Verint recently announced a definitive agreement to acquire KANA Software. Its goal, in the words of the press release, is to “transform the way organizations engage with their customers.” Customer engagement and customer experience management have become the topics of many conversations in my research area, so I wanted to understand the substance behind this move.

I have been following Verint for years and recently wrote about two of its latest “business impact solutions,” which I have written about. Verint combines individual products into prepackaged bundles that address issues such as call avoidance and cost to serve, and offer agents personalized guidance on the next best action. The company is best known in the workforce optimization space, offering a comprehensive suite of products that covers interaction recording, quality monitoring, workforce management, training and coaching, and analytics. Through other acquisitions and internal development it also has created a suite of “voice of the customer” products and an extensive range of analytics products. All of these play a part in customer experience management, but not in the way most of us think about it.

Recently I have been taking a closer interest in KANA and wrote about how it is changing customer service. This is the space it is best known for, and through its own series of acquisitions and development it has created suites of products that cover the agent desktop, knowledge management, case management, business process management, Web self-service, chat and co-browsing, email and postal mail management, mobile and social collaboration, and analytics. The Web self-service, email and postal mail management and collaboration products are close to most companies’ idea of customer experience management, but as with Verint, many would say the others are not core customer experience products. On the surface it is not apparent how the combination of the two product sets will live up to the billing in the press release.

A few things about the acquisition are immediately obvious. The two companies together will become an even bigger player in the global market, and thus should benefit customers with better service and the opportunity to purchase products from a single vendor. Second, with the possible exception of analytics, there is little overlap in the product sets, so customers will be able to purchase complementary products. Both companies have experience with cloud-based services, so I expect to see more of the products available to a wider set of companies. If there is a downside, it stems from the fact that both sets of products have come about through a series of acquisitions. Both companies have been working on integration and rationalization of their user interfaces, but now they have to begin again to bring the two product sets together. My research shows this will be vital to the future success of the combined company, as usability has become a top factor for companies considering the purchase of new software.

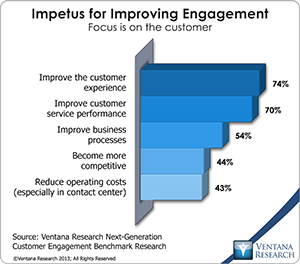

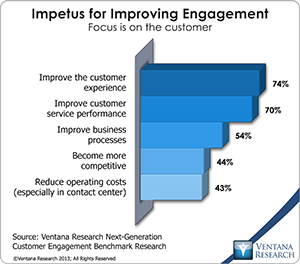

A few things about the acquisition are less obvious. My recent  research on customer relationship maturity, the agent desktop and next-generation customer engagement points to the fact that customer experience has become the way companies differentiate themselves and our research has found it is the way to improve the customer experience in almost three quarters (74%) of organizations. But over the past 12 to 18 months this has become far more complex. Companies now have to support more channels of communication; more business units are engaging directly with customers; more systems must be accessed to resolve interactions; companies need more information to drive decisions and actions; users and employees want to do more on the move; and everything has become “social.” And companies must do all of this while reducing operational expenses. In terms of systems, my next-generation customer engagement research finds that companies have now deployed a vast range of systems, from CRM, performance management, business process management and workforce optimization to self-service, text messaging, chat, collaboration, agent desktops, voice recognition and an increasing number and types of analytics tools – and the list doesn’t stop there. In combination these systems manage channels of communication, the people side of handling interactions, business transactions and information sources, and analysis of how well interactions are being handled and the business outcomes – all core requirements to support the complex world of customer engagement. Closer examination of the combined Verint and KANA product sets shows that together they include most of these systems, and so when fully integrated they should indeed enable companies to improve customer engagement.

research on customer relationship maturity, the agent desktop and next-generation customer engagement points to the fact that customer experience has become the way companies differentiate themselves and our research has found it is the way to improve the customer experience in almost three quarters (74%) of organizations. But over the past 12 to 18 months this has become far more complex. Companies now have to support more channels of communication; more business units are engaging directly with customers; more systems must be accessed to resolve interactions; companies need more information to drive decisions and actions; users and employees want to do more on the move; and everything has become “social.” And companies must do all of this while reducing operational expenses. In terms of systems, my next-generation customer engagement research finds that companies have now deployed a vast range of systems, from CRM, performance management, business process management and workforce optimization to self-service, text messaging, chat, collaboration, agent desktops, voice recognition and an increasing number and types of analytics tools – and the list doesn’t stop there. In combination these systems manage channels of communication, the people side of handling interactions, business transactions and information sources, and analysis of how well interactions are being handled and the business outcomes – all core requirements to support the complex world of customer engagement. Closer examination of the combined Verint and KANA product sets shows that together they include most of these systems, and so when fully integrated they should indeed enable companies to improve customer engagement.

During a briefing about the acquisition I learned that in the short term KANA will operate as a separate business unit in the Verint Enterprise group, but the teams will work together to target every business unit involved in customer engagement and deliver on several business imperatives such as getting the right person with the right skills to handle a customer interaction, reducing customer and agent effort when handling interactions, and improving customer and employee satisfaction. Among all the product sets, I think three will be key: collaboration, the desktop and analytics. Collaboration will help break down the barriers between business units, giving customers consistent experiences regardless of whom they engage with. A better desktop will enable anyone to more easily access the systems and information they need to resolve interactions. And analytics will not only provide the common information for everyone handling interactions but also enable companies to map the customer journey across touch points and understand which deliver the best results. Like any acquisition, this one will have challenges, so I will watch with interest to see how well the combined companies meet the challenging goal they set out.

Regards,

Richard J. Snow

VP & Research Director