SAP recently presented its analytics and business intelligence roadmap and new innovations to about 1,700 customers and partners using SAP BusinessObjects at its SAP Insider event (#BI2014). SAP has one of the largest presences in business intelligence due to its installed base of SAP BusinessObjects customers. The company intends to defend its current position in the established business intelligence (BI) market while expanding in the areas of databases, discovery analytics and advanced analytics. As I discussed a year ago, SAP faces an innovator’s dilemma in parts of its portfolio, but it is working aggressively to get ahead of competitors.

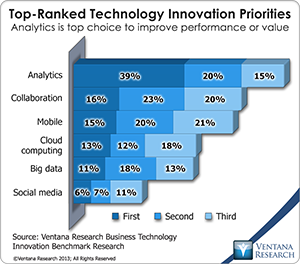

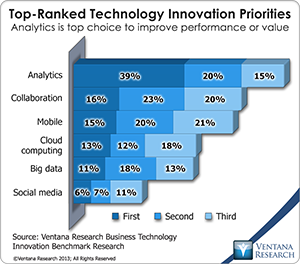

One of the pressures that SAP faces is from a new class of software that is designed for business analytics and enables users to visualize and interact on data in new ways without relationships in the data being predefined. Our business technology innovation research shows that analytics is the top-ranked technology innovation in business today, rated first by 39 percent of organizations. In conventional BI systems, data is modeled in so-called cubes or other defined structures that allow users to slice and dice data quickly and easily. The cube structure solves the problem of abstracting the complexity of the structured query language (SQL) of the database and slashes the amount of time it takes to read data from a row-oriented database. However, as the cost of memory decreases significantly, enabling the use of new column-oriented databases, these methods of BI are being challenged. For SAP and other established business intelligence providers, this situation represents both an opportunity and a challenge. In responding, almost all of these BI companies have introduced some sort of visual discovery capability. SAP introduced SAP Lumira, formerly known as Visual Intelligence, 18 months ago to compete in this emerging segment, and it has gained traction in terms of downloads, which the company estimated at 365,000 in the fourth quarter of 2013.

One of the pressures that SAP faces is from a new class of software that is designed for business analytics and enables users to visualize and interact on data in new ways without relationships in the data being predefined. Our business technology innovation research shows that analytics is the top-ranked technology innovation in business today, rated first by 39 percent of organizations. In conventional BI systems, data is modeled in so-called cubes or other defined structures that allow users to slice and dice data quickly and easily. The cube structure solves the problem of abstracting the complexity of the structured query language (SQL) of the database and slashes the amount of time it takes to read data from a row-oriented database. However, as the cost of memory decreases significantly, enabling the use of new column-oriented databases, these methods of BI are being challenged. For SAP and other established business intelligence providers, this situation represents both an opportunity and a challenge. In responding, almost all of these BI companies have introduced some sort of visual discovery capability. SAP introduced SAP Lumira, formerly known as Visual Intelligence, 18 months ago to compete in this emerging segment, and it has gained traction in terms of downloads, which the company estimated at 365,000 in the fourth quarter of 2013.

SAP and other large players in analytics are trying not just to catch up with visual discovery players such as Tableau but rather to make it a game of leapfrog. Toward that end, the capabilities of Lumira demonstrated at the Insider conference included information security and governance, advanced analytics, integrated data preparation, storyboarding and infographics; the aim is to create a differentiated position for the tool. For me, the storyboarding and infographics capabilities are about catching up, but being able to govern and secure today’s analytic platforms is a critical concern for organizations, and SAP means to capitalize on them. A major analytic announcement at the conference focused on the integration of Lumira with the BusinessObjects platform. Lumira users now can create content and save it to the BusinessObjects server, mash up data and deliver the results through a secure common interface.

Beyond the integration of security and governance with discovery analytics, the leapfrog approach centers on advanced analytics. SAP’s acquisition last year of KXEN and its initial integration with Lumira provide an advanced analytics tool that does not require a data scientist to use it. My coverage of KXEN prior to the acquisition revealed that the tool was user-friendly and broadly applicable especially in the area of marketing analytics. Used with Lumira, KXEN will ultimately provide front-end integration for in-database analytic approaches and for more advanced techniques. Currently, for data scientists to run advanced analytics on large data sets, SAP provides its own predictive analytic library (PAL), which runs natively on SAP HANA and offers commonly used algorithms such as clustering, classification and time-series. Integration with the R language is available through a wrapper approach, but the system overhead is greater when compared to the PAL approach on HANA.

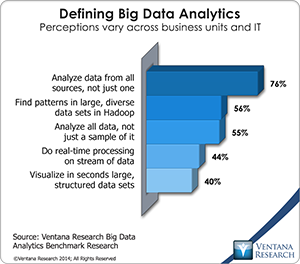

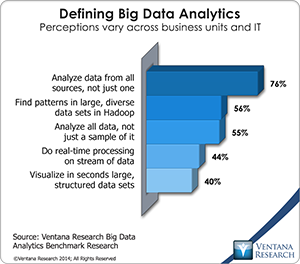

The broader vision for Lumira and the BusinessObjects analytics platform SAP said is “collective intelligence,” which it described as “a Wikipedia for business” that provides a bidirectional analytic and communication platform. To achieve this lofty goal, SAP will  need to continue to put resources into HANA and facilitate the integration of underlying data sources. Our recently released research on big data analytics shows that being able to analyze data from all data sources (selected by 75% of participants) is the most prevalent definition for big data analytics. To this end, SAP announced the idea of an “in-memory fabric” that allows virtual data access to multiple underlying data sources including big data platforms such as Hadoop. The key feature of this data federation approach is what the company calls smart data access (SDA). Instead of loading all data into memory, the virtualized system sets a proxy that points to where specific data is held. Using machine learning algorithms, it can define how important information is based on the query patterns of users and upload the most important data into memory. The approach will enable the company to analyze data on a massive scale since utilizing both HANA and the Sybase IQ columnar database which the company says was just certified as the world record for the largest data warehouse, at more than 12 petabytes. Others such as eBay and Teradata may beg to differ with the result based on another implementation, but nevertheless it is an impressive achievement.

