I recently attended NICE Systems’ annual user conference, this year called Interactions 2013. In discussions of its different products and latest releases and testimonials from selected clients, I was surprised by how the messages were packaged. NICE has a long history of acquiring companies, and it has let many of them continue to operate as autonomous lines of business. Often there was minimal integration with other NICE products, a variety of user interfaces, no common software administration tools. In my opinion this policy prevented it from taking advantage of having a suite of products focused on handling customer interactions. At the conference, Zeevi Bregman, CEO and President, positioned NICE as supporting three lines of business: interaction management, fraud and compliance, and security. He explained at length how the three are inextricably linked, tying fraud and compliance and security to interaction management and customer service. Fraud and compliance is linked to customer service because market segments such as banking have to ensure that the customer service they provide conforms to legislative requirements, and security is an increasing part of knowing customers and ensuring the safety of their information. Other executives also stressed these themes.

As I delved deeper into the products, it became obvious that NICE has shifted from selling product lines to selling solutions to key business issues. Supporting this shift are greater integration of products, new user interfaces and core products targeted at business solutions. This was most obvious in the new release of customer engagement analytics (CEA). This major product announcement emphasized that it enables companies to bring together structured and unstructured data to complete a fuller picture of the customer. As well as the now obligatory tools to support the visualization of customer information, trends and hot issues, a major capability is the ability to map and analyze the customer journey. As my research into customer relationship maturity revealed, the most customer-centric companies now use customer journey mapping techniques to determine how they expect different customers to engage with the company at different times and through multiple channels. Our research finds many departments including the contact center (77%) involved with inbound interactions increasing the need to gain consistency across channels. Customer engagement analytics takes this one step further by capturing interaction data from all touch points, combining it with other customer data and visualizing (or mapping) how customers actually engage with the company – how frequently, at what times, for what reasons, through which channels (and across channels), and with what outcomes. It also analyzes the causes that drive customers to interact with the company. Combining both sides of the analysis, companies can work proactively to improve interactions, in the moment while a call is taking place or in the future (by changing processes and refocusing training of agents).

unstructured data to complete a fuller picture of the customer. As well as the now obligatory tools to support the visualization of customer information, trends and hot issues, a major capability is the ability to map and analyze the customer journey. As my research into customer relationship maturity revealed, the most customer-centric companies now use customer journey mapping techniques to determine how they expect different customers to engage with the company at different times and through multiple channels. Our research finds many departments including the contact center (77%) involved with inbound interactions increasing the need to gain consistency across channels. Customer engagement analytics takes this one step further by capturing interaction data from all touch points, combining it with other customer data and visualizing (or mapping) how customers actually engage with the company – how frequently, at what times, for what reasons, through which channels (and across channels), and with what outcomes. It also analyzes the causes that drive customers to interact with the company. Combining both sides of the analysis, companies can work proactively to improve interactions, in the moment while a call is taking place or in the future (by changing processes and refocusing training of agents).

NICE presenters also featured customer engagement analytics as supporting other solutions or business processes. In this context, they frequently used the phrase “closed loop,” which showed the influence of the Merced acquisition. When it was independent Merced had been a pioneer of closed-loop processes that complete the circle of capturing data, analyzing it to understand what happened or is happening, and finally ensuring that relevant actions are taken to improve future decisions and activities. One of the moist common examples is capturing interactions (for example, call recordings), analyzing how agents handled calls and then using this information to impact quality scores, training, coaching and call-handling techniques.

NICE’s new focus on business solutions goes beyond closing the loop, which tends to remain within a business unit and/or focused business process such as agent quality monitoring. Its approach supports what I call “joined up” thinking and processes. We all know, and my research confirms, that most companies still run as silos: Each line of business does things its own way, has its own systems and takes its own view of the customer. Joining up crosses business units, and while it doesn’t necessarily use a single source of customer data, it does at least share a single view of the customer across processes, decisions and actions. A joined-up approach also crosses communication channels to ensure customers get a consistent, personalized, in-context experience, no matter which channel, person (contact center agents) or technology (Web-based self-service) they use. NICE does this by using customer engagement analytics and bundling different products into a variety of business solutions. One of the first of these is call volume reduction, which is a bundle tuned to reduce the number of inbound calls. Another NICE is calling service-to-sales, which aims to maximize sales opportunities from service interactions. Through an increasing number of partnerships, NICE also is using CEA to influence call routing, helping companies perform smarter call-routing based on the customer’s profile, the context of the interaction and the skills required by the person handling the interaction.

