In April Workday released version 19 of its suite of applications for human capital management (HCM), financial management and other areas. Workday’s strategy is to differentiate itself in the ERP market, specifically in competing with Oracle and SAP, by being a pure-play cloud vendor. The strategy touts specific value propositions in the system’s cost effectiveness, flexibility, and ease of use and management through its cloud computing and HR to accounting software approach. Much of the job of executing on these promises is realized in the content of the quarterly releases, which is becoming a more common release model among both ERP vendors and cloud-only vendors such as Workday.

Efforts to make the system more flexible and easier to use were evident in the last two releases. Workday 18 focused on adding some new mobile features, such as enhancements to the current profile capabilities and a new team profile for the iPad. (For analysis of the initial release of Workday’s mobile application support in Release 16, see my colleague Mark Smith’s comments.) Release 19 is focused on strengthening the core platform’s flexibility and extensibility by enhancing cloud connectors for HCM and enabling the user interface to handle more custom labels and fields. In addition, both releases added some capabilities to the analytical functionality.

More specifically, Workday’s HCM application benefits from several enhancements to the core platform focused on increasing application flexibility and adding integration to third-party applications. The addition of Google Android to Workday’s mobile support will broaden access, as well as adding drag-and-drop talent calibration analytics beyond the historical human capital trending introduced in Workday 18.

The core platform enhancements in Workday 19 expand Workday’s custom fields and labels, add more cloud connectors for HCM, update the e-verify service and add integration to third-party time clocks for time capture. The enhancement of the custom fields add significantly to what was available in Workday 18, which was only applicant, worker and job profile objects; this release has a broader set of objects within which users can create custom fields that extend inside HCM and the financial management application – including supervisory, company and location objects, for example, which will help users tailor the system more closely to their specific business process and information needs in these applications. Workday also added to release 19 a custom API that enables third-party applications to send information to a custom field. It is worth noting that Ultimate Software announced the same capability for creating custom fields in its most current release, as I discussed. Workday 19 also extends the custom labels capability beyond those in release 18. This feature likewise is something that several competing vendors have and is useful for companies that have specific terms they wish to use internally.

Three new HCM cloud connectors are in Workday 19 as well: an outbound competency model connector, through which third-party applications can receive competency information from Workday (this will be good for learning partners such as Saba); an inbound connector for worker organization assignment; and an inbound talent profile connector, which will let third parties pass information to Workday’s talent profile. Finally, in core platform connector services Workday 19 updates the e-verify connector so the service complies with the latest regulatory requirements. For Workday these enhancements will make the HCM product more attractive in large enterprise sales opportunities where the company may not be able to meet the purchaser’s requirements itself but could take a stronger position by also offering partners’ products and custom reports.

Combined with partner products, Workday 19 will be a more competitive offering. In workforce management, for example, Workday’s own product has less functionality than competing products. However, partnership with Kronos enables it to add capabilities of a leading time-and-attendance product with functionality that will suit the needs of most enterprise clients. Workday 19 continues to expand workforce management integration by providing a connector to time clocks from Accu-Time Systems, which will allow Workday to capture time data and place it into Workday Time Tracking.

On the highly competitive mobile front, which has been a strong point for Workday, both Workday 18 and 19 have made advancements. Release 18 includes an integrated professional and personal profile that can pull information from LinkedIn, a team profile for the iPad that enables managers to look at various aspects of their team from their tablet and an enhancement to the Time Tracking application that allows employees to use mobile devices to check in and out. These were smart choices for Workday because mobility has a high profile among users, shows well on the Apple devices and most importantly helps managers search for information more easily.