need to continue to put resources into HANA and facilitate the integration of underlying data sources. Our recently released research on big data analytics shows that being able to analyze data from all data sources (selected by 75% of participants) is the most prevalent definition for big data analytics. To this end, SAP announced the idea of an “in-memory fabric” that allows virtual data access to multiple underlying data sources including big data platforms such as Hadoop. The key feature of this data federation approach is what the company calls smart data access (SDA). Instead of loading all data into memory, the virtualized system sets a proxy that points to where specific data is held. Using machine learning algorithms, it can define how important information is based on the query patterns of users and upload the most important data into memory. The approach will enable the company to analyze data on a massive scale since utilizing both HANA and the Sybase IQ columnar database which the company says was just certified as the world record for the largest data warehouse, at more than 12 petabytes. Others such as eBay and Teradata may beg to differ with the result based on another implementation, but nevertheless it is an impressive achievement.

Another key announcement was SAP Business Warehouse (BW) 7.4, which now runs on top of HANA. This combination is likely to be popular because it enables migration of the underlying database without impacting business users. Such users store many of their KPIs and complex calculations in BW, and to uproot this system is untenable for many organizations. SAP’s ability to continue support for these users is therefore something of an imperative. The upgrade to 7.4 also provides advances in capability and usability. The ability to do complex calculations at the database level without impacting the application layer enables much faster time-to-value for SAP analytic applications. Relative to the in-memory fabric and SDA discussed above, BW users no longer need intimate knowledge of HANA SDA. The complete data model is now exposed to HANA as an information cube object, and HANA data can be reflected back into BW. To back it up, the company offered testimony from users. Representatives of Molson Coors said their new system took only a weekend to move into production (after six weeks of sandbox experiments and six weeks of development) and enables users to perform right-time financial reporting, rapid prototyping and customer sentiment analysis.

SAP’s advancements and portfolio expansion are necessary for it to continue in a leadership position, but the inherent risk is confusion amongst its customer and prospect base. SAP published its last statement of direction for analytic dashboard about this time last year, and according to company executives, it will be updated fairly soon, though they would not specify when. The many tools in the portfolio include Web Intelligence, Crystal Reports, Explorer, Xcelsius and now Lumira. SAP and its partners position the portfolio as a toolbox in which each tool is meant to solve a different organizational need. There is overlap among them, however, and the inherent complexity of the toolbox approach may not resonate well with business users who desire simplicity and timeliness.

SAP customers and others considering SAP should carefully examine how well these tools match the skills in their organizations. We encourage companies to look at the different organizational  roles as analytic personas and try to understand which constituencies are served by which parts of the SAP portfolio. For instance, one of the most critical personas going forward is the Designer role since usability is the top priority for organizational software according to our next-generation business intelligence research. Yet this role may become more difficult to fill over time since trends such as mobility continue to add to the job requirement. SAP’s recent upgrade of Design Studio to address emerging needs such as mobility and mobile device management (MDM) may force some organizations to rebuild dashboards and upscale their designer skill sets to include JavaScript and Cascading Style Sheets, but the ability to deliver multifunctional analytics across devices in a secure manner is becoming paramount. I note that SAP’s capabilities in this regard helped it score third overall in our 2014 Mobile Business Intelligence Value Index. Other key personas are the knowledge worker and the analyst. Our data analytics research shows that while SQL and Excel skills are abundant in organizations, statistical skills and mathematical skills are less common. SAP’s integration of KXEN into Lumira can help organizations develop these personas.

roles as analytic personas and try to understand which constituencies are served by which parts of the SAP portfolio. For instance, one of the most critical personas going forward is the Designer role since usability is the top priority for organizational software according to our next-generation business intelligence research. Yet this role may become more difficult to fill over time since trends such as mobility continue to add to the job requirement. SAP’s recent upgrade of Design Studio to address emerging needs such as mobility and mobile device management (MDM) may force some organizations to rebuild dashboards and upscale their designer skill sets to include JavaScript and Cascading Style Sheets, but the ability to deliver multifunctional analytics across devices in a secure manner is becoming paramount. I note that SAP’s capabilities in this regard helped it score third overall in our 2014 Mobile Business Intelligence Value Index. Other key personas are the knowledge worker and the analyst. Our data analytics research shows that while SQL and Excel skills are abundant in organizations, statistical skills and mathematical skills are less common. SAP’s integration of KXEN into Lumira can help organizations develop these personas.

SAP is pursuing an expansive analytic strategy that includes not just traditional business intelligence but databases, discovery analytics and advanced analytics. Any company that has SAP installed, especially those with BusinessObjects or an SAP ERP system, should consider the broader analytic portfolio and how it can meet business goals. Even for new prospects, the portfolio can be compelling, and as the roadmap centered on Lumira develops, SAP may be able to take that big leap in the analytics market.

Regards,

Tony Cosentino

VP and Research Director

roles as

roles as