Discussions about multichannel interactions inevitably led to use of a second popular phrase – big data. NICE executives insisted the company isn’t about to become a major big data player for the sake of being seen as such; rather they said it needed to place big data at the heart of what it is doing because much of that involves processing huge volumes of data, especially in the form of millions of call recordings and social media transactions, as well as video recordings. This emphasis agrees with comments by my colleague Tony Cosentino and mirrors my own view that big data per se is not the issue; what matters is what you do with it. The reality of multichannel customer service is that it produces millions and millions of bytes of data. Companies not only have to process these volumes, but much of customer service, customer experience or custom engagement happens in real-time – a phone call, a chat session, an in-store or branch office meeting or a social media post, for instance. The person or technology handling those interactions needs up-to-date information there and then to make a response based on the most up-to-date information, putting the interaction in context and perhaps most importantly personalizing it based on a complete view of the customer. Old techniques didn’t allow companies to support this approach, so I find it significant that NICE is building big data into its business-related solutions.

One such example is Mobile Reach. This product supports what NICE calls hybrid customer service or what I am tending to call connected service. We are used to hearing about assisted service, person-to-person interaction, and self-service (person-to-technology interaction). Connected service includes both, and mobile interaction is a good example. What I call the 2.0 customer is increasingly turning to mobile apps for self-service. However most mobile apps have limitations and cannot complete some types of complex interactions, even on a smart device. Connected mobile service addresses this issue by allowing certain steps to be completed on the device (such as entering basic data), then integrates that data with business applications to provide more information and/or drive next steps; if these steps don’t complete the interaction, it supports seamless connection to a live agent in a smart way; for example, it might bypass IVR because the system knows who the customer is and which person is best equipped to complete the interaction. NICE Mobile Reach is one of the smarter mobile app platforms, and I recommend that companies evaluate it as they step into this brave new world.

Also at the conference, I heard and met with several NICE customers. Of course, they were chosen because they are the most successful in using the products, but as a group they expressed two common themes. First of all becoming customer-centric starts at the top; the CEO must want to do it and support initiatives and actions that deliver a customer-focused approach. Second, employees, including contact center agents, have to buy in to the approach, commit to it and live it. To achieve this, companies must support those employees, give them the tools and information they need, and reward those who meet expectations. To do this most companies will have to re-evaluate processes and technology to determine whether they can support such an approach; they need as well to develop new customer–related metrics and not continue to rely on just those that show how efficiently things are running.

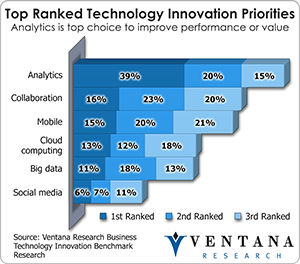

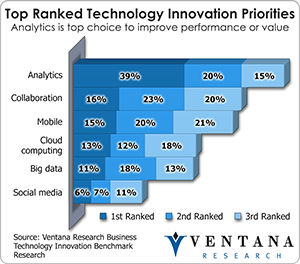

NICE is rapidly evolving to utilize technology innovations that are priorities in organizations today. Our research found analytics and mobile technology are part of the top three today, and with the growing demand on big data that NICE is beginning to exploit. All the messages I heard from NICE were encouraging and a million miles from the old-style marketing of products that do x, y and z, and insisting they are the best. Is NICE all the way there yet? By management’s own admission, not yet. However, compared what I have seen in the past, it has come a long way on the journey and so is certainly a vendor to watch over the next few years.

that are priorities in organizations today. Our research found analytics and mobile technology are part of the top three today, and with the growing demand on big data that NICE is beginning to exploit. All the messages I heard from NICE were encouraging and a million miles from the old-style marketing of products that do x, y and z, and insisting they are the best. Is NICE all the way there yet? By management’s own admission, not yet. However, compared what I have seen in the past, it has come a long way on the journey and so is certainly a vendor to watch over the next few years.

Regards,

Richard J. Snow

VP & Research Director