Ventana Research is sharing insights gleaned from our latest Value Index research, an assessment of how well vendors’ offerings meet buyers’ requirements. The Ventana Research Value Index: Agent Management 2022 is the distillation of a year of market and product research by Ventana Research. Drawing on our Benchmark Research, we apply a structured methodology built on evaluation categories that reflect the real-world criteria incorporated in a request for proposal to customer experience vendors supporting the spectrum of Agent Management. Using this methodology, we evaluated vendor submissions in seven categories: five relevant to the product experience ﹘ adaptability, capability, manageability, reliability and usability ﹘ and two related to the customer experience ﹘ TCO/ROI and vendor validation.

This research-based index evaluates the full business and information technology value of Agent Management software offerings. I encourage you to learn more about our Value Index and its effectiveness as a vendor selection and RFI/RFP tool.

This research-based index evaluates the full business and information technology value of Agent Management software offerings. I encourage you to learn more about our Value Index and its effectiveness as a vendor selection and RFI/RFP tool.

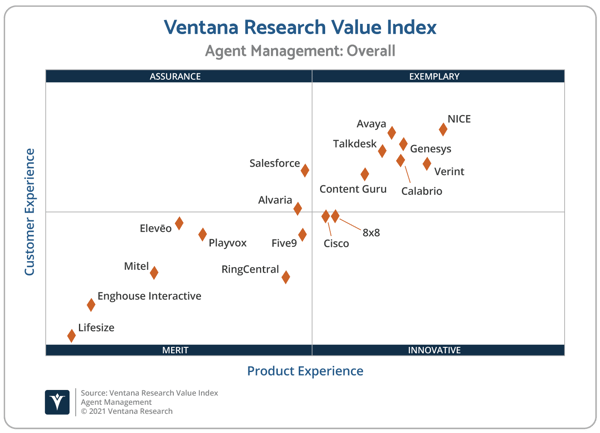

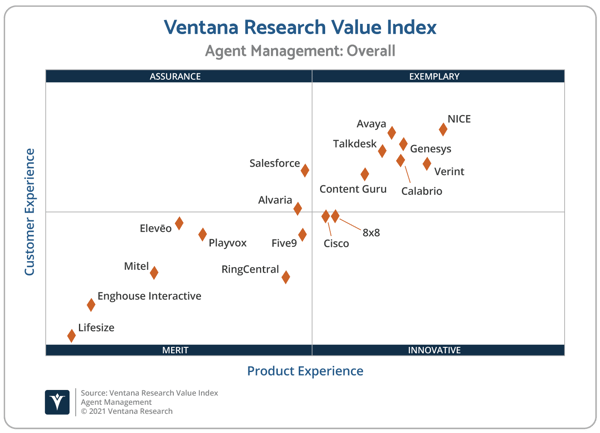

This Value Index research evaluates the following vendors that offer products for Agent Management as we define it: 8x8, Alvaria, Avaya, Calabrio, Cisco, Content Guru, Elevēo, Enghouse Interactive, Five9, Genesys, Lifesize, Mitel, NICE, Playvox, RingCentral, Salesforce, Talkdesk and Verint. Six of these 18 suppliers responded positively to our requests for information and provided completed questionnaires and demonstrations to aid our analysis of their Agent Management products. Along with briefings and information where provided, publicly available online material was also used for the analysis as of November 1, 2021.

The following vendors declined to participate or did not respond to our invitation: 8x8, Cisco, Enghouse Interactive, Lifesize, Mitel and RingCentral. To organizations considering products from these vendors, we recommend extra scrutiny as part of any software assessment because they did not make their technology available for the Value Index evaluation process.

Unlike many IT analyst firms that rank vendors from an IT-only perspective or focus on a specific type of Agent Management, Ventana Research has designed the Value Index to provide a balanced perspective, rooted in an understanding of business drivers and needs. This approach not only reduces cost and time but also minimizes the risk of making a decision that is bad for the business.

Using the Value Index will enable your organization to achieve levels of efficiency and effectiveness needed to optimize Agent Management. We urge organizations to do a thorough job of evaluating Agent Management products in this Value Index which offers results of our in-depth analysis of these vendors and also acts as an evaluation methodology. The Value Index can be used to evaluate existing suppliers, plus it provides evaluation criteria for new projects. Using it can shorten the cycle time for an RFP.

The Value Index for Agent Management in 2022 finds NICE first on the list, followed by Verint and Avaya. Companies that rated in the top three of any category ﹘ including the product and customer experience dimensions ﹘ earn the designation Value Index Leader.

The Value Index Leaders in Product Experience are:

Leaders in Customer Experience are:

Value Index Leaders across any of the seven categories are:

- NICE, which has achieved this rating in seven of the seven categories.

- Verint, in four categories.

- Calabrio and Talkdesk, in three categories.

- Avaya and Genesys, in two categories.

The overall performance chart provides a visual representation of how vendors rate across product and customer experience. Vendors with products scoring higher in a weighted rating of the five product experience categories place farther to the right. The combination of ratings for the two customer experience categories determines their placement on the vertical axis. As a result, vendors that place closer to the upper-right are “exemplary” and rated higher than those closer to the lower-left and identified as vendors of “merit.” Vendors that excelled at customer experience over product experience have an “assurance” rating, and those excelling instead in product experience have an “innovative” rating.

Note that close vendor scores should not be taken to imply that the packages evaluated are functionally identical or equally well-suited for use by every organization or process. Although there is a high degree of commonality in how organizations handle Agent Management, there are many idiosyncrasies and differences that can make one vendor’s offering a better fit than another.

The technology underlying Agent Management has advanced considerably in recent years. There is a shift underway from traditional agent management tools toward a more modern package: intelligent virtual assistants (IVAs); agent-assist or guidance driven by artificial intelligence (AI); and automation via workflows that streamlines processes and provides connections to back-office functions. Then, there are improved “agent management” applications that are further outside the standard definition but that affect agents and supervisors just the same: knowledge management; desktop integrations; gamification; and customer collaboration tools like co-browsing and bot-assisted chat.

We assessed these new tools in conjunction with standard workforce management, call recording, quality and performance management systems. While not every component or tool will make sense in every deployment, we believe that a variety of options to suit a wider spectrum of use cases is important. We also believe that the pandemic has changed some of the underlying criteria buyers use to assess their software purchases.

Features, functions and vendor assessments are not the only deciding factors. For example, an organization may face budget constraints such that the TCO evaluation can tip the scale to one vendor or another. This is where the Value Index methodology and appropriate weighting can be applied to determine the best fit of vendors and products to an organization’s specific needs.

Our firm has made every effort to encompass in this Value Index the overall product and customer experience from our Agent Management blueprint, which we believe reflects what a well-crafted RFP should contain. Even so, there may be additional areas that affect which vendor and products best fit an organization’s particular requirements. Therefore, while this research is complete as it stands, utilizing it in your own organizational context is critical to ensure that products deliver the highest level of support for your projects.

You can find more details on our website as well as in the Value Index Market Report.

Regards,

Keith Dawson

This research-based index evaluates the full business and information technology value of Agent Management software offerings. I encourage you to learn more about our

This research-based index evaluates the full business and information technology value of Agent Management software offerings. I encourage you to learn more about our