Workiva offers an environmental, social and governance application that enables organizations to manage the highly distributed tasks necessary for reporting to regulators and stakeholders on ESG matters. ESG issues have grown increasingly pressing over the past few years as investors and government entities urge organizations to measure and disclose relevant metrics. I’ve already covered the broader topic as it relates to external reporting and how financial planning and analysis groups are likely to own this mandate going forward. I’ve also addressed the data strategy that finance organizations should adopt to meet regulatory compliance requirements. Notably, I assert that by 2025, more than one-half of corporations required to comply with ESG reporting will centralize responsibility for preparing reports and filings with financial planning and analysis to achieve accuracy, control and efficiency objectives.

Sensitivity to ESG issues has grown over the past decade. Efforts by organizations to objectively and consistently quantify the non-monetary impacts on society are not new, but their urgency has grown, especially  as some organizations have published numbers that have been questioned and characterized as greenwashing. Regulatory reporting requirements are expanding in multiple jurisdictions, including the European Union related to its Corporate Sustainability Reporting Directive, the United Kingdom’s climate-related financial disclosures and similar requirements in New Zealand. Environmental reporting requirements are also under consideration in the U.S. and Canada.

as some organizations have published numbers that have been questioned and characterized as greenwashing. Regulatory reporting requirements are expanding in multiple jurisdictions, including the European Union related to its Corporate Sustainability Reporting Directive, the United Kingdom’s climate-related financial disclosures and similar requirements in New Zealand. Environmental reporting requirements are also under consideration in the U.S. and Canada.

Organizations face multiple challenges with respect to ESG reporting, some of which are similar to those posed by all forms of regulatory reporting. There are three main differences between ESG and financial reporting:

- While accounting practices and standards evolved over centuries, regulatory requirements are not well-established and are likely to evolve rapidly in coming years. Moreover, double-entry bookkeeping recorded entirely in financial terms simplifies auditing and testing the validity of presentations in the context of those accounting standards. This is far more difficult for ESG.

- The data necessary for producing ESG metrics must be taken from a wide range of systems and sources, and these are likely to grow more complex as regulations evolve.

- There are multiple frameworks and approaches to analyzing and summarizing the data used in ESG reporting depending on the regulatory authority or the information that the organization wants to convey.

However, like financial reporting, organizations must be able to manage the complex processes associated with gathering data, employing frameworks and creating narratives as well as editing, reviewing and approving final reports. Reporting may involve dozens of individuals across multiple locations, with a specific structure and formatting required for each jurisdiction’s regulatory report. The process is ongoing, so the ability to automate repetitive tasks and reduce or eliminate the need for consistency checks is essential. Accuracy and auditability must be assured, which means that data used for all reporting must be traceable to an authoritative source and data transformations must be highly controlled.

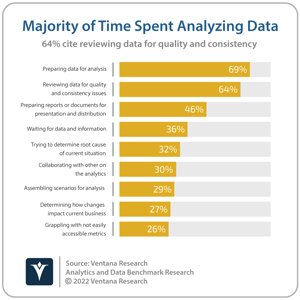

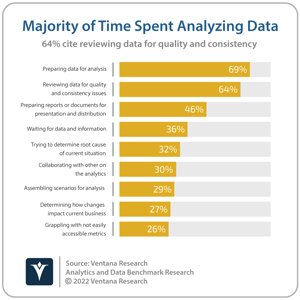

Workiva’s platform helps organizations address ESG-specific challenges as well as those that apply broadly to regulatory and financial disclosures. Its framework explorer enables organizations to compare requirements across multiple frameworks, such as those created by the Global Reporting Initiative (referred to as GRI), Sustainable Accounting Standards Board (or SASB) and the Task Force on Climate-Related Financial Disclosures (or TCFD), making it easier for those preparing reports to have the very latest versions of these frameworks to ensure accuracy and consistency. Workiva pioneered the platform-specific data store, Wdata, which enables organizations to connect its ESG reporting directly to authoritative systems of record, saving considerable time compared to manually collecting and collating data. Our Analytics and Data Benchmark Research found that two-thirds of analysts spend a considerable amount of time on data preparation and reviewing data for quality and consistency issues, so addressing this issue with proven technology substantially enhances the productivity of the department. The system also enables the collection of data from more loosely structured sources, such as records kept in controlled spreadsheets or filings related to employment, health and safety. This level of data control promotes auditability and ensures consistency.

Like statutory financial disclosures, ESG reporting benefits from workflow management that ensures work is performed in a timely fashion as well as reviewed and approved to support good governance. Workflows also reduce administrative overhead as those responsible can manage task completion by exception and receive immediate notification when processes fall behind. ESG reports are an assemblage of text, tables, charts and illustrations which almost always must conform to statutory requirements, to corporate style guides or both. Being able to control these aspects of reporting ensures consistency and conformity to requirements. Automated features, such as “roll forward” updating of periodic reports and ensuring that data points cited in multiple locations, tables and charts always agree increases productivity and promotes accuracy and consistency. Workiva also provides multiple formats for creating reports and deliverables.

administrative overhead as those responsible can manage task completion by exception and receive immediate notification when processes fall behind. ESG reports are an assemblage of text, tables, charts and illustrations which almost always must conform to statutory requirements, to corporate style guides or both. Being able to control these aspects of reporting ensures consistency and conformity to requirements. Automated features, such as “roll forward” updating of periodic reports and ensuring that data points cited in multiple locations, tables and charts always agree increases productivity and promotes accuracy and consistency. Workiva also provides multiple formats for creating reports and deliverables.

Managing sustainability and ESG requires reporting that supports complex topics confronting senior executives, especially given the degree of uncertainty around pending legal and regulatory requirements as well as related internal objectives, methods and frameworks for assessing these non-financial elements of a company’s performance. FP&A groups need a strategy to enable their organization to meet ESG reporting needs, especially in managing the process of devolving objectives across the organization. Technology is the key to achieving efficient compliance with ESG mandates. I recommend that organizations assess and evaluate Workiva for its ability to make compliance and reporting mandates easier, more assured and more productive.

Regards,

Robert Kugel

as some organizations have published numbers that have been questioned and characterized as

as some organizations have published numbers that have been questioned and characterized as  administrative overhead as those responsible can manage task completion by exception and receive immediate notification when processes fall behind. ESG reports are an assemblage of text, tables, charts and illustrations which almost always must conform to statutory requirements, to corporate style guides or both. Being able to control these aspects of reporting ensures consistency and conformity to requirements. Automated features, such as “roll forward” updating of periodic reports and ensuring that data points cited in multiple locations, tables and charts always agree increases productivity and promotes accuracy and consistency. Workiva also provides multiple formats for creating reports and deliverables.

administrative overhead as those responsible can manage task completion by exception and receive immediate notification when processes fall behind. ESG reports are an assemblage of text, tables, charts and illustrations which almost always must conform to statutory requirements, to corporate style guides or both. Being able to control these aspects of reporting ensures consistency and conformity to requirements. Automated features, such as “roll forward” updating of periodic reports and ensuring that data points cited in multiple locations, tables and charts always agree increases productivity and promotes accuracy and consistency. Workiva also provides multiple formats for creating reports and deliverables.