The Ventana Research Value Index for Workforce Optimization in 2015 is now released. Workforce optimization covers all aspects of managing everyone who handles customer interactions  and is thus vital to improve operational efficiency, and customer and employee satisfaction. It includes the following applications: interaction capture, quality monitoring and assurance, workforce management, coaching and learning management, variable compensation management, and interaction and agent analytics. Our Value Indexes are informed by more than a decade of analysis of how well technology suppliers and their products satisfy specific business and IT needs. For each we perform a detailed evaluation of product functionality and suitability to task in five categories as well as of the effectiveness of vendor support for the buying process and customer assurance. In this case the resulting index gauges the value offered by each vendor and its products in supporting workforce optimization.

and is thus vital to improve operational efficiency, and customer and employee satisfaction. It includes the following applications: interaction capture, quality monitoring and assurance, workforce management, coaching and learning management, variable compensation management, and interaction and agent analytics. Our Value Indexes are informed by more than a decade of analysis of how well technology suppliers and their products satisfy specific business and IT needs. For each we perform a detailed evaluation of product functionality and suitability to task in five categories as well as of the effectiveness of vendor support for the buying process and customer assurance. In this case the resulting index gauges the value offered by each vendor and its products in supporting workforce optimization.

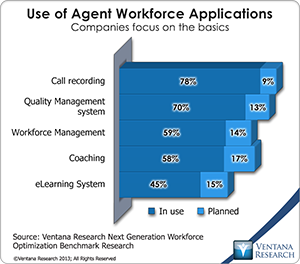

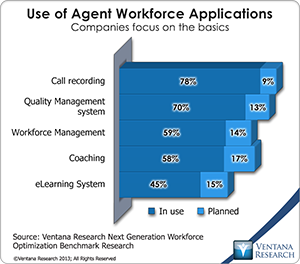

The workforce optimization software market is mature. Eight of the 10 vendors we evaluated in our 2012 Agent Performance Value Index – now renamed workforce optimization because includes all employees who handle customer interactions – took part in this assessment. They have been joined by Calabrio and Interactive Intelligence. Callcopy (now called Uptivity) is not included in this edition because it was recently acquired by inContact (which declined to participate), and we did not include Enkata or LiveOps because of their limited functional coverage for this software category. We also did not include vendors with stand-alone applications in this Value Index. While most products are mature, our benchmark research into next-generation workforce optimization shows that user organizations are less evolved in the use of such  products: 47 percent rank at the lowest of four levels, Tactical, and only 13 percent reach the highest Innovative level. The research shows that of the applications included in workforce optimization, the most commonly used are call recording (by 78%), quality monitoring (70%) and workforce management (59%), while use of applications such as capturing nonvoice interactions (29%) and variable compensation management (28%) lags. This last point is echoed by the vendors’ offerings: Only NICE Systems has a fully functional compensation application, with the others are limited to providing input to third-party applications. Nevertheless we find that organizations increasingly understand the benefits of using a fully integrated suite of workforce optimization applications. Such suites allow organizations to connect processes associated with handling interactions such as linking customer satisfaction to agent performance and using performance analytics to inform coaching and training. Regarding the latter the research shows that organizations that have adopted a workforce optimization suite have achieved on average five benefits, most often improved agent coaching processes. About half (48%) of organizations said it is very important that when the applications are fully integrated they are easier to manage, provide a better user experience, produce fewer errors and enable linking of processes.

products: 47 percent rank at the lowest of four levels, Tactical, and only 13 percent reach the highest Innovative level. The research shows that of the applications included in workforce optimization, the most commonly used are call recording (by 78%), quality monitoring (70%) and workforce management (59%), while use of applications such as capturing nonvoice interactions (29%) and variable compensation management (28%) lags. This last point is echoed by the vendors’ offerings: Only NICE Systems has a fully functional compensation application, with the others are limited to providing input to third-party applications. Nevertheless we find that organizations increasingly understand the benefits of using a fully integrated suite of workforce optimization applications. Such suites allow organizations to connect processes associated with handling interactions such as linking customer satisfaction to agent performance and using performance analytics to inform coaching and training. Regarding the latter the research shows that organizations that have adopted a workforce optimization suite have achieved on average five benefits, most often improved agent coaching processes. About half (48%) of organizations said it is very important that when the applications are fully integrated they are easier to manage, provide a better user experience, produce fewer errors and enable linking of processes.

Among components of workforce optimization suites, the research shows relatively low adoption of analytics although it is the application the highest percentage of companies said is most likely to have an impact on interaction-handling performance. We also find that agent analytics is the tool most (21%) organizations plan to invest in. The research shows that with the ever growing number of employees involved in handling interactions, organizations are also beginning to recognize the value of other innovative technologies such as cloud computing, access to applications through mobile devices and big data analytics.