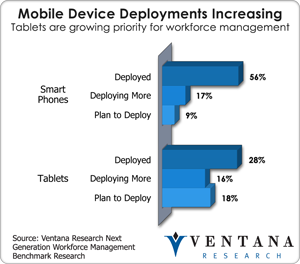

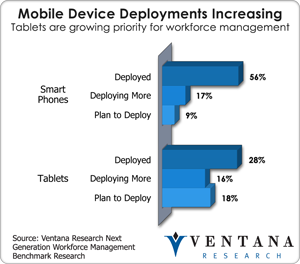

Workday followed up in Release 19 with support for the Google  Android platform and thus now supports the Apple iOS, HTML 5 and Android systems. Release 19 also improves the manager self-service application for the iPad so those users can execute job change transactions through a guided process. In addition, time entry for the Time Tracking application now can be done on both iPhone and iPad. The effort Workday has put into mobile access within this application and these last few releases should get the attention of its target prospects. Indeed, according to our benchmark research report on next-generation workforce management, more than half (56%) of organizations have deployed applications on smartphones and more than one-fourth (28%) on tablets, as the chart shows.

Android platform and thus now supports the Apple iOS, HTML 5 and Android systems. Release 19 also improves the manager self-service application for the iPad so those users can execute job change transactions through a guided process. In addition, time entry for the Time Tracking application now can be done on both iPhone and iPad. The effort Workday has put into mobile access within this application and these last few releases should get the attention of its target prospects. Indeed, according to our benchmark research report on next-generation workforce management, more than half (56%) of organizations have deployed applications on smartphones and more than one-fourth (28%) on tablets, as the chart shows.

There is also heated competition in human capital management analytics and workforce planning. Both the ERP vendors with whom Workday primarily competes are fairly strong in analytics (such as Oracle Fusion HCM), and suite vendors (such as SumTotal Systems) have embedded analytics in their applications. However, Workday’s analytics seem easy to use and thus are attractive to business  users, but Workday must add depth to its analytic capabilities. Workday 18 includes a drag-and-drop talent calibration capability which can help facilitate performance ratings from different groups or divisions. Workday has introduced trending analytics so companies can track various talent and workforce management metrics. Release 19 expands this library with trending analytics available for headcount, attrition and compensation. Finally Release 19 has a new analytics screen to help centralize overall headcount planning by comparing a plan to actual headcount in both tabular and graphical formats. Overall these improvements should increase the value of the product to managers and executives, who often view HCM products through the lens of their analytical capabilities and how easy the analytics are to use. On this front Workday lacks the depth of analytics some of the other vendors have, but what it provides seems useful for its target customers. Several of the trending analytics Workday has implemented in these last two releases are relevant to findings in our benchmark research on collaboration and human capital management shown in the adjacent chart. Specifically, attrition analytics aligns with retention rates (62%), the second-most important workforce metric that businesses said are important to supporting their talent management activities, and talent calibration aligns with leadership development (58%), the third-most important metric.

users, but Workday must add depth to its analytic capabilities. Workday 18 includes a drag-and-drop talent calibration capability which can help facilitate performance ratings from different groups or divisions. Workday has introduced trending analytics so companies can track various talent and workforce management metrics. Release 19 expands this library with trending analytics available for headcount, attrition and compensation. Finally Release 19 has a new analytics screen to help centralize overall headcount planning by comparing a plan to actual headcount in both tabular and graphical formats. Overall these improvements should increase the value of the product to managers and executives, who often view HCM products through the lens of their analytical capabilities and how easy the analytics are to use. On this front Workday lacks the depth of analytics some of the other vendors have, but what it provides seems useful for its target customers. Several of the trending analytics Workday has implemented in these last two releases are relevant to findings in our benchmark research on collaboration and human capital management shown in the adjacent chart. Specifically, attrition analytics aligns with retention rates (62%), the second-most important workforce metric that businesses said are important to supporting their talent management activities, and talent calibration aligns with leadership development (58%), the third-most important metric.

Overall Workday’s strategy is working well in its primary target market of legacy ERP clients, as its first-quarter earnings, recently released, showed growth of 61 percent from a year ago. However, with the recent investments Oracle and SAP have made, specifically Oracle’s release of Fusion HCM and purchase of Taleo, and SAP’s purchase of SuccessFactors, it is likely this market will get more competitive for Workday. That said, both Releases 18 and 19 have made progress in fulfilling specific value propositions of ease of use and flexibility, which will be necessary to succeed in this increasingly competitive environment. Organizations considering investment in Workday that approach HCM with a fully integrated human resources and talent management application suite is suitable to their future direction.

Regards,

Stephan Millard

VP & Research Director