evaluates the following vendors that offer products that address key elements of payroll management as we define it: ADP, Ceridian, Kronos, Oracle, SAP, Ultimate Software and Workday.

The Value Index for Payroll Management in 2015 shows that currently the top supplier is SAP, followed closely by ADP; both are rated Hot vendors. SAP was the only vendor to submit its on-premises product and ranks first in Reliability, Capability and TCO/ROI. In third place is Ceridian, slightly more  than one percentage point behind ADP, which ranked first in Manageability and Validation. Ranked fourth is Workday, also rated Hot, which ranks first in Usability. In fifth place, only 0.3 percent lower, is Ultimate Software, which is rated Hot in all seven evaluation criteria.

than one percentage point behind ADP, which ranked first in Manageability and Validation. Ranked fourth is Workday, also rated Hot, which ranks first in Usability. In fifth place, only 0.3 percent lower, is Ultimate Software, which is rated Hot in all seven evaluation criteria.

Oracle also is a Hot vendor and came in sixth, separated by one percentage point from Ultimate Software. Oracle ranks first in Adaptability with strong integration capabilities and recent advancements in its cloud computing application platform as a service technology. Oracle did not provide a submission for this Value Index, but documentation of its product is publicly available and used along with knowledge of the product through briefings, customers and conferences. Rounding out this Value Index is Kronos, which is rated Warm; its product is suited to provide payroll management for small and midsize companies located in the U.S. Kronos did rank highest in Validation, being well established in the related workforce management software segment.

This Value Index evaluation finds that all the products assessed can handle the core payroll capabilities for domestic North American companies. These capabilities include calculating gross to net pay, executing multiple payrolls, managing tax calculations for most scenarios, and allowing configuration of business logic to accommodate most payroll scenarios. All the products provide some type of reporting and analytics to handle compliance reviews for zero net pay and other standard policy violations.

The products differed in their standings in our seven categories. In our Usability assessment, we segment according to role, specifically payroll professionals or managers, employees and senior managers. In our benchmark research Usability is the evaluation criteria most often rated very important. All the products provide a functional user interface for payroll professionals, though some, such as Workday, provide a more intuitive experience. ADP and SAP followed closely. For employees, the largest group of users, the leading products have evolved robust mobile and Web-based employee self-service applications. For senior managers, the vendors of the leading products have combined new, more powerful analytics capabilities with mobile functionality to differentiate their offerings from others.

The Reliability category determines whether the products can deliver the performance and scalability required. The evaluation criteria include the nature of the product’s support for an organization’s IT architecture at the level of the enterprise, the network, the server and the data, and the sophistication of its development and customization capabilities. SAP ranks the highest in Reliability with ADP following closely and Ceridian and Ultimate Software also rated Hot.

In the Capability category, which in our benchmark research is the evaluation criterion third-most often rated very important, we found differences among products in advanced functionality, notably the degree to which they can handle international payrolls. Ultimate Software and Workday do not process international payroll within their products but through partnerships with payroll aggregators; they receive some amount of the information back into their product from the aggregators to be reported on or managed there. Conversely, SAP and ADP handle much of the international payroll processing directly while relying on partnerships for some cases. Nearly every vendor offers a broader product suite beyond payroll management. Most offer a human resources management system, most have workforce management, and some have a talent management product. The ERP vendors Oracle, SAP and Workday also offer a financial management product for posting payroll directly to the general ledger. SAP ranks highest in Capability; ADP and Ceridian are tied for second place. Ultimate Software, Workday and Oracle also are rated Hot.

Manageability assesses whether products meet business and IT needs for installation, deployment and administration. Here Ceridian ranks highest, with ADP and SAP following closely, though all vendors are rated Hot in this category. For Adaptability, there is value in providing an integrated approach to payroll and other human capital management products, but it also is useful for products to integrate well with third-party products for customers that prefer to use them. ADP, Oracle and SAP provide more established integration frameworks, which is reflected in our ratings. Workday provides integration tools but requires customers to use its HR management product as a condition of purchasing payroll. Oracle ranks first in Adaptability, followed by Workday and ADP.

Our Value Index also provides for customer assurance in two categories. Validation assesses the vendor’s commitment to the market segment and its products along with the breadth of its communication of relevant information. Here Ceridian,  Ultimate Software and SAP rank highest though all are rated Hot. The TCO/ROI category applies evaluation criteria designed to assess the value the vendor delivers with its products. Here SAP and Workday lead the field, and Ceridian, ADP and Ultimate Software follow closely.

Ultimate Software and SAP rank highest though all are rated Hot. The TCO/ROI category applies evaluation criteria designed to assess the value the vendor delivers with its products. Here SAP and Workday lead the field, and Ceridian, ADP and Ultimate Software follow closely.

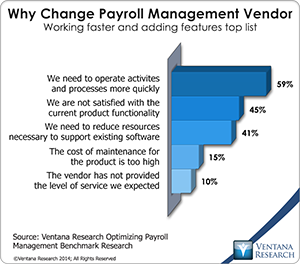

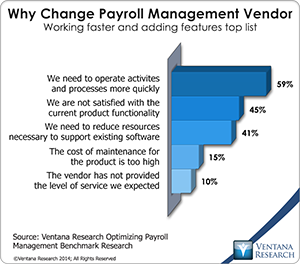

Organizations can use the Value Index realize other benefits from upgrading their software and match important priorities. For example, half of organization in our research that made such investments have gained efficiency and accuracy in the payroll management process, two-fifths are better able to comply with regulations, and three in 10 have better analytics and visibility into payroll metrics. Among considerations for establishing a business case for payroll management software, the most-often cited, audit and regulatory compliance (very important to 52%), addresses payroll effectiveness while the item ranked fifth is reducing the time for payroll tasks (very important to 33%). The research finds a variety of reasons organizations change their payroll management vendor, from operating faster (cited by 59%) to reducing resources (41%) required to operate the processes.

Our benchmark research and Value Index analysis are carefully crafted tools that can help any organization assess and improve payroll management. Please download the executive summaries of each as you begin to frame the challenge and opportunity for yours and reach out to us if you want to use the complete research for a methodical assessment of your organization and vendors.

Regards,

Mark Smith

CEO and Chief Research Officer

than one percentage point behind ADP, which ranked first in Manageability and Validation. Ranked fourth is Workday, also rated Hot, which ranks first in Usability. In fifth place, only 0.3 percent lower, is Ultimate Software, which is rated Hot in all seven evaluation criteria.

than one percentage point behind ADP, which ranked first in Manageability and Validation. Ranked fourth is Workday, also rated Hot, which ranks first in Usability. In fifth place, only 0.3 percent lower, is Ultimate Software, which is rated Hot in all seven evaluation criteria.