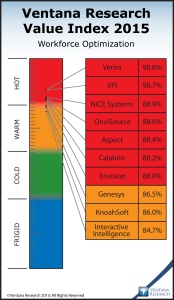

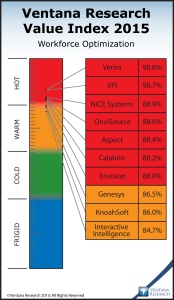

Based on these and other evaluation criteria, overall the  top-ranked vendor in our Workforce Optimization 2015 Value Index is Verint (as it was in 2012), followed very closely by VPI, which has improved its score although it also ranked second in the 2012 Value Index. They are followed by five other Hot vendors: NICE Systems, OnviSource, Aspect, Calabrio and Envision. All the Hot vendors have a comprehensive suite of highly functional workforce optimization applications (with the exception of variable compensation management) and provide what we consider to be required capabilities. The other three vendors are rated Warm. Genesys did not make a formal submission so its rating is based solely on publicly available information including their product documentation, and KnoahSoft and Interactive Intelligence lack some core capabilities that are part of our framework for workforce optimization.

top-ranked vendor in our Workforce Optimization 2015 Value Index is Verint (as it was in 2012), followed very closely by VPI, which has improved its score although it also ranked second in the 2012 Value Index. They are followed by five other Hot vendors: NICE Systems, OnviSource, Aspect, Calabrio and Envision. All the Hot vendors have a comprehensive suite of highly functional workforce optimization applications (with the exception of variable compensation management) and provide what we consider to be required capabilities. The other three vendors are rated Warm. Genesys did not make a formal submission so its rating is based solely on publicly available information including their product documentation, and KnoahSoft and Interactive Intelligence lack some core capabilities that are part of our framework for workforce optimization.

The overall scores are lower than in our 2012 research, primarily due to lack of support for innovative technologies, which we added to this Value Index and urge vendors to address in their development plans. Among these technologies, the most support currently offered is for cloud computing. While the majority of vendors can process increasingly greater volumes and more types of data, most need to invest in big data technologies so their analytics can utilize all forms and sources of data. The same is true for use of mobile devices; most vendors provide access through a Web browser, but users are coming to expect a more intuitive user interface that supports better visualization and more “click to use” capabilities, so vendors ought to consider adding mobile apps that can access core capabilities.

Our benchmark research correlates the size of contact center with the likelihood of an organization investing in workforce applications: Those with large contact centers twice as often plan to invest. However, this dynamic is changing; more companies distribute interaction handling across the organization and must serve more channels of interaction, and cloud computing and mobility impact the model for investing in applications and hardware. These changes, plus a fundamental need to improve customer and employee satisfaction, are likely to make the next-generation of workforce optimization more important to businesses. Please use our 2015 Workforce Optimization Value Index executive summary to learn more and utilize our full research to understand the strengths and weakness of the various vendors and to help build a business case for investing in this key area.

Regards,

Richard J. Snow

VP & Research Director

and is thus vital to improve operational efficiency, and customer and employee satisfaction. It includes the following applications: interaction capture, quality monitoring and assurance, workforce management, coaching and learning management, variable compensation management, and interaction and agent analytics. Our Value Indexes are informed by more than a decade of analysis of how well technology suppliers and their products satisfy specific business and IT needs. For each we perform a detailed evaluation of product functionality and suitability to task in five categories as well as of the effectiveness of vendor support for the buying process and customer assurance. In this case the resulting index gauges the value offered by each vendor and its products in supporting workforce optimization.

and is thus vital to improve operational efficiency, and customer and employee satisfaction. It includes the following applications: interaction capture, quality monitoring and assurance, workforce management, coaching and learning management, variable compensation management, and interaction and agent analytics. Our Value Indexes are informed by more than a decade of analysis of how well technology suppliers and their products satisfy specific business and IT needs. For each we perform a detailed evaluation of product functionality and suitability to task in five categories as well as of the effectiveness of vendor support for the buying process and customer assurance. In this case the resulting index gauges the value offered by each vendor and its products in supporting workforce optimization.

top-ranked vendor in our Workforce Optimization 2015 Value Index is Verint (as it was in 2012), followed very closely by VPI, which has improved its score although it also ranked second in the 2012 Value Index. They are followed by five other Hot vendors: NICE Systems, OnviSource, Aspect, Calabrio and Envision. All the Hot vendors have a comprehensive suite of highly functional workforce optimization applications (with the exception of variable compensation management) and provide what we consider to be required capabilities. The other three vendors are rated Warm. Genesys did not make a formal submission so its rating is based solely on publicly available information including their product documentation, and KnoahSoft and Interactive Intelligence lack some core capabilities that are part of our framework for workforce optimization.

top-ranked vendor in our Workforce Optimization 2015 Value Index is Verint (as it was in 2012), followed very closely by VPI, which has improved its score although it also ranked second in the 2012 Value Index. They are followed by five other Hot vendors: NICE Systems, OnviSource, Aspect, Calabrio and Envision. All the Hot vendors have a comprehensive suite of highly functional workforce optimization applications (with the exception of variable compensation management) and provide what we consider to be required capabilities. The other three vendors are rated Warm. Genesys did not make a formal submission so its rating is based solely on publicly available information including their product documentation, and KnoahSoft and Interactive Intelligence lack some core capabilities that are part of our framework for workforce optimization.