The application of artificial intelligence (AI) and machine learning (ML) to business computing will have a profound impact on white collar professions. This is especially true in heavily rules-based functions such as accounting. Companies recognize the transformational potential of AI and ML, but the progression and pace of the adoption of these technologies is unclear. Some applications of AI and ML are already in use but others are a decade or more away from replacing human tasks.

Read More

Topics:

Big Data,

Machine Learning,

Office of Finance,

Analytics,

CFO,

finance,

CEO,

AI,

accountants,

NLP,

Accounting

SYSPRO is a 35-year-old software vendor that focuses on selling enterprise resource planning (ERP) systems to midsize companies, particularly those in manufacturing and distribution. In manufacturing, SYSPRO supports make, configure and assemble, engineer to order, make to stock and job shop environments. The company attempts to differentiate itself through vertical specialization and its years of ongoing development, which can reduce the need for customization and cut the cost of initial and...

Read More

Topics:

Big Data,

SaaS,

ERP,

Governance,

Human Capital Management,

Office of Finance,

close,

Continuous Accounting,

Analytics,

CIO,

Cloud Computing,

Collaboration,

CFO,

CRM,

CEO

The topic of corporate governance received renewed attention recently after the publication of an open letter signed by 13 prominent business leaders, including Warren Buffett of Berkshire Hathaway and Jamie Dimon of JPMorgan Chase. The first principle the group advocated in the letter is the need for a truly independent board of directors. To achieve that aim, the letter suggests having the board meet regularly without the CEO and that the members of the board should have “active and direct...

Read More

Topics:

Mobile,

Governance,

Human Capital Management,

Office of Finance,

Consolidation,

Reconciliation,

CFO,

CEO,

board of directors,

accounting close

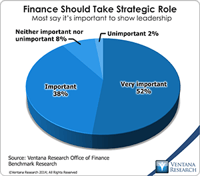

The imperative to transform the finance department to function in a more strategic, forward-looking and action-oriented fashion has been a consistent theme of practitioners, consultants and business journalists for two decades. In all that time, however, most finance and accounting departments have not changed much. In our benchmark research on the Office of Finance, nine out of 10 participants said that it’s important or very important for finance departments to take a strategic role in...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Social Media,

Governance,

GRC,

Human Capital,

Mobile Technology,

Office of Finance,

Budgeting,

close,

Continuous Accounting,

Continuous Planning,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

In-memory,

Uncategorized,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

Last year Ventana Research released our Office of Finance benchmark research. One of the objectives of the project was to assess organizations’ progress in achieving “finance transformation.” This term denotes shifting the focus of CFOs and finance departments from transaction processing toward more strategic, higher-value functions. In the research nine out of 10 participants said that it’s important or very important for the department to take a more strategic role. This objective is both...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

end-to-end,

Tax,

Tax-Datawarehouse,

Analytics,

Business Performance,

CIO,

Financial Performance,

In-memory,

CFO,

CPQ,

Risk,

CEO,

Financial Performance Management,

FPM

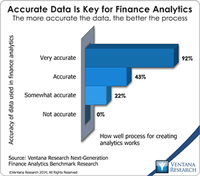

Our research consistently finds that data issues are a root cause of many problems encountered by modern corporations. One of the main causes of bad data is a lack of data stewardship – too often, nobody is responsible for taking care of data. Fixing inaccurate data is tedious, but creating IT environments that build quality into data is far from glamorous, so these sorts of projects are rarely demanded and funded. The magnitude of the problem grows with the company: Big companies have more...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Operational Performance,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

Information Applications,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

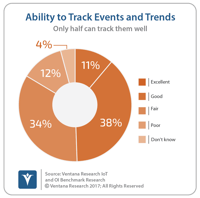

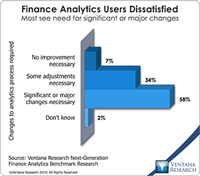

Business computing has undergone a quiet revolution over the past two decades. As a result of having added, one-by-one, applications that automate all sorts of business processes, organizations now collect data from a wider and deeper array of sources than ever before. Advances in the tools for analyzing and reporting the data from such systems have made it possible to assess financial performance, process quality, operational status, risk and even governance and compliance in every aspect of a...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

Office of Finance,

Budgeting,

close,

Finance Analytics,

Tax,

Analytics,

Business Analytics,

Business Intelligence,

Business Performance,

CIO,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

Information Management,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

A core objective of my research practice and agenda is to help the Office of Finance improve its performance by better utilizing information technology. As we kick off 2014, I see five initiatives that CFOs and controllers should adopt to improve their execution of core finance functions and free up time to concentrate on increasing their department’s strategic value. Finance organizations – especially those that need to improve performance – usually find it difficult to find the resources to...

Read More

Topics:

Big Data,

Performance Management,

Planning,

Predictive Analytics,

Sales Performance,

Supply Chain Performance,

Office of Finance,

Budgeting,

close,

dashboard,

PRO,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Customer & Contact Center,

Financial Performance,

In-memory,

CFO,

Supply Chain,

CEO,

demand management,

Financial Performance Management,

FPM,

S&OP

Senior finance executives and finance organizations that want to improve their performance must recognize that technology is a key tool for doing high-quality work. To test this premise, imagine how smoothly your company would operate if all of its finance and administrative software and hardware were 25 years old. In almost all cases the company wouldn’t be able to compete at all or would be at a substantial disadvantage. Having the latest technology isn’t always necessary, but even though...

Read More

Topics:

Big Data,

Planning,

Predictive Analytics,

Governance,

GRC,

Office of Finance,

Budgeting,

close,

Tax,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

CIO,

Cloud Computing,

Financial Performance,

Governance, Risk & Compliance (GRC),

In-memory,

CFO,

Risk,

CEO,

Financial Performance Management,

FPM

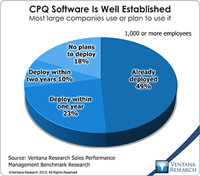

PROS Holdings, a provider of price and revenue optimization software, has an agreement in principle to acquire Cameleon Software, which offers configure, price and quote (CPQ) applications. The combined company is likely to benefit from a broader geographic presence (PROS is based in Houston while Cameleon is in Toulouse, France) for their sales and marketing efforts. However, the longer-term strategic value of the merger lies in the combination of the related categories of price optimization...

Read More

Topics:

Sales,

Sales Performance,

FP&A,

PRO,

PROS,

Operational Performance,

Analytics,

Business Analytics,

Business Collaboration,

Business Performance,

Financial Performance,

CFO,

CPQ,

CEO,

FPM,

Price Optimization,

Profitability