Mobile technology continues to advance weekly, with new software releases and new versions of devices. Though it has been in the headlines frequently in recent weeks, can Microsoft really change the mobile technology dynamics in the business world?

In the last three years the mobile technology market has changed completely. The dominance of Research in Motion (RIM) and Microsoft has been usurped by the vertical innovation of Apple, with its iPhone and iPad, and the openness of Google’s Android ecosystem. This reversal of dominance shows that consumers can dictate what technology platform will rule not just the consumer ecosystem but also the business environment.

Over the last decade Microsoft has lost its edge in mobile technology and lost the confidence of not just consumers but also retailers and telecommunication carriers who expended significant effort to provide the Microsoft option to customers. This leaves Microsoft with a last chance to rebuild trust with Windows 8, which operates across a range of mobile technology offerings, including the recently released Surface tablet and a new Windows Phone operating system and devices. Microsoft hopes that a new user experience that involves the use of tiles to get quick access to information and applications will mean an advantage for Windows in the mobile environment. This big bet has yet to be proven in the market.

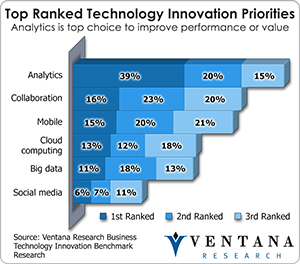

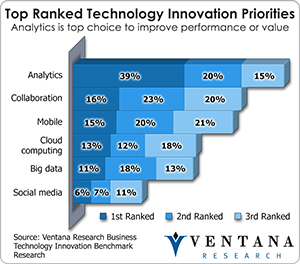

We recently conducted benchmark research on technology innovation  to determine the value, priority and benefits of new technology for business and IT. We found mobile technology to be one of the top three priorities. While many companies (46%) have used mobile technology for business for more than a year, most (63%) still only have a small set of the applications and information available for mobile devices. Organizations prefer native applications (39%), but the access via web browser (33%) is right behind, and a fifth of organizations have no preference. These facts all impact Microsoft as it attempts to catch up to other mobile brands.

to determine the value, priority and benefits of new technology for business and IT. We found mobile technology to be one of the top three priorities. While many companies (46%) have used mobile technology for business for more than a year, most (63%) still only have a small set of the applications and information available for mobile devices. Organizations prefer native applications (39%), but the access via web browser (33%) is right behind, and a fifth of organizations have no preference. These facts all impact Microsoft as it attempts to catch up to other mobile brands.

One way to measure the success of a mobile platform is the commitment by third-party software developers to provide a range of applications and services to meet business needs. While Microsoft is rapidly moving to provide applications and services for the consumer market, its support for business applications is less than stellar. It hopes that support for a common Windows 8 operating system will make it easier to get the support from business software providers. Don’t take my word for it – visit the Microsoft application store for its Windows Phone and business applications and start looking for applications to support marketing, sales, customer service, human resources, operations and other departments. Names like IBM, Oracle, SAP, Salesforce.com and dozens of others are missing. Then visit the Apple App Store and compare the results.

My interactions with more than a hundred software providers finds a significant level of pessimism about Microsoft’s mobile efforts, which is why the company’s platform is on the bottom of the list of development priorities. Most organizations are taking a wait-and-see approach to determine whether the consumer markets embrace Microsoft’s new offerings. Consumer preference matters because many organizations are transitioning to a bring-your-own-device (BYOD) approach, where companies provide a list of devices they support to access business applications and information in the enterprise. Companies today most often purchase smartphones (58%) for their employees, but that is less so with tablets (43%). Tablet deployments are growing (34%) but remain far behind smartphone use in organizations (85%). This BYOD approach is what Apple did to influence what now is an overwhelming support of its mobile technology in business. Whether this leaves an opportunity for Microsoft depends on business and IT preferences and how individuals influence decisions inside of businesses.

Individuals in organizations do have preference for specific smartphone technologies. Our research found Apple (50%) is first, with Android and RIM way behind and Microsoft’s presence insignificant. In tablets, Apple’s iPad dominates (66%), Android comes second, and Microsoft (8%) lags. Apple and Android have more applications, and have provided seamless upgrades and software revisions on a range of devices over multiple years. Apple and Android have not required updates to the underlying technology in new devices – an approach that has historically plagued Microsoft and frustrated customers who lacked enough computing power or memory to operate new mobile releases. In past years Microsoft’s attempts to dominate the mobile technology market required not just a great processor but significant storage and memory to operate its environment. Historically Microsoft has been beholden to technology manufacturers who failed to adequately power mobile technology to meet its environment’s demands.

Meanwhile, business use of mobile technology is growing rapidly thanks to the significant benefits it provides. Organizations see better communication and knowledge-sharing (62%) and faster response to opportunities and threats (39%). Organizations that have not deployed mobile technology have concerns about security (47%) and the risk of providing access through technologies for which they lack skills and competencies. Our research into next-generation workforce management and sales applications and technology shows the demand for mobile technology is a priority for businesses because it can increase productivity and help workers complete daily activities and tasks.

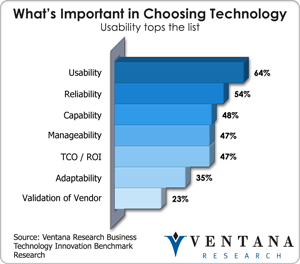

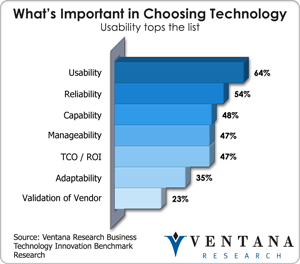

Microsoft has taken some bold steps with introduction of the new  Windows 8 interface, which uses tiles and eliminates the Start menu. Having to learn a new interface is to some extent a barrier to adoption, but Microsoft is right to focus on usability, which is the top evaluation priority according to our benchmark research into business technology innovation.

Windows 8 interface, which uses tiles and eliminates the Start menu. Having to learn a new interface is to some extent a barrier to adoption, but Microsoft is right to focus on usability, which is the top evaluation priority according to our benchmark research into business technology innovation.

Miracles have happened in the technology industry, but history, including the rise of Apple mobile technology, shows that market share and confidence build gradually over time and with consistent delivery of improvements to the technology that are easy to use and simple to get access to from the technology. Microsoft will need to do more than just provide a common Windows environment across devices to gain the confidence and trust of buyers. It will take a serious commitment to mobile technology over time to build trust, in the face of fierce competition from Apple and Android, with their own advancements in devices and operating environments.

I look forward to seeing whether Microsoft can defy reality and the research on the business climate and trends in the market and gain enough adoption by consumers to make its mobile technology a priority within organizations.

Regards,

Mark Smith

CEO & Chief Research Officer