NICE Systems is best known for its suite of workforce optimization products [http://www.nice.com/workforce-optimization-lobby] that I recently assessed. However, after attending its user event last year, I wrote in 2013 that it was extending its portfolio and changing its focus to concentrate on packaged solutions that address specific business needs. Over the years the company’s portfolio has evolved through a combination of in-house development, acquisitions and partnerships. This approach enabled NICE to build a broad portfolio quickly, but it also created challenges in integrating the separate products into a homogeneous whole. One of the key acquisitions was Fizzback, which gave NICE entry to the market for customer feedback and voice of the customer (VOC) software. In this context I was keen to learn during a recently briefing how the company is integrating these products into a broader VOC portfolio.

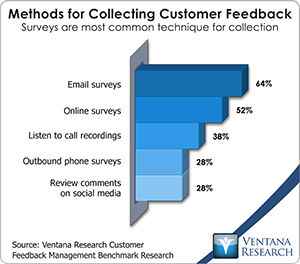

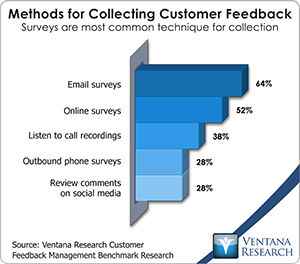

The portfolio begins with four key products: NICE Fizzback and three related to analytics, NICE Interaction, Social Media and Engagement. My benchmark research into customer feedback management finds that companies still collect customer feedback predominantly through surveys, using either email, Web-based or outbound phone approaches. Fizzback supports all of these, so companies can collect direct feedback. Complicating the situation, however, my benchmark research into customer engagement shows that companies support on average 7.5 customer engagement channels and each of these produces data that contains valuable customer insights, that aren’t immediately visible – what might be regarded as indirect feedback. NICE’s three analytics products capture data from these channels and use text and speech analytics to extract insights. By combining the results from Fizzback and the analytics, companies can build a more complete view of customer comments and sentiment, including how those are affected as customers use multiple channels to resolve their issues.

The portfolio begins with four key products: NICE Fizzback and three related to analytics, NICE Interaction, Social Media and Engagement. My benchmark research into customer feedback management finds that companies still collect customer feedback predominantly through surveys, using either email, Web-based or outbound phone approaches. Fizzback supports all of these, so companies can collect direct feedback. Complicating the situation, however, my benchmark research into customer engagement shows that companies support on average 7.5 customer engagement channels and each of these produces data that contains valuable customer insights, that aren’t immediately visible – what might be regarded as indirect feedback. NICE’s three analytics products capture data from these channels and use text and speech analytics to extract insights. By combining the results from Fizzback and the analytics, companies can build a more complete view of customer comments and sentiment, including how those are affected as customers use multiple channels to resolve their issues.

These results become input for three other products: NICE Quality Management, Performance Management and Real-Time Guidance and Automation. Quality Management is used to monitor and assess agent performance. By linking this with outputs from the VOC portfolio, companies can focus agent training and coaching on areas that are impacting the customer experience. The link with Real-time Guidance and Automation allows information and alerts to be passed to agents as they handle interactions, ensuring that they follow the correct process and have the information at hand to quickly resolve customer issues. Performance Management creates a view of how interactions are handled and supports the creation of alerts and workflows that ensure corrective action is taken to improve the overall customer experience.

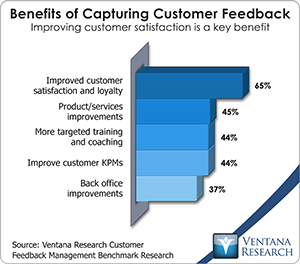

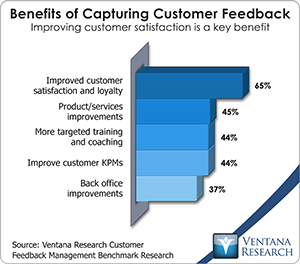

My research into customer feedback management shows that companies can achieve a number of benefits by collecting and using these responses. Beyond improving customer satisfaction and loyalty (65%), companies can address common causes of negative customer feedback and sentiment: the need to improve products and services so customers have to engage less; to improve agent performance through more focused training and coaching; and to improve back-office processes that can also help lessen the need for interactions. As is the case in any improvement program, complete basic information is most likely to deliver the most benefits. Each of NICE’s VOC products has capabilities that stand by themselves to support different business needs. However, the combination of products allows companies to close loops – for example, focusing agent training to meet customer expectations and automating the process of data sharing to improve operational efficiency.

My research into customer feedback management shows that companies can achieve a number of benefits by collecting and using these responses. Beyond improving customer satisfaction and loyalty (65%), companies can address common causes of negative customer feedback and sentiment: the need to improve products and services so customers have to engage less; to improve agent performance through more focused training and coaching; and to improve back-office processes that can also help lessen the need for interactions. As is the case in any improvement program, complete basic information is most likely to deliver the most benefits. Each of NICE’s VOC products has capabilities that stand by themselves to support different business needs. However, the combination of products allows companies to close loops – for example, focusing agent training to meet customer expectations and automating the process of data sharing to improve operational efficiency.

All of my research indicates that the customer experience must be an enterprise-wide responsibility, and therefore companies should connect everyone who handles interactions. To do that information and processes must flow across business unit boundaries, which requires connected systems and a common, complete view of how interactions are handled and their outcomes. NICE has come a long way in its efforts to create business-related product packages, and its broader VOC portfolio enables companies to link a range of actions to customer feedback. I recommend that companies assess how NICE’s products can help them improve operational efficiency, as well as employee and customer satisfaction.

Regards,

Richard J. Snow

VP & Research